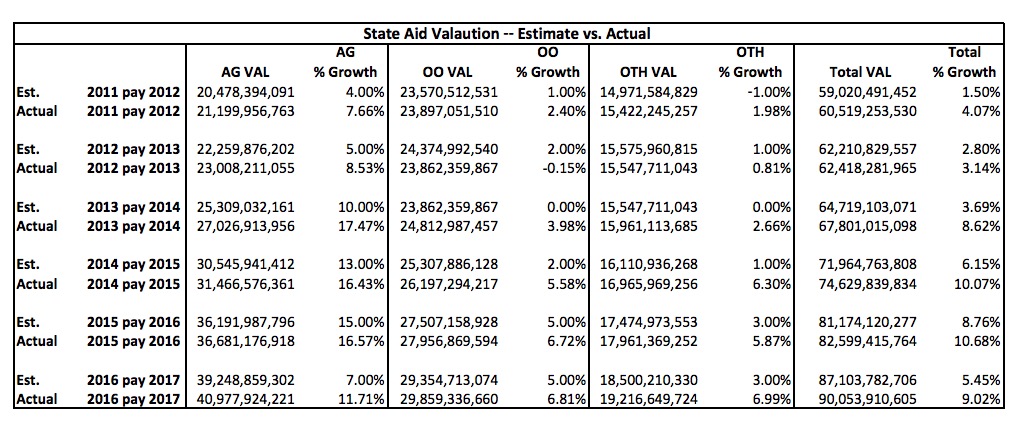

The Appropriations Committee documents include this table of total property values in South Dakota from 2011 through 2016 (payable 2012 through 2017).

In 2011, in the second year of our using the potential productivity model to assess agricultural land, 35.0% of taxable property value came from agricultural land, 39.5% from residential property, and 25.5% from commercial property. In 2016, ag’s percentage of total value had risen to 45.5%, while residential’s share is down to 33.2% and commercial’s to 21.3%.

Looked at another way, over the last five years, the taxable value of residential and commercial land has risen 25% while the taxable value of ag land has risen 93%.

Of course, when we apply the tax levies of Senate Bill 35, we tax residential property at 2.2 times the rate we tax agricultural land, and we tax commercial land at 4.6 times the ag rate. Multiply those levies by valuations, and we find commercial property bearing 45.2% of the K-12 burden, residential 34.0%, and ag 20.8%.

In 2012, if I’m reading the levies correctly from that year’s SB 49, those levy × valuation burdens would have been 47.8% commercial, 34.6% residential, and 17.7% agricultural. In five years, we’ve slid 2.6 percentage points of K-12 tax burden off commercial property owners and 0.6 percentage points off homeowners and slid them onto ag land owners.

Play with those numbers, dear readers, and tell me: are South Dakota’s 31,000 farms bearing a fair share of the K-12 tax burden?

Ag land taxes are a sweetheart deal when you compare their tax rates to what they would be if farm land were taxed based upon market value like commercial and residential.

However, I don’t believe that the duty to put everybody’s kids through school should fall disproportionately on farmers either, and it kind of is under this system of school funding that we have.

So ag property tax rates are lower than they should be in comparison to non-ag property tax rates, but farmers are paying a disproportionate share of school funding even at artificially low rates. And there is not enough money flowing into the system to move SD from the bottom of the teacher pay list. What this says to me is that there needs to be a new and reliable revenue source besides property taxes to fund schools. Increasing the sales tax isn’t getting the job done satisfactorily.

In a community that is only ag, the tax base per child is probably higher than the tax base per child in the city. So the schools have enough money in rural areas. But when rural areas cry that they need more help from the state, then I think they should raise their own taxes and fund their school for their own kids rather than ask others to help.

Rorschach has zeroed in on the issues here and I agree.

Cory, You are looking at taxing real estate property in terms of their existing value if they were sold as opposed to their value in terms of the income that they generate. This is reasonable in terms of examining how our current system of real estate taxation works. However, if you are truly trying to be the most fair in terms of taxation policy, you should also look at real estate in terms of its capacity to generate income.

I would argue that ag land has the lowest capacity to produce income as a percentage of its value of the three categories of real estate. Basically, ag land has the lowest return on investment of the three types of real estate which would be a good argument for its lesser tax rate.

I hate to devote too much thought to this archaic system of taxing based upon presumed wealth (real estate tax) and necessary expenditures for living (sales tax) while we ignore the disparity of income between different people.

Socialism is bad, Mr. Larson. It is bad. The people who work harder should get more money. Just like the monkeys who work harder get the most food. Slackards should not prosper.

As to the tax issue, I have in the past agreed that I would be open to considering an income tax if it were a flat percentage treated the same on everybody. X% on me, X% on you, X% on Bob Streetman. You could make the X% be on gross wages so people couldn’t deduct things if you want. I don’t understand all those details so you fellows can figure that all out, or let the tax experts do it. But if I make $100 and you make $100,000 we each pay X% on those amounts.

Then, we funnel more of it to the good teachers and a lesser share to the sub-average teachers. Just like the monkeys, they need to work for their spoils.

“Then, we funnel more of it to the good teachers and a lesser share to the sub-average teachers. Just like the monkeys, they need to work for their spoils.”

Still waiting Grudz for you to tell us how to tell a good teacher from a sub0average teacher.

Mr. reitzel, I have explained the Seven Indisputable Levels of Teacher to you several times. Mr. H’s own comments have confirmed the SILT. The levels are 7, and they are indisputable.

Not to mention the used sales tax as another way SD is cashing in on ag and dependent upon the framer the only problem is when farmers aren’t buying like last year and this year for fear of what’s in store for them with grain prices, sd has no money that was budgeted from previous years spending Yes they pick up the tab for a lot of entities in the SD budget

Also mentioning when a new school is needed, who pays for it within the county ? The agriculture industries, thus the farmers, so asking if they pay their fair share I would say over and beyond. The article is about one bush in the painting, not the entire picture as to if farmers pay their fair share, in SD education system

I’ve always wondered why an ag residence isn’t taxed at the residential rate. Tax the land at the ag rate, but the house should be taxed at the residential rate. That would seem fair to me.

Darin—”capacity to generate income”? How about instead of taxing people every year on the money they could make if they sold their property, we just tax them once, when they actually sell that property?

One of the problems is that the system for determining value of ag land is hugely flawed. We own land in two counties about 120 miles apart. County A , we feel is valued reasonably if not undervalued. It is possible to make reasonable income there. County B, we feel, is way overvalued considering rainfall and potential for earnings. In discussions I have had with assessors in each county I have learned that the state is satisfied with valuations in County A, but County B still has to raise valuations to satisfy a magic state formula. We have been active farmers our entire life and struggle to understand the new system or find equity in it.

Caroline, you’re saying County B is drier and less productive, but the state is pressuring them to raise valuations? I thought the productivity tax formula derived by our trust SDSU professors was supposed to be objective, with no way of saying that land is more value than what’s actually been produced on it over the last several years.

Someone get Al Novstrup in here to comment. He served on the committee that created that formula. He should be able to explain it.

Cory, It is my understanding that the magic formula was borrowed from another state. SDSU provides much of the data that goes into the formula. Other pieces of data come from soils information provided by USDA/NRCS. Some of this information has been recently updated and information for other parts of the state is decades old. The SDSU data uses county averages. Depending on the size of the county and other variations, it is reasonable to assume some are seriously undertaxed and others are seriously overtaxed. It would be nice to hear from Mr. Novstrup as my understanding could be entirely wrong…..but I don’t think so.

Mr. Novstrup is probably an expert on the formulas. I will email him.