Governor Larry Rhoden’s proposed budget assumes the state will take in 2.4% more revenue in Fiscal Year 2027 than it is on track to take in this fiscal year. Yet Rhoden proposes using none of that additional $58.7 million to help K-12 schools meet their rising costs. He’s proposing cutting K-12 state aid to general education by $12.9 million from budgeted FY 2026 levels and scaling down this year’s state aid to our public schools by $15.5 million.

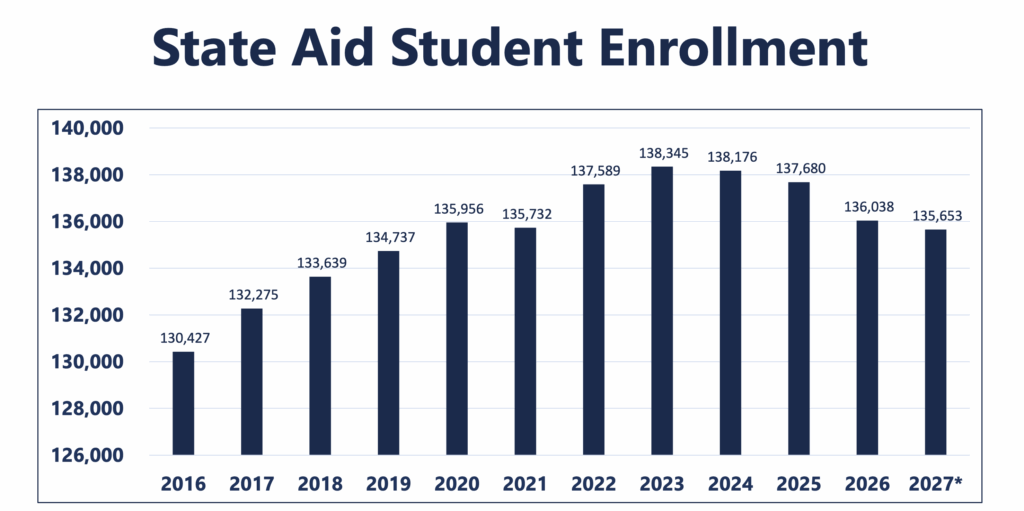

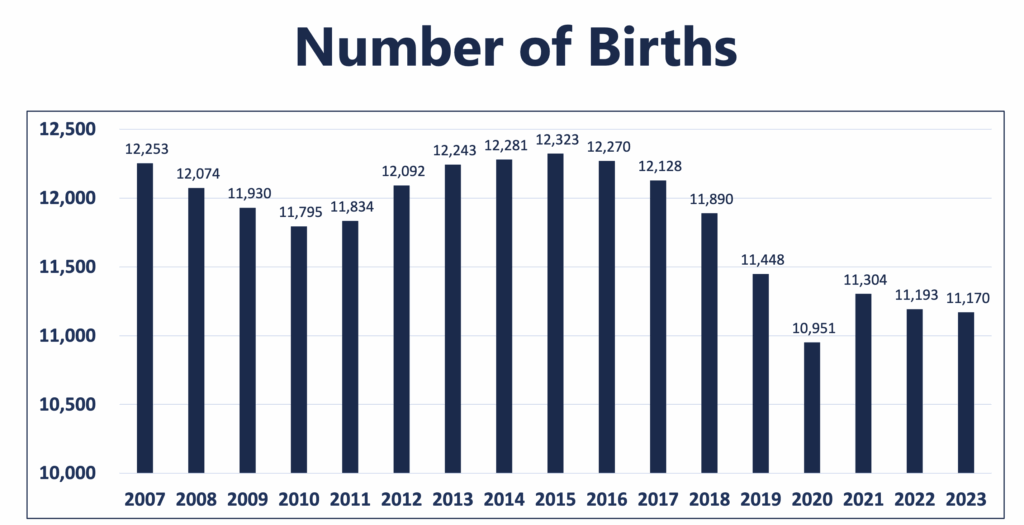

Rhoden justifies again ignoring the state law that says we should ratchet up K-12 funding each year by the lesser of inflation or 3% by pointing out that we have fewer enrolled students and fewer babies:

For K-12 education, in particular, enrollments are down across the state. And why is that? There are two main reasons. Number one, births are down 9% over the last 10 years. And even though South Dakota still has the highest birth rate in America, it’s not high enough to keep up. In the meantime, we’ve seen a 216% growth in students getting alternative education, such as homeschooling. Those families are choosing the best education option for them, and they should! Our funding formula is largely based on the number of students in public education, and when there are fewer students, this is what happens [Gov. Larry Rhoden, budget address, 2025.12.02].

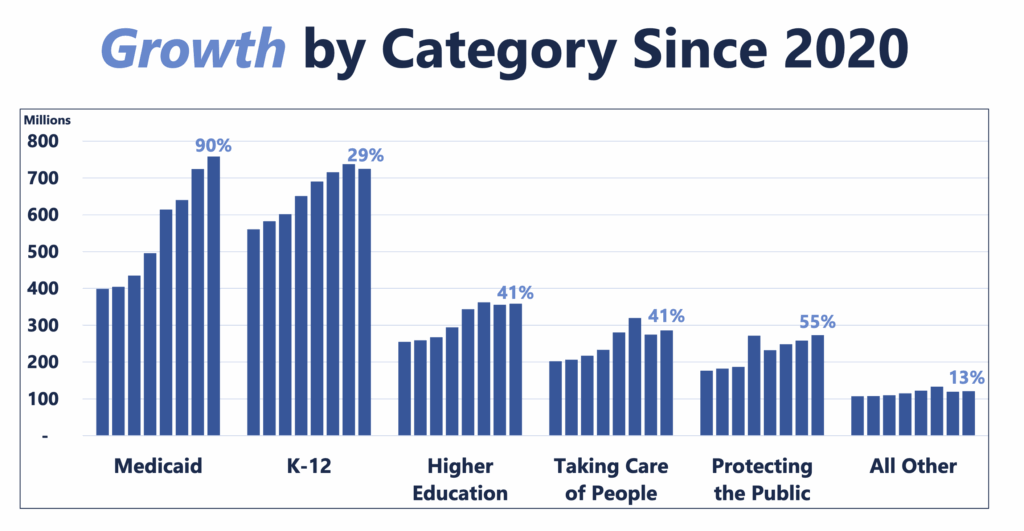

Governor Rhoden says the state has increased K-12 funding 29% since 2020—the lowest increase among the five major budget areas over that period—so the public schools can deal with flat funding this year after a stingy 1.25% increase last year.

On the faintly less dim side, Governor Rhoden has not yet proposed any increase to the stealth vouchers program that diverts $5 million in public tax dollars to private schools. The Legislature increased funding for that program by 75% in 2022 and by 42% this year.

Rhoden says schools and everyone else should view his “limited budget” as an “opportunity“… which sounds like something Rhoden would say to his boys when they had a whooping coming. But nobody sounds eager to seize this “opportunity”:

Rapid City Democratic Rep. Nicole Uhre-Balk said inflation will eat away at flat funding if legislators approve Rhoden’s plan.

“Not increasing is a cut,” she said.

…Rep. Mellissa Heermann, R-Brookings, worries efforts to “drag ourselves up” in teacher pay rankings will be erased without more state support to education. South Dakota moved up the national ranks from 50th in teacher pay in 2021 to 46th this year.

“It’s been difficult for us to even maintain the gains we’ve had,” said Heermann, who served on the Brookings School Board for six years. “All other states around us are also increasing their teacher pay, so my fear is that 0% is going to move us backwards.”

…“Up until about last year, schools were doing OK keeping up with inflation. They weren’t getting ahead,” [SDEA lobbyist Sandra] Waltman said. “But when you start to receive funding that’s less than inflationary, that’s when you start to fall behind and see school districts cut positions and budgets” [Makenzie Huber, “‘Not Increasing Is a Cut’: Governor’s Flat Funding Plan for Education, Health Care Worries Advocates,” South Dakota Searchlight, 2025.12.01].

Governor Rhoden’s FY 2027 budget leaves $14 million unallocated—mad money for the Legislature to spend on other priorities. Let’s hope appropriators start with that $14M and find additional revenue (like maybe clawing back the $5 million we’re improperly diverting from insurance tax to private schools!) to help the public schools keep up with inflation.

SDGOP race to the bottom is clearly too close to call. The November Business Conditions Index for South Dakota dropped below growth neutral falling to 49.1 from October’s 51.2 and the average weekly number of workers in the state receiving unemployment compensation is 5.1% higher. The US Dollar is in the toilet and suicide rates in the ag section are spiking.

As a general rule, Republican governance has been bad for child births, and five years later the beginning of a dip in school enrollments begins.

The hate and pessimism of Trump rule must have spilled over into the bedroom, as births started to plummet. Before Trump came on the scene, the Obama years had a lot of hope and optimism, which seemed more conducive to lovemaking and bringing new life into the world. After the Trump epidemic years, Biden was able to push child childbirth numbers up a bit, but along came a Republican Congress that set childbirth numbers tumbling again. The declines in childbirth seem to be set off by Republican control over government, as the Bush II years also had declining birth rates.

He could bring in Elon for a couple months. He’s a very fertile guy.

I noticed during the Obama years that there was business comeback in the rural areas of SD. I saw some excitement and hope in rural SD. People were building new shops or opening businesses in old buildings. Then came the Trump years and it has been nothing but decline in the rural areas of SD. Grocery stores, lumber yards, hardware stores, gas station/C-stores, and eating places are examples of businesses that closed during the Trump years. I have even noticed small town bars are closing, which to me is the flashing red light that things are not good.

Republicans seem to want to attacked and destroy any and all forms of government including public schools. Like so many things, there was no concern about public education, until the Trump MAGA started attacking public schools as a way to energies the MAGA base.

As a general rule, South Dakota is a deadbeat when it comes to living up to paying support for students education. State government is like the deadbeat dads who seek to escape responsibility to support their children. The state has a Constitutional and statutory responsibility to fund education, yet it fails most years to even meet the bare minimum increase that it set for itself. The state sets out a ta table for child care that parents have to meet, yet the state continually violates its own laws to provide and adequate education. They should be ashamed.

Apparently, Mr. Pay, we gotta slash those property taxes, and to do that we gotta gouge the kids or at least poke them in the eye. That’s what grudznick is being told. I am undecided.

By not rolling the declining enrollment funds back into K-12 education, the governor misses an opportunity to to put teachers and other school people a priority. The funds are there to give an inflationary increase, the will to do it is sorely lacking.

According to his screed at the Dakota War Toilet quack Fred Deutsch wants government to determine student outcomes.