Already convinced that Senator John Thune’s tax talk is bunk is Rapid City businessman and Republican blogger John Tsitrian. He sees through the temporary tricks that send working-class class taxes back up in a few years. Tsitrian also sees no proof of Thune’s promises that his Trumpy tax cuts will create jobs or that we need to dig ourselves deeper into debt to stimulate the labor market:

As to the Senator’s promise that the bill will create “2700 new full time jobs for South Dakota workers,” I’d like to know what the heck he’s talking about. We have more jobs than workers as it is. As an employer in this state who is in full contact with the situation every day, I know that we have a serious labor shortage in South Dakota. Our dairy industry is seeking workers from Puerto Rico, and our persistent problem with a shortage of construction workers is an ongoing challenge. And don’t even tell me about the situation on my home turf, the tourism industry. Tax cut or no tax cut, how does South Dakota create jobs when we can’t fill the ones we have? More to the specific point, though, Thune’s contention about job growth is pie-in-the-sky. Job growth was weak after George W. Bush’s national tax cuts. Same goes for Kansas Governor Sam Brownback’s in his state during the past few years. I have yet to see a connection between business tax cuts and job creation, at least during economic expansions like the one we’re in now. I challenge Thune and his supporters to find some evidence backing up that claim [John Tsitrian, “South Dakota Senator John Thune’s Bait-and-Switch on Tax Cuts,” The Constant Commoner, 2017.11.18].

The national unemployment rate is 4.1%, lower than it has been for most of the last 50 years. Unemployment in South Dakota in September was 3.1%, with some 13,900 South Dakotans actively looking for work. How many of those South Dakota job-seekers do you think Donald Trump and his family will hire with the millions they’ll save?

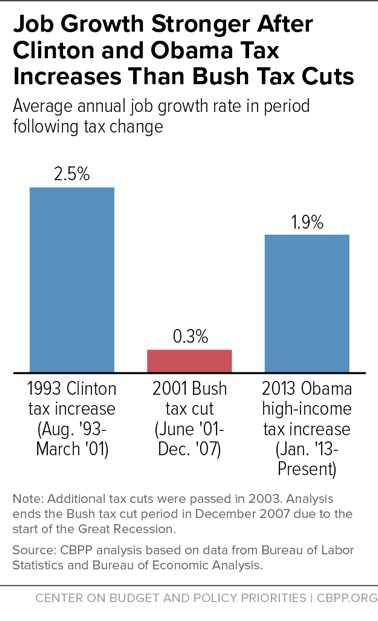

As usual, Tsitrian’s links are instructive. Among those links, the Center for Budget and Policy Priorities points out that jobs grew faster after Clinton and Obama tax increases than after Bush II’s 2001 tax cuts. CBPP notes that tax cuts for corporations and the rich—and such top-end cuts are the thrust of the plan Thune is touting—do not trickle down.

Tsitrian is one of the majority of Americans whom Thune and his party are failing to convince on tax reform. Conservative David Frum, who wants to cut corporate rates while tightening collections, says Republicans are losing the tax reform battle because, instead of patiently and openly crafting good law and consensus, they are rushing like corporate raiders:

…what is heading toward [the White House] is not the kind of reform that can command broad political support, and thus stand the test of possible electoral defeat in 2018 and 2020. It’s a scandalous expression of upper-class and Sunbelt chauvinism that will melt away within weeks of the next Democratic electoral success. Even if it becomes law, as still seems improbable in the face of the plan’s terrible poll numbers, what firm would venture a long-term investment based on tax changes so likely unsustainable?

Daniel Patrick Moynihan’s old rule of thumb for bills before the Senate—“They pass 70-30, or they fail”—no longer applies. Seventy-vote majorities no longer exist in this hyperpartisan era. The Affordable Care Act passed with only 60 votes. But the spirit of the rule lingers. By refusing to hold hearings and forestalling Congressional Budget Office scoring, Republicans have moved fast. But they have not convinced the public mind, to recycle an antique but still meaningful phrase. They may win a vote. They have not won the argument. What they are doing will not last, and will therefore not deliver any of the promised benefits. It’s the equivalent of a 1980s-style corporate raid, that will yield a hasty and morally dubious windfall for a few insiders while damaging the longer-term economic health of the larger enterprise [David Frum, “Republicans Are Throwing Away Their Shot at Tax Reform,” The Atlantic, 2017.11.20].

Come back to your senses, Senator Thune. Ditch your rudderless President and get back to the empirical evidence and sensible policy that people in your own party, like John Tsitrian, should be preaching.

Thanks, Cory. For the record, a few weeks ago I changed my registration from Republican to Independent.

Me too. Changed registration.

The Democrats used to claim that Republicans were “just for the rich”. Now, they can prove it. And, if Roy Moore is elected, you can accuse them of a whole lot worse.

People in each neighborhood association are always checking up on each other. If one family seems to be living better than everyone else, then all the neighbors try to find out how they are making their money. Everybody is sensitive because if someone seems to be living well, then people get jealous of that house. Nobody has to be asked to bring that wealthy family down and make sure that this wealthy family loses their money. When you see a family lose their house, that feels good. That’s why it’s important not to show off how wealthy you are. ~ Escaped North Korea,2014

Liberals in each state are always checking up on each other. If one American seems to be living better than the liberals, then all the liberals try to find out how they are making their money. Liberals are sensitive because if someone seems to be living well, then liberals get jealous of that person. No liberal has to be asked to bring that wealthy Trump down and make sure that this Trump loses his money. When liberals see a family lose their house, that feels good. That’s why it’s important not to show off how wealthy you are. ~ House of Liberals, 2017

Economics is just one facet of government wingnuts are clueless about.

Empirical evidence provides plenty of ammo for raising taxes puts more people to work than taxcuts for the greedy.

Drumpf’s legal troubles are as vast and assorted as his OFF SHORE business holdings. He is as corrupt or worse than the entire state of North Mississippi.

Dear OldSarg.

You can look at it another way. If Jimmy James is paying taxes on his salary, perhaps….. just perhaps…… the Koch brothers should be paying on their hundred-billion dollar nest egg. And no, they have not paid taxes on that net worth. They wouldn’t until the company is sold (which they haven’t) or they die. Now, you guys want to remove that second part.

You are creating a new class of billionaires that can avoid paying taxes, for centuries, on their wealth. They’d be getting a new “basis” every generation and sliding right past that thing called income tax. Unlike me.

To recognize this reality is not jealousy. Its common sense to anyone who is even remotely trying to be objective.

OldSarg,

You seem to be projecting your own feelings onto those who criticize the Republicans’ current tax plan. As Mr. Tsittrian points out, maybe it is just a bad plan that will not do what it is advertised to do. I know a bit about economics and that is my evaluation too.

This Republican Tax Bill increases the deficit by 1.5 Trillion dollars in a time of economic prosperity when the deficit should be declining, increases taxes in the long-run for people earning under $75,000.00, triggers $25 billion in cuts to Medicare with more planned in the future, ends health insurance for an estimated 13 million people and transfers their uncompensated healthcare costs onto state and local government, is estimated to increase insurance premiums an additional 10% (someone has to pay for these uncompensated medical costs), and (to buy the votes of Alaskan Senators) opens up ANWR (Alaskan National Wildlife Reserve) to exploitation by the oil and gas industry. It does all this to provide a tax cut that, in the end, benefits mainly millionaires and billionaires. (Ask yourself, who owns most of those companies that will benefit from seeing the corporate tax rate cut in half, from 40 to 20%. Not most working people)

It is a bad bill. Look at it with an open mind. And, I suggest you stop impugning the motives of those who criticize it. Your words may say more about you than them.

OldSarg, playing the tired and inaccurate “they are just jealous of the wealthy” card. Could not be further from the truth, so quit buying that propaganda.

Most hard working people (middle/lower class) want is a level playing field. Plain and simple. People that are making passive income/making their wealth off of the backs of others, that are gaming the system and avoiding taxes (or in Trump’s words in a debate, “that makes me smart”) is what is angering. And coupled with the firm data that these types of cuts don’t help the economy or America as a whole, but only benefit the wealthy – and actually HURT the economy/everyday Americans…. THAT is the problem.

People are jealous of the wealthy? Pah-leeze

Dana “Most hard working people (middle/lower class) want is a level playing field.”

So, what is a level “playing field”? You would think a “level playing field” would be the same taxation rate for everyone. That would be “fair”. Instead, the left has stolen money from the middle class in a bogus “health care” penalty (tax). Instead, the left takes from the workers and spread the money earned by others to those who are not willing to work. Instead, the left keeps the poor and minorities locked within the Gulags called “slums” where they lose their benefits if they move out to better their lives. Instead, the left all profess “fairness, equality, suppress free speech, build an onerous government mother for all”. You claim the yoke of “fairness” but you only sue the words and refuse the truth of what the word even means. Meanwhile your leftist sexual assault ridden Hollywood ilk, leftist politicians and thieving sports stars act as your masters of thought.

As much as you want to punch back at me for hurting your feelings I see it as the people do. Your leftist failed ideology is the minority. Loud but still the minority. Your people have lost America.

Is there a holiday coming up, soon? Old Cossack is full of it today. Talking points from right wing sites spouted verbatim and with gusto. The old one wants us all to hit our knees and be thankful for the wealthy and wingnuts that owe allegiance to the koch bros.

I’ll pass.

Corporations do not increase production unless there is an increase in demand. Not pushing their head office overseas as fast will not change demand. Borrowing more money out of the economy to finance the budget just gives the corporations more competition for capital. Corporations make decisions on profitability, not by tax rate. Corporations do not like high taxes, but low taxes never made an unprofitable company into a profitable one. It just lowered their competitors taxes.

The idea of a fixed taxation rate for everyone is interesting. I wonder how such a system would pay for all the stuff that Old Sarg wants the government to do for him, such as police and fire protection, roads, clean water, sewers, military pay, A-bombs, submarines, bombers, fighter jets, aircraft carriers, roads, bridges, tunnels, border walls, traffic control, airports, hospitals, schools, rounding up and deporting millions of people, prisons, mental hospitals, ambulance services, snowplows, guns and tools of LE, weather warning systems, emergency relief after disasters, courts, legislatures, etc, and perhaps most important of all – our wars.

How much would the proposed flat tax rate for everyone have to be to fund these expenses designed to help OldSarg have a safe, happy and healthy life. If everyone paid only 5% of their income, would that suffice? Ten percent?

And I assume that OldSarg would eliminate the FICA and SSA tax on workers, especially if he objects to government funded social security for retirement, old age care for the indigent, and medical care. Otherwise, I would think that tax has to accounted for.

And this flat rate idea would probably have to eliminate the highly regressive sales tax, since sales tax is not based on income. It seems unfair that that family spending most or all of its income on necessities such as food, should pay a higher percentage of its income as sales tax than people with substantial incomes.

In other words, if we keep sales taxes and the poor pay 6% of their total income for this tax, should the rich also be assessed 6% of their total income as a fair share of the sales tax burden?

And what about the families without income, who end up selling items or using whatever savings they might have to purchase these 6% sales taxed necessities. Would a flat rate system treat everyone the same and require everyone to pay 6% of their net worth each year to achieve equal percentages?

That is some pretty creative thinking by OldSarg! Lets work out the details and maybe ask Thune, Roubnds, or Noem to propose legislation to implement such a fair flat rate taxation system.

Even if we had a flat tax, Trump, the 1% and corporations would find away to deduct it.

We both grow apples. We each have one apple tree. You spent money on fertilizer. I took my fertilizer money and bought a pear for myself. This year your apple tree had 10 apples. My apple tree had 8 apples. I paid the government one apple. You have to give the government two apples. Is that fair?

You paid 20% tax on your apples. I paid 12.5%. Progressive tax rates are punishment for those who care enough to do better.

You may have had sour Granny Smith and the other guy had a sweet Gala. You should pay more for being a sourpuss.

Jerry, I’m not a sourpuss at all. I’m a rather happy guy. I’m in a great place in my life. A gorgeous wife, a son that will soon me an attorney (and paid for his own schooling through savings and scholarships), a new SUV, a wonderful house and no debt at all. I literally have just about anything I could want. That doesn’t mean I can’t see what is fair and what is not. After I left the service I owned a business, I had employees, I paid them very well, I paid my quarterly taxes, reported my income and watched as more and more of my increase in labor go to the government, for what? My health insurance was $1,100/mo, my living expenses were average and my tax rate was just north of 28%. I saved money, gave raises well above the area average. Now I am approaching my retirement goal at age 60 and all I hear from folks like yourself is you should get more of what I have because you “think” I have more than you. . . You had the same chance I did. You had to make many of the same choices I have, though you may have decided differently, and we all live with those choices but that doesn’t mean you are somehow entitled to more of what I worked for and built. No, I’m not a sourpuss but neither will I just stand to the side while people like you steal from my grain bin that I filled through my efforts. No, not a sourpuss. I’m just that guy that says “No” to those who are acting like children and refuse to accept their own failures as their own.

I paid the government one apple. You have to give the government two apples. Is that fair?

You should be happy as hell to spend so little on taxes for the benefits you receive.

By the time Drumpf and stoopid wingnuts get done screwing up the tax system and economy you’ll be on yer bony knees begging for a return of the good old days under Obama, the GOAT.

But people like you don’t deserve Obama’s greatness and class. You deserve to be joined at the hip with the mangled apricot as he ruins America.

“You had the same chance I did.” Now, why would you think that is the case unless you actually know who you are talking about?

https://themighty.com/2015/06/mom-shares-photos-of-children-with-spina-bifida/

Mike from idiocy “for the benefits you receive”. I receive police, fire, water, trash pickup, and other things just as you do. I don’t receive a government retirement check or anything more than you yet you are so stuck on worrying that someone has more than you you are making yourself physically sick. You need to get past your envy and jealousy of what others have and appreciate what you do have. You have a computer, internet, a nose empty of buggers. You should be happy.

It is doubtful that anyone on this blog wants what OldSarg has or wants to take it away.

OldSarg continually makes the false argument about income distribution when the real argument is about making people and corporations pay an equitable amount of taxes for the services provided them.

bearcreekbatty That person is not you is it. You are using them for your own selfish benefit and for some reason you think it justifies your argument. It doesn’t. They are not you. This makes you a fake and yes, a liar of sorts. What you did is no different than someone who had been a soldier posting links to pictures of soldiers missing limbs and claiming “all vets are disabled” to gain pity. It is wrong and, just to make it understandable to you, nasty. Don’t be that guy.

No one is saying the government should not help those in need. My argument is on “fairness”, what is fair and what is not, concerning taxation.

Roger corporations are people. A corporation can be a farmer, a grocer, a fuel supplier. Corporation is simply a government registration for the purpose of protection under our present laws. I have no argument with corporations paying the exact same tax rate that individuals pay. Remember, the majority of jobs are jobs created under corporations and all corporations are owned by people. We call them shareholders and guess what? If you own a mutual fund, an IRA, a government FERs plan or even a share of a Credit Union you are also a shareholder thus the owner of a “corporation”.

One wonders how you could pay $1,100.00 a month for you and the bride. You must have a group plan. Good news for you though. When you retire at age 60, your new plan will cost you north of $1,200.00 a month for just you! Add the bride, assuming the same age and you double it. The new trumpcare does not differentiate with gender, only age and tobacco use.

My advise is to sell the new SUV, trade to a used KIA, trade the crib in for smaller digs and tighten your belt. What you have could be gone in a wink of an eye with a health issue. Medical bankruptcy’s are back in vogue, so what is your’s could be on the auction block for others very quickly. In America, we live on shifting sand regarding many issues. In short, keep working until you give up the ghost, you cannot afford to not with that cost looking at you month in and month out. Add NOem’s tax crap and you may need a temp job for the holidays.

OldSarg wants to have a debate about class warfare and get back to his hobbyhorses about all liberals being nasty people. OldSarg, like our Congressional delegation, offers no rebuttal to the evidence provided by Tsitrian and CBPP that tax cuts for the wealthy and corporations do not appear to have the stimulatory effect for which these tax cuts are being touted. It’s a lot easier to bang one’s beer glass against the bar and shout than it is to sift through empirical data… especially when the empirical data don’t support your ideological point. OldSarg/Thune/Rounds/Noem offer wishes, not facts.

Drag OldSarg and Thune, Rounds, and Noem back to the main point: they are pushing us toward an unnecessary increase in the national debt. There is no practical reason to pass these tax cuts. The practical justifications Thune, Rounds, and Noem are offering are false.

Majority of jobs are created by small start ups, not korporations Old Cossack’s korporations send jobs overseas to avoid paying taxes. Just ask yer idol, Drumplethinskin, Sarge.

For the record-which Old Goofball can’t accept as the truth because the koch bros haven’t clued him in, the small SS check I live on is mine, I paid my dues and I am not going to sit by and let you gawdless, phony kristians take away and give it to the koch bros.

The misnomered tax reform, like health care reform is nothing but a huge push of wealth up the ladder to the penthouse at the expense of everyone making less than 75000 per year. Old Gomer’s wingnuts tried to steal 600 to 800 billion from Medicaid to end help for the poor and use that money to pay for the taxcuts to koch bros. Then they lie about it and their horse’s arses minions defend it as a good deal all around.

Well Old Fogey, we aren’t as stoopid as you are and know better than to trust wingnuts with the economy and other people/s money.

Cory, it doesn’t matter what anyone here says about CBPP, worker shortage, or anything else. The only opinions, views or ideas that are not attacked are those that repeat what you say in the original post. You are being echo’d by the cast from Fraggle Rock. .

*CPBB is a partisan organization just as the democrats or republicans are. That is called a “fact”. Read their web site.

*Worker shortage? You want more employees but you aren’t willing to pay more in wages guess what? You don’t find new employees.

Those were simple. . .

Tax Code: There are just north of 73,000 pages of tax code. the Bible is about 1,200 pages. The Bible, used by the majority of those on this earth, is used as guide to “life”. It is 1.6% the length of the US Tax Code. It has somewhat worked for the last 2,000 years. You know, “morals, sin, bad things, good things, love, death, all that stuff”. The tax code, all 73,000 pages of it is written to tell government employees how to take money from the people they are supposed to serve. I’m a thinking maybe it needs to be shortened a bit. . .

mike the ironic needs a pill.

OldSarg sounds like a ‘wannabe 1 percenter’.

OldSarg – “hurt my feelings”??? Really???

Bwah ha ha ha ha ha ha ha…… man, I can’t stop laughing. But it gets more laughable the more you try to justify the tax scam — er I mean tax reform — without any data or evidence to back up your claims. All you do is throw around word salad that doesn’t make a lick of sense.

So yeah, I said “level playing field”. When the rich are taxed lower than middle class and lower class? Tell me where that’s wrong and how that helps this country overall? I’ll wait…..(you seem to have alot of disdain for “leftists” who want to help people……weird)

Of course like many, I’ve been waiting many decades to see what the trickle down economics plan that Reagan passed will eventually spill out to the rest of us. But what all economists will tell you, is that America was hurt by Reaganomics. Not helped. And it hurt us for many many years, while corporations laughed all the way to the bank. Kansas, the most recent failed experiment. Thank goodness Republicans there finally woke out of the stupor and went against Brownback. Lots of damage caused in the interim that will take years to repair, but at least some of the curtain was pulled back.

So yeah, excuse me if I’m on guard for the current leadership to try the same old tried and true failed scam…er, I mean reform. Hasn’t worked in the past, why would it work now?

(and the whole rant you went on there at the end? Leftist, sex assault etc? Wowsers! Can we get back on topic, OldSarg, and give me some good hard data how these ….uh hem…tax cuts will help all of us?)

Cory, please note that I also linked to the Congressional Joint Committee On Taxation and the National Bureau of Economic Research for my sources, both of which are are about as nonpartisan as it gets.

Dana “without any data or evidence to back up your claims” and yours is where?

Don’t get it? Okay, let me help you out: You want everyone else to fortify their argument with links, facts and court cases all that to prove in the Court of Opinion yet you provide none of your own. . . You are a genius. You should leave your career of posting and move to a mountain top, live the life of self acknowledged enlightenment. You have proven yourself “One Whom Others Cannot Argue”.

“When the rich are taxed lower than middle class and lower class?” I never said that. I said “Fair Tax” like in the same tax rate for all.

“Tell me where that’s wrong and how that helps this country overall?” It is “Fair”. Big word but it means a lot.

Understand “Genius of the Mountain”?

“Fair” is a four letter word that to republicans means a carnival and a rodeo.

I trust former Republican now Independent John Tsitrian

Roger ~ Not really. You off all people should be concerned about the meaning of “fair”. Just think of the number of government grants you have lived off of because being “fair” means you can claim allegiance based upon race.

OldSarg, that is an insult and a wild assumption made because I’m an Indian.

I have never lived off a government or any other kind of grant.

Old Hemorrhoid- who benefits most from dissolution of estate tax?

Who benefits most from huge cut in korporate taxes?

Who benefits most from pass through tax on korporations?

Who benefits the most from losing the alternative minimum tax?

If you wisely chose Drumpf and the koch bros, you would be right for once.

Meanwhile, the lowest of the low and the rest up to around 75000 per year get a taxcut for the first year. In the second year their cut shrinks and after that many will pay considerably more in taxes while your stinking rich compadres amass bigger cuts and all these other benefits.

All the while the deficit is exploding under right wing failed leadership, which is deeply ingrained in right wing dimdots with no clew as to how the economy works.

Don’t take my word for it. Now run off and change the subject to one yer more comfortable with- like throwing babies out into the cold.

Roger, how would anyone have known you were Indian, White, Black, Chinese or whatever and why is it so important to you? Why does it have to be about race? What brought you to that level? Honestly, why would you assume someone thought you were anything? We were talking about “taxes”.

mike take your welfare check and be happy. It will be easier for you. The Kochs never attacked you. You aren’t worth the effort.

OldSarg,

If your grant comment wasn’t about race, what was it about? Are you assuming that anybody that disagrees with you lives off grants or welfare?

And, speaking about welfare, let’s talk about the massive amounts of welfare republicans want to give corporations and the 1% in the form of unpaid for tax cuts to them. Doesn’t it bother you, OldSarg. that these people and corporations profit for doing absolutely nothing and contributing nothing.

How many of the 1% are like Trump and pay no taxes and yet stand to gain billions of dollars in welfare from this faulty tax plan?

Old Smokey, The Kochs never attacked you. You aren’t worth the effort.

Where did that come from? Poor little man. Can’t answer the questions so you obfuscate. Tsk, tsk, tsk.

Okay, OldSarg, when you said “all I hear from folks like yourself is you should get more of what I have because you “think” I have more than you. . . You had the same chance I did,” who exactly is the “you” that you are referencing? I did not think you were judging me, as we have never met and you were responding to Jerry. Rather, I read the comment as referring to people that, by supporting higher taxes on those who can afford to pay, you think might want our government to use the taxes it collects for their own personal benefit.

Of greater importance than OldSarg’s whining is where will these promised jobs go to?

This tax plan also claims to be a jobs act yet there is no explanation of how this trickle down tax plan creates jobs.

Are these jobs created by this tax plan private sector or government jobs.

The Trump administration is desperately waiting for Roy Moore to win the Alabama senate seat in December to ensure passage of this monster.

Mr. C, if I offered to buy your breakfast with my social security money, only because I think you’re a swell fellow, would that be accepting a government grant?

The only way I would accept a breakfast from you, grudz, is if you are present.

According to OldSarg that offer would probably be considered a government handout.

Roger, “According to OldSarg” I never said that. This is the actual problem. You make stuff up. This is why you are so upset. You look for anything disparaging in anything someone posts.

But a better question would be: Have you ever won, accepted or applied for a government grant? Just wondering. . .

OldSarg. Sigh. I won’t waste my time trying to provide a comment to your, interesting and inaccurate reply to what I said. Not worth it in reading your comments to me and others.

Mr Tsitrian (and other blog comments here) have provided alot of data/facts to back up why this tax scam is indeed a scam. That is what the focus should be, and why would I doubt that data? There has been nothing reported to poke holes in that data or to show that it is inaccurate in any way. Nothing. Nada. As many that are much smarter than me have said, “if the GOP tax plan is so good, why do they have to keep lying about it”? THAT is the perfect question!

Old Fart Smeller learnt his blogging skillz from the Wingnut Skool of Bull-Puckery.

For the record- every single model legislation put out to wingnut legislators from the koch bros organizations is a direct assault on every American not in the 1% class.

http://tinyurl.com/ycufzubj

How wingnuts read the constitution. Hillaryous or scary if true.

OldSarg

Yes, I have written grant applications for non-profits and tribal organizations, grants that were available to many government and non-profits. Most of the grant applications I wrote were awarded.

If you are implying that the government has grants available for personal use, I am not aware of them and thus have never applied for one.

Again, you continually dodge the topic of this thread, how does the Trump\Thune tax plan provide promised jobs?

I have never agreed with anything I have seen OldSarg post, but in this thread, he has raised a question I am curious about myself – one that nobody seems to want to answer.

Why is a flat tax rate unfair? Everyone pays the same percentage of their income – period.

I understand the argument most of you will make – that taking 20% of $15,000 hurts a low-wage-earner more than taking 20% of $15,000,000 hurts a high wage earner. But “what hurts more” isn’t the issue. It’s what is fair. I have more or less been poor my whole life, so I am not asking this in order to support millionaires keeping their money, I am genuinely curious. The argument is kicking around that “rich people or corporations need to pay their fair share for the services they receive” or something of that sort. I would argue that a single person who owns a home and drives to their full time job would use just about the same public resources throughout his income-earning life whether he makes minimum wage or is a top-dollar salary guy. Actually, most of the wealthy people I know take less from the “public” than the poor people do. Except rich farmers.

So, I want lower taxes for the poor and higher taxes for the rich – but not because it is fair, but because it benefits me. This is what most of you are seemingly unwilling to admit – that your position is what it is mostly because it is beneficial to you, not because it is fair or beneficial to others.

Also, whether he deserves it or not, it’s funny to see how many people are calling OldSarg names on this thread. It makes your arguments less compelling and unfortunately makes him look like the “bigger” man, so to speak.

Ryan,

With all due respect, OldSarg does his fair share of name calling and perhaps more.

I think you are missing the bigger picture, Ryan. For instance with the cost of healthcare, the wealthy are more likely to be able to afford to pay the cost of a health insurance premium every month if they go out into the market to shop for one. The middle class, not so much.

The fair tax is a very concrete way of measuring fairness. Sure it sounds good, but it obviously benefits the wealthy more and as always, the middle class gets hit the most because the poor are the ones that qualify for the benefits like subsidized housing and obamacare.

It would be my last resort to support a fair tax, but I would probably end up supporting one over this tax cut mess of a bill.

(who is grudz, Roger, that is the question)

What isn’t fair is the federal government giving income back to multi- billion dollar korporations, instead of making them pay some tax.

What isn’t fair is cutting of FICA taxes for the wealthy after the first 120 thousand dollars earned while everyone under that pays on all their income.

What isn’t fair is allowing the wealthy to buy and stockpile favors from congressweasels that the rest of us can’t afford.

What isn’t fair is when some people show up in the cat box here and complain about what they find in the litter, and then claim they are the victims of name calling, etc.

I’m not calling any names. I’m pointing out that, as usual, faced with a clear argument he can’t refute, OldSarg resorts to the barroom-brawl distractions that fit into easy talking points. OldSarg can’t deal with fact and evidence. Call that whatever you like.

And Ryan, you answered your own argument. We don’t tax solely based on use of resources. If we did, that would be like asking poor people to pay for their own food stamps, which would defeat the purpose of helping people weather poverty. We tax based on the burden different income groups can bear. Higher marginal rates reflect differences in impact on utility. That last $1000 for the guy earning $25K saves him a lot more grief than the last $1000K that the guy earning $1M makes.

But remember: this discussion isn’t even about progressive taxation (which Thune acknowledged two weeks ago is the right kind of taxation). This post is about indicting the fundamental thesis of the Trump/Thune tax cuts, that we need to use deficit spending to give rich people and corporations more money to create more jobs. The evidence presented refutes that main thesis, which should be enough reason for every Senator to vote against this bad tax plan.

Guys, guys, guys you are all attacking me not because “of” my views but because my views differ from yours.

A “fair” tax is a level percentage from all members of society. Yes, even those on food stamps should contribute whether it be through volunteer work or their job at the same rate as the rich man in his limo.

The annual Federal Budget is $3.8 Trillion dollars and we have about 350 million Americans. The average American household is 2.53 people. The average household income is $50K. That gives us 138,339,921 households paying taxes. That generates just $6.9 Trillion dollars so a flat tax will not work unless our tax rate was 50% of all of the Nation’s income. Sp the flat tax is out because our government is spending way more than we can afford.

grudznick is totally for the fair tax. We should make everybody pay in the same percentage. Same percentage. Work harder, earn more, contribute equal percentage. This way the people who don’t work hard enough aren’t rewarded for sitting on their haunches.

The only time wingnuts concern themselves with equality is when it will benefit the wealthy, as in their paying less taxes to equal what poor people pay.

Equality is good, Mr. Mike. Even there where you live, oneiowa.org pushes harder for equality in all areas.

OldSarg, I’m not attacking you. This post isn’t about you. (Not one of my blog posts is.) Nor is this post about your regressive tax scheme (which, as I said above, even Thune rejects).

This post is about the failure of the Trump/Thune tax plan’s fundamental job-creation thesis, which you have done nothing to defend.

Yet Thune has the gall to go to the Koch Brothers’ lunch today in Sioux Falls, repeat the job claims debunked by Tsitrian and his sources, and claim that he supports a balanced budget amendment even as he pitches a tax plan that further unbalances the budget. That’s like toasting Prohibition with tequila.

Well said, too Bad he doesn’t have a Brain to figure it out.

Partisan Smoke Blowing…

thune is up to his neck in this sheit. he is McConnell’s boy.

Will they continue to tolerate Trump’s unprecedented conflicts of interest? He holds stakes in roughly 500 international businesses, many in countries where he must negotiate trade and other agreements. The conflicts are so serious that the Office of Government Ethics director couldn’t abide them and resigned, while Republicans just stood pat.

https://www.salon.com/2017/11/20/what-will-the-republicans-game-plan-for-2018-elections_partner/

Things like differing healthcare cost burdens and food stamps are outside the scope of the issue I was responding to. I’m asking honestly the specific question why a flat income tax for all wage earners is unfair.

The income tax, as you all know, is but one mechanism for us giving the government our money. Rich people own much more property than poor people, and that property is much more valuable, so rich people are more negatively affected by property taxes than poor people, who likely pay no property taxes. Only rich people pay estate taxes, and only rich beneficiaries pay inheritance taxes. No impact there on poor people, or middle income families. With personal exemptions, childcare credits, mortgage interest credits, and everything else on the average 1040, poor people get by contributing essentially nothing financially, other than sales tax, to the public funds that allow society to function. I don’t say this as a judgment, but as a factor in the overall impact of the income tax on individuals. Complaining that the impact the federal income tax has on a family in a low or middle income tax bracket is an unfair burden is just plain silly to me.

This isn’t about federal education grants, welfare programs, farm subsidies, or anything else. I support programs to help people in all sorts of tough situations. We owe it to our fellow humans to pick up their slack if we are more fortunate than they are for any number of reasons. But those things aren’t what I’m asking about, either.

This far-too-long comment is only about tax on wages earned. Somebody show me the light of why earning more should equate to higher income taxes.

http://thehill.com/homenews/senate/359574-sen-thune-i-think-senate-tax-bill-can-be-passed-before-jan-1

Thune thinks some dems will join his vote to cut taxes for the Koch Brothers (yukking it up with them at lunch in Sx Falls no doubt). I seriously doubt the GOP threat to further sabotage ACA by abolishing the mandate, and then patently withdrawing that threat (as Lisa Murkowski is liking to give her a chance to save face) is an art of the deal.

THUNE SAYS: “Tax relief for middle-income Americans is one step closer to reality.” lets see how he has twisted the truth. more to follow….”loose relationship with the truth” and he’s “accepted alternative facts”. (in the words of Watergate prosecutor Jill Wine Banks ABC news 11.20.17) see https://www.thune.senate.gov/public/index.cfm?p=press-releases&id=448ABD78-7E80-4522-9F01-E0702187F317

OldSarg, if you are all about fairness, then I assume you are railing against the bargain capital gains rates that Congress has bestowed on the wealthy. You remember I’m sure that the working stiffs that put in their 40-60 hour weeks pay taxes at ordinary income tax rates. On the other hand, Donald Trump, and his rich buddies, typically make their money in the form of capital gains. So, Joe Sixpack with a good paying job is paying a higher marginal rate than Joe Millionaire.

But supporting millionaires and billionaires over the middle class is no surprise for you and your party. What is surprising, perhaps, is that many in your party have now decided that they will support a child molester to serve in the Senate rather than a Democrat. Is this the new party of family values? Oh, how the mighty have fallen!

I have a feelin…thune’s wooden nose is growing, trying to swindle SD middle class taxpayers.

“[R]ates as low as 15 percent or 20 percent — would not deliver substantial economic benefits for the middle class and would instead result in huge revenue losses and a much lighter tax burden for those at the top of the income distribution.” http://www.factcheck.org/2017/09/benefits-corporate-tax-cut/ Kimberly Clausing — an economics professor at Reed College and author of the paper “Who Pays the Corporate Tax in a Global Economy?”

Today, the Tax Policy Center released its analysis of who would benefit the most under the Senate’s bill, which has passed out of committee but has yet to receive a floor vote. Much like the score published by Congress’s Joint Committee on Taxation, it shows the spoils disproportionately go to the rich; the top 1 percent of Americans get just over one-fifth of the cuts; the top 5 percent get just under half of the them. https://slate.com/business/2017/11/senate-tax-bill-gives-six-figure-cuts-to-the-top-0-1-percent-says-tax-policy-center.html

Top 0.1 percent: Average tax cut, $360,430, enough to pay the average salary of an American anesthesiologist. Your tax cut is literally worth all the things that slogging through seven years of medical school might afford you. All of the things.

Top 1 percent: Average tax cut, $77,190, enough to pay for a nice Lexus LS. ….

40th to 60th percentiles: Average cut, $1,250, enough for this Frigidaire two-door refrigerator.

20th to 40th percentiles: Average cut, $530, probably enough to replace the brake pads on your car.

10th to 20th percentiles: Average cut, $150, enough to pay for a couple of dinners for four at Chili’s.

thx john ole’ budy ole’ pal (nice wooden nose!)

Darin, if you own a mutual fund then you also benefit from the 15% tax rates on capital gains.

Guys read this again: “The annual Federal Budget is $3.8 Trillion dollars and we have about 350 million Americans. The average American household is 2.53 people. The average household income is $50K. That gives us 138,339,921 households paying taxes. That generates just $6.9 Trillion dollars so a flat tax will not work unless our tax rate was 50% of all of the Nation’s income. So the flat tax is out because our government is spending way more than we can afford.”

50% of everything EVERYONE earns in the United States is needed to support the spending our government does every year! Arguing about fair tax, progressive tax, deductions or someone having more than you have is all MOOT! We, as a Nation, are broke beyond reason. These are simple numbers I would hope anyone on here could understand. There is no “fix” for our tax system, no adjustment, no elimination of any tax or forced health care insurance payment that will fix this. As much as this sounds like Doom and Gloom the fact remains IT IS! Without radical spending cuts to this government we will not survive as a Nation period.

Here’s Moody’s Analytics Economist Mark Zandi today on why the tax plan is set to fail: https://finance.yahoo.com/news/moodys-chief-economist-republican-tax-plan-set-fail-170334541.html

olesarge, u as bad as thune. you started the name calling at 11:20, then got caught, and lied that you didn’t. garbage in/out. lay off the Limbaugh, the Hannity, the colter, the trump admin liars, the entire right wing “news” bullsheit, fcs. and quit standing in the grocery line snarling coming up with faulty conclusions, and myob. then at 19:11, u stupid sheit you brought up race: “…grants you have lived off of because being ‘fair’ means you can claim allegiance based upon race” then had the gall to deny it at

HRC correctly assessed, we are finding as we cut through all his smoke and bluster, that Trump was “Putin’s puppet. “NO, NOT A PUPPET” he exclaimed! Same with u, olesarge: “people like you steal from my grain bin that I filled through my efforts. No, not a sourpuss”. U say here you hate liberals who have lost Ameraca, you hate Indians who have taken out grants, u bible-thump while railing against the complex tax code. u hate government employees who “take money from the people they are supposed to serve.” if only everyone had a simple life of hard work like yours, eh? your boy got a law degree. you are proud. merely an angry happy sergeant who is a great boss, with little big picture understanding. good. no predatory college loans? no forced arbitration agreements. hope your family doesn’t have interruptions like addiction, cancer, job injury, disability, class 5 hurricanes, walking while black, going back home after military service to the rez, to set u back. u own title to your little lot and home on Indian land stolen, and exercise white privilege daily, unknowingly. life happens, just not to you. u are almost 60 so u know it all. so

FACT: “The U.S. has the highest statutory corporate tax rate among developed countries, BUT the effective corporate tax rate is about AVERAGE when tax credits are factored in.” What the corporations really avoid or evade is the reality. the tax code is so complex to legalize the illegal evasion corporations and the rich use to evade taxation. folks like the Koch brothers had their lawyers and accountants and politicians write those 73,000 pages to stay out of prison. now SD is joining the state tax haven game. talk about sanctuaries. http://www.factcheck.org/2017/09/benefits-corporate-tax-cut/

This is contrary to Thune’s “hide-the-ball” white paper at https://www.thune.senate.gov/public/index.cfm?p=press-releases&id=448ABD78-7E80-4522-9F01-E0702187F317 where you say: “[O]ur businesses pay some of the highest taxes in the industrialized world [1st Pinocchio, John!].”

You continue: “This plan would make U.S. businesses [No John, we are already “about AVERAGE.” 2d Pinocchio!! We are not] more competitive [by virtue of your tax cuts], which would create jobs [John, non-corporate “businesses” might make PART of your statement somewhat correct, but not for our corporate businesses. Did you learn this OMISSION method of misrepresentation of truth peppering false statements with some element of “truth” from “Art of the Deal?” 3rd Pinocchio, John!!! Taxes are already about average so why will jobs be created in a status quo situation? 4th Pinocchio!!!!] and increase wages [why will wages go up? Our corporate businesses are paying very little effective tax already! Wages should already be up! Yes–just like that John, 5 Pinocchios] for American workers.” WOW, John, 5 Pinocchios in one 12 word sentence!!!!!!

Pretty disrespectful to your 850,000 some constituents, but they are exactly who the KOCH BROTHERS want to take advantage of, with no protection or effective representation from you. Sell-out. Shame on you. You should have learned in your 1st year in business after religious college, that misrepresentation by omission is just like lying. It is lying.

Just like the underlying whopper that your entire tax cut reform is underpinned by a 3% or better growth in GDP every year. This doesn’t meet the smell test either. That is for a separate discussion.

Leslie, it doesn’t matter. It just plain does not matter. We have all been arguing the wrong topic. High taxes, low taxes or no taxes will not cure what ails us. My numbers are right. The government is spending 50% of everything we earn on an annual basis. You worrying about me and how upset you are that I post things you don’t like is not skin off my butt. It just doesn’t matter anymore. This can’t be fixed though taxes.

Taxes are taken through money made.

Spending happens without consideration of what we produce.

This does not work. Not for your family, business or government period.

https://jobsanger.blogspot.com/2017/11/tpc-analysis-of-gop-tax-plan-to-reward.html

telling graph shows how little of the taxcuts for the wealthy doesn’t go to the wealthy.

Old Whoever hasn’t figured out this is a giveaway to the wealthy, compliments of his buddies. It has nothing logical to do with improving the economy for anyone other than the top. It will do nothing except shift more wealth upward in a hurry and add to the staggering debt and deficits wingnuts lie about when theywhine they are concerned.

Old Sarge can always be counted to forget the facts and use his incomplete posts to attempt to bolster his agenda.

“USA spends half it’s earnings on an annual basis?” So what? It’s the unbalanced tax structure that creates the deficit and debt. That means the rich don’t pay their fair share, Sargie. Show us your tax returns and prove my point, Donald Trump. This can ONLY be fixed through taxes.

PS … USA’s net worth is $89.4 trillion and our debt is only $20.2 trillion. The ratio of household net worth to personal disposable income has risen to 639% from 629% a year ago. If this is a crisis it’s been a crisis for 50 years and it’s not destroyed us, yet. #FakeNewsSarge

Portly, mine isn’t just a “fact”, It is actually arithmetic. Beyond that “Net Worth” doesn’t tell you how you are doing, how your family is doing or how the Nation is doing. America’s “Net Worth” is NOT liquid it is in their house. That means you cannot “spend” it.

The FACT is: 50% of the income produced by all American families on an annual basis would only provide enough money for our government to operate for ONE year!

“This can ONLY be fixed through taxes” at WHAT tax rate Genius? Here, let me do this arithmetic for you: If you make a dollar half of that dollar is required by the government. That is a 50% tax rate.

Oh, Portly: in the future try using your own words instead of plagiarizing the works of others “the ratio of household net worth to personal disposable income has risen to 639% from 629% a year” http://time.com/money/3919690/americans-total-net-worth-record/. Stealing the work of others is like wearing medals you never received. Have you done this in other parts of your life? Is this something you have always done?

You should credit the source instead of simply stealing their words. Shame on you.

Au contraire, mon frère.

1. My net worth tells me exactly how much I’m worth. I don’t want to spend it. I want to increase it above my net debt. It’s a very important stat in my financial planning.

2. Only one year’s taxes? What? We’re not going to collect taxes next year?

3. A 50% tax rate on the top 1% would fix the problem. You’re astute to bring it up when it doesn’t support your agenda. PS … I’m not a genius. My IQ is only 132. How about you?

4. USA reports are facts fungible to all of us. I got those numbers from another source than Time but facts is facts, buddy. PS ….. I have lots of medals … from when I was SoDak state diving champion when I was 12 and state swimming champion when I was 14. Lots of track/field medals, too. Trophies, too. Didn’t steal ’em. Still got ’em.

5. Tell me your definition of shame and I’ll shut up and not continue to do it to you.

Happy Turkey Day. Hope you’re not alone, again. :)

This tax heist is just another in a long line of thefts that have cost veterans billions. Since 2010 and continuing on through today, Thanksgiving, the federal government owes at least $10 Billion dollars to veterans and to providers for services rendered. Unfortunately, those creditors are coming after veterans for the pay. There are 350,000 of us who have to pay the facilities for guaranteed services rendered through no fault of our own. https://militaryadvantage.military.com/2016/04/appeals-court-finds-the-va-wronged-vets-by-ignoring-2010-law/

Don’t believe a word that Thune/Rounds and NOem say about how much this will do for you. This will be just like it has been since 2010 regarding veterans, we will all be left holding the bag for these guys bottom line.

Swimming?

Paul Krugman at the New York Times writes:

“Yet this time is different. It’s not just that the lies have gotten even more brazen. There’s now a combination of incoherence and rage that we, or at least I, haven’t seen before. These days, they can’t even seem to get their fake story straight — and they literally start yelling obscenities when someone tries to point out the facts.”

Thune/Rounds/NOem and the rest of the lying liars have been told by their rich handlers that if they do not get a tax cut so they can all get a rebate on their jets and yachts, then no more campaign buy ups. The teat will have dried up if the republicans cannot lie and cheat their way into the biggest screwing middle class and lower, taxpayers have ever had.

When Ohio Senator Rob Portman, appeared at a Koch sponsored “townhall” the other day – a very astute Ohioan confronted Mr Portman about how the tax “reform” will trigger cuts to Medicare. In typical gobbily-speak of the GOP, he talked around the subject – and well, flat out lied about it. But the astute Ohioan appeared to know much more about the bill, past legislation (PAYGO), etc than the dear Ohio senator! And kept pressing him on the facts (those darn facts get in the way, don’t they?) It was at a certain point, when a rep from Americans for Prosperity had to step in, stop the townhall, and save Portman from himself.

I wonder (well not much) if Thune embarrassed himself like this. Hmmmm

Here is the link ref Portman from Cleveland.com:

http://www.cleveland.com/metro/index.ssf/2017/11/sen_rob_portman_gets_slammed_o.html

Good catch there Dana P, Yes that PAYGO is where the rubber meets the road. I wonder if Thune/Rounds and NOem are even aware of that and how it works or maybe they might think it is the new convenient store in Polo. They need to be asked that question, but who do we have here that can do that? Corrrrry, of course. Ring the bell to get this feller on the call circuit. This would be a very good question for the governor’s race as well as the house race.

Mr. H controls most of what the Democratic Party does in South Dakota, ever since their leadership imploded through massive and total failure to perform. I don’t think the Democratic Party is going to boost any other candidates like Ms. Wismer or Ms. Hawkes to run against Mr. Sutton. They are going to spend the whole wad of cash they have on Mr. Sutton but they will wait a while.

Cory, they ar off topic. Do something quick!

Mr. H is shopping the early Black Friday shopping at the mall in Aberdeen, queued up at the Kohl’s for some big deals when the doors open at midnight. Mr. H is a bargain shopper, thrifty as he is. I expect he’ll blog about the news of the weekend on Friday night, and we can wait.

Heavy sigh OldSarg. The tax “reform” WOULD trigger PAYGO — um, and that’s off topic? And that R’s that are talking about their tax plan and trying to sell it are either lying or don’t understand the full impacts of the plan — is off topic?? Wow!

Mr Tsitrian and Cory have provided much data on this entry about this tax scam. Here is some additional data, from Vox this morning. “The math just doesn’t work” :

https://www.vox.com/policy-and-politics/2017/11/24/16689998/penn-wharton-budget-model

[“Queued up” at midnight? How poorly you understand me, Grudz.]

The Penn-Wharton analyst Dana cites is a Gingrich/Bush II veteran. His analysis says “The result will likely be lower incomes for the bottom half of the income distribution even before considering the negative impact of inevitable spending cuts to offset the surprisingly low federal tax intake…. they find that ‘the Senate Tax Cuts and Jobs Act reduces federal tax revenue in both the short- and long-run relative to current policy. In the near term, there is a small boost to GDP, but that increase diminishes over time.'”

Totally on-topic, Dana. Good read.

Also key in Dana’s link: the chart from CBPP’s read of Joint Committee on Taxation data showing the only people keeping tax cuts by 2027 and beyond are folks making over $100K.

Also in Vox, out of 42 economists quizzed, all believe the GOP tax plan increases the debt, and only one thinks the plan will boost the economy.

“…..get back to the empirical evidence and sensible policy …..” GET BACK???? GET BACK TO…..? What on earth are you smoking Corey? Since when have Thune’s policy positions EVER been based on empirical evidence? No, really – I mean – WHEN has this ever been the case? Can you refer me to a single instance?

Point taken, Richard. Perhaps we direct Thune back to what his high school English teachers would have expected in terms of using supporting evidence in his term papers. Or maybe the call is less to Thune specifically but to statesmen in general to adopt principles of debate, oratory, and policymaking that guided past leaders.

Thune and one economist think that this tax rip off is a good thing for anyone but himself and the rest of the multi multi millionaires https://www.vox.com/policy-and-politics/2017/11/22/16691016/economists-gop-tax-plan-igm-poll

Thune has so much money in his war chest that it is making more money that what donors could give to him. We are stuck with this sad sack until he finally has had enough at the trough.

This so called tax reform bill along with Drumpf Don’t Care healthcare reform were nothing more than redistribution of more wealth to the top.

https://tinyurl.com/yae724ld

How trickle down economics really works in one simple lesson.

Rand “Atlas shrugged while my neighbor kicked my butt for no apparent reason” Paul sez he is voting for taxcuts for the wealthy.

John Thune is wealthy, Rand Paul is wealthy, Mick Rounds is wealthy they are all wealthy and they need this tax cut to be even more wealthy. NOem is wealthy and she already played it forward, what else can they do?

Remember when Obama was president, all they could do was pass the repeal of Obamacare 65 times. They passed it so many times with the replacement in the top drawer that never materialized, but they had success at passing that bill over and over again. Obama just did what he did and governed. trump, on the other hand, is gonna get sacked, and may go to jail,so there is that.

One of the commonly espoused tenets of the Republican tax plan is that giving a huge tax cut to corporations will spur investment in production of more widgets and thus spur more jobs. What Republicans don’t talk about is that US corporations have piled up more than $2 trillion in cash already in corporate treasuries. This is in addition to the many multiples of $2 trillion that corporations have in borrowing power. US corporations are not short on capital to increase production if they felt the market could absorb more of their production.

Contrast this with consumers who have languished under the economic constraints of slow wage growth. This in turn limits consumer demand for products and causes companies to be conservative with their investments in new production capacity.

Targeting corporations for large tax cuts and expecting them to use the money to build unneeded production is contrary to every commonly held economic principle. Instead, corporations will primarily pass the tax savings on to shareholders. Wealthy investors will be the primary beneficiaries of this tax cut strategy.

If instead, the tax cuts were actually targeted at the middle class and poor, this money would be spent in the economy, spurring demand for consumer products. Corporations then would have the incentive to increase production to meet the new demand. In order to meet the increased production requirements, corporations would have to hire new workers, driving up wages. Corporate profits would increase and the economy would grow more quickly. It results in a win/win/win situation with corporations, the middle class, and the economy as a whole all benefiting and sharing in the resulting prosperity. As Trump predicted, we might get tired of all the winning. If only Trump had a clue about economics or an adviser that could educate him on the fact that the middle class is the economic engine of this country.

Hey, Darin! Didn’t we have better wage growth before Reaganomics, back when corporations and rich folks paid higher tax rates? It seems the governing philosophy that the rich get first dibs on all money may be promoting an entitlement mentality among the capital class.

https://www.salon.com/2014/04/19/reaganomics_killed_americas_middle_class_partner/

Yes, Cory, we had both higher wage growth and greater economic growth rates during periods when we had higher marginal rates on the wealthy. I’m not advocating a return to 70-90% top marginal rates, but I’m certainly advocating that tax cuts should be focused on the middle class.

If we are going to add $1.5 trillion to our debt to give tax cuts, the cuts should be targeted to the middle class which will spend the money and spur our economic expansion. When you give the tax cuts primarily to corporations and the wealthy, they don’t have to spend the money on investments in our economy. As I mentioned, most corporations already have access to all the capital they need at low rates of interest. Wealthy folks can park their money in offshore accounts, investments in precious metals, or other activities which do not result in economic expansion.

You want an expanding economy with higher growth rates? Target the tax cuts to the middle class and they will spend the money as sure as Trump will put his foot in his mouth. The dollars spent by the middle class will turnover in the economy multiple times as the effects of consumer demand ripple through each sector of retail, wholesale, transportation, advertising and manufacturing.

Hey, Darin! That’s what Tim Bjorkman says! Now if we could get you and Tsitrian to run for something, we’d have candidates all over the place talking economic sense!

Seriously, your last paragraph could be the single economic message around which every Democrat could craft the campaign message that would win majorities in every chamber. Punctuate it with, “…and we won’t take away your health care”, and Dems win supermajorities.

Wingnuts know that money or benefits given to lower classes are immediately spent. Foodstamps return much more than they cost which I suppose is why wingnuts are in a rush to take people off them.

Cory, I’m very pleased that Tim Bjorkman is focused on policies that will support the economic resurgence of the middle class and poor. I agree that should be the emphasis of every Democrat. Democrats should compare and contrast the Republican tax plan, which is an embarrassment of riches for the wealthiest Americans while hardly making any real difference for much of the middle class and poor.

As Bernie Sanders predicted in last night’s debate, as soon as this tax cut for the rich is passed, which adds $1.4 trillion to the national debt, Republicans will suddenly be concerned about the debt once again. They will then seek cuts to Medicaid, Medicare, and other programs that work for the benefit of the middle class and poor on the basis that the expansion of our debt is unsustainable.