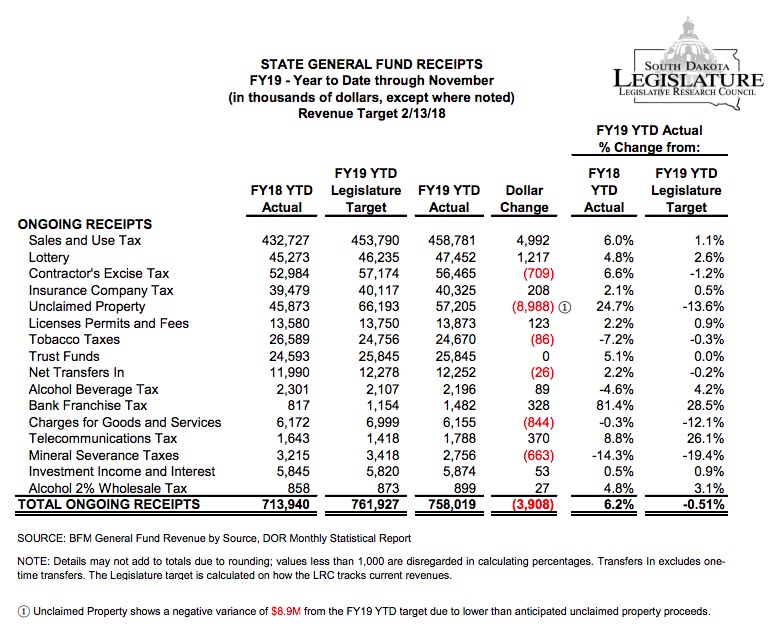

The Legislative Research Council reported that, as of the end of October, South Dakota was up $5.98 million in revenue collections compared to what the Legislature budgeted last March. The Bureau of Finance and Management said we were up $3.0 million.

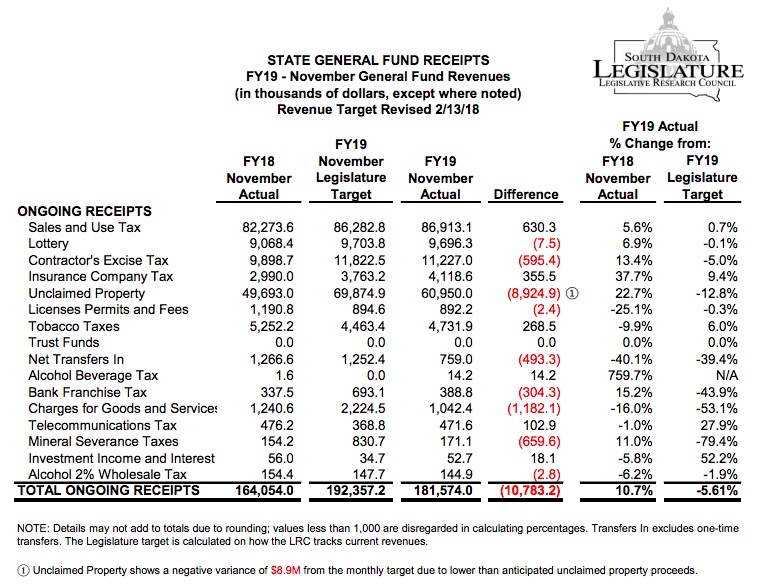

Never mind: the latest General Fund Receipts report from the LRC says we took an 8.9-million-dollar kerhwallop in unclaimed property receipts, leaving us $10.8 million short for November collections and $3.9 million below budget projections from July 1 through November 30.

In his budget address on December 4, Governor Dennis Daugaard projected $2.3 million less in revenue than the adopted FY2019 budget assumed. If the above shortfall of $3.9 million extrapolates smoothly through the remaining seven months of the fiscal year, our total revenue shortfall would be $9.4 million. (Kiss your new oversight committee and the Partridge Amendment goodbye….)

November’s tobacco taxes came in above Legislative projections, but tobacco collections returned to their historical decline, dropping 9.9% compared to November 2017. October is the only month so far this fiscal in which tobacco collections exceeded the previous year’s collections. November’s significant decline following October’s unusual 23.3% surge suggests that smokers and chewers really did stock up in October in fear of G. Mark Mickelson’s Initiated Measure 25 to raise the tobacco tax by a buck a pack, then eased up and burned through their stash after we rejected IM 25 on November 6.

I know of a lot of people (me included) that make the drive to Beulah to buy 5-10 cartons at a time because it saves $20 a carton. It’s well worth the gas.

Do cigarettes still have coupons you save up for lung transplants, cancer care, funerals, etc?

Now, Cat, you don’t go selling those Wyoming smokes to your neighbors, do you? That would be naughty….

Did any of your smoking friends buy more cigarettes in state during the IM 25 debate?

If we allowed indoor smoking in casinos only we could raise the tax a heavy hit and drop property taxes a big scootch and still have the same amount of money.

That’s no way to run a railroad, Grudz. Everyone who rides the train buys a ticket, not just the people riding in special cars. Likewise government: everybody who benefits from schools, roads, cops, and parks should help pay for schools, roads, cops, and parks.

Cory–I’m curious how property owners without kids benefit from schools which is about 70 percent of property tax. Please don’t use the argument that educating kids is for the childless person’s benefit or that they are paying for people who rent. I’v discussed both and they always fail.

1. The majority of childless people attended public school. They use that education every day.

2. Childless people may change their minds and have kids. They benefit from knowing that, if they conceive or adopt, they will have good public schools available for their kids immediately, wherever they go.

3. Childless people live in society. They live better when they are surrounded by well-educated individuals who are able to take care of themselves, stay healthy, hold down a job, bag their groceries, read the “Keep Off My Grass!” sign in their front yard, and generally contribute to society.

Public education is a basic social and democratic institution. We all have an obligation to support it… unless we prefer to be surrounded by idiots.

Cory I wouldn’t dream of selling my cigarettes. I buy so many because I hate the drive. Everyone I know already buys the max allowed (5 cartons for walk in or 10 cartons for preorder) so I didn’t see a rise in purchases.

However, it was the first time my very non-political friends actually joined in political discussions. I think IM 25 woke them up to the fact that politics can have a large impact on their lives and voting gives them a voice.

Cat, if the cigarettes don’t kill you, the drive to Wyoming and back might. Try to cut back. ;-)

Interesting that IM 25 got your friends paying attention to politics! I can’t complain about that civic benefit. I hope they’ll remember IM 25 (and their success in defeating the tax that targeted them) and come back and vote in 2020.

Cory– The parents paid property taxes to educate so their children could benefit.

Also, you fell back into the argument that childless single or couples should pay school property taxes for other parents children so they don’t become idiots. Seems that public education is socialism that most are involved in, but declare socialism as a bad thing.

Sure, public education is by definition a socialist enterprise, acting to provide a public good that the free market cannot and will not. In this case, socialism is a lot better than letting only the rich and lucky get education while the rest of the community remains ignorant and disempowered.

The argument that childless families should pay for public education remains solid and unrefuted by your logical fallacy about socialism.

I pay for police, but I haven’t used police today.

I pay for a fire department, but I’ve never had a housefire.

We all pay into Medicare right now to take care of people other than ourselves.

Many public goods don’t operate on fee-for-service basis. We sustain basic public institutions so they are available to everyone. You don’t pay porperty tax just to educate your kids. You pay property tax to educate everyone’s kids.