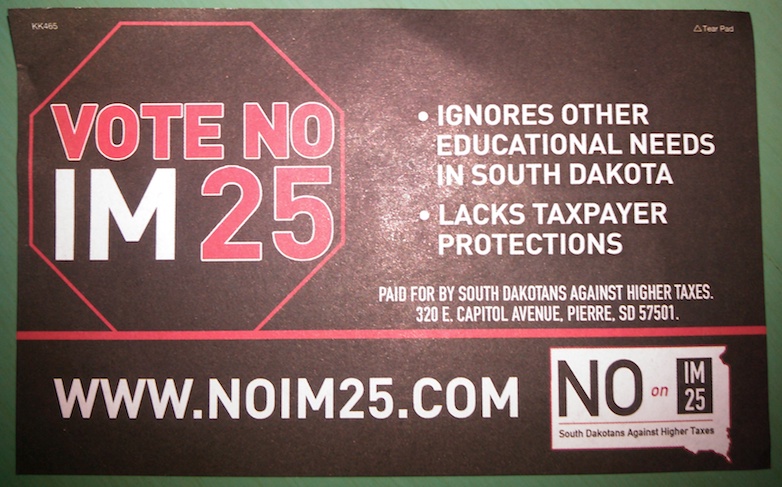

On my milk run to the corner Cenex last night, I found a “NO on IM 25” display on the counter with a whole packet of these tear-off clips for voters:

The same image and text appears front and back. Nowhere does the card say what IM 25 is. Specifically, nowhere does the card say that Initiated Measure 25 would increase the tobacco tax to fund our vo-tech schools. It just rolls our two generic talking points and shouts “NO”.

Funny that a campaign allegedly concerned about education would not actually provide any education on its flyer. I suspect the No on 25 campaign is more concerned about sales of the cigarettes just a few feet away from its campaign display.

Now if “Ignores other educational needs in South Dakota” and “Lacks taxpayer protections” are valid and sufficient reasons to oppose a ballot measure, I guess we could use them to justify a straight “NO” ticket on almost everything on the 2018 ballot.

- Initiated Measure 24, which tries to ban out-of-state money from ballot question campaigns, doesn’t address education and doesn’t protect taxpayers from the losing lawsuit that South Dakota will face if we pass this unconstitutional measure.

- Amendment Z, which would clutter our constitution with a lawyer-friendly anti-voter single-subject restriction on amendments, doesn’t promote education or taxpayer rights.

- Amendment X, another attack on voter rights in the form of a 55% requirement to pass amendments, would actually have gotten in the way of addressing educational needs by blocking Amendment R, the vo-tech governance reorganization we barely passed in 2016.

- Amendment W, the Anti-Corruption and Voter Protection Amendment, is the only 2018 ballot measure that can make even a stretched claim to beat the No on 25 criteria: W explicitly protects voter rights, thus protecting taxpayers’ ability to check the Legislature’s efforts to take more money out of our pockets, and W creates a statewide ethics board that would issue reports that might educate South Dakotans about corruption in government. Might.

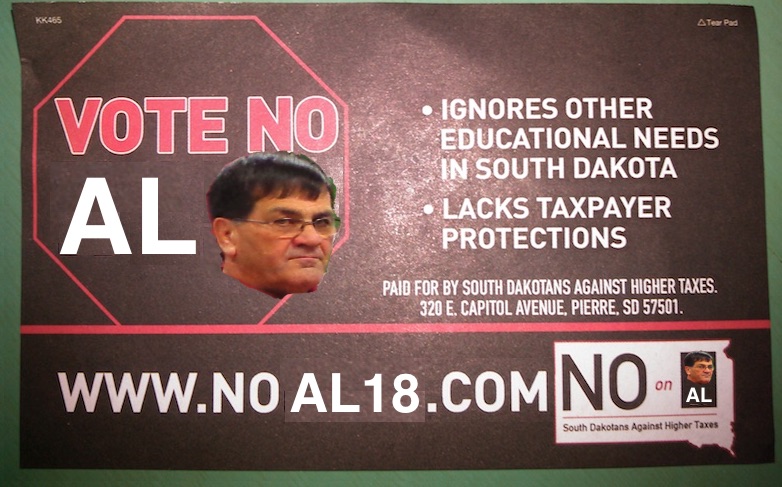

And if those generic arguments work against ballot measures, maybe we can also use them against incumbents:

Hmm… maybe the NO on 25 tear slip isn’t that bad….

Now the NO on 25 flyer is only repeating main points that have been endorsed by the Republican and Democratic parties against IM 25. But Steve Westra’s anti-25 committee isn’t out to educate voters or protect taxpayers. They’re just out to foment negative vibes among a suspicious electorate and secure a “NO” on a measure that would cut into a few interested businesses’ profits.

Related Gas-Hopping: Team Westra is also advertising at the Wolf Stop gas station and casino in Aberdeen:

Also on display at the Kessler’s Holiday

And the only BQC with a standalone booth at the State Fair

With the current makeup of, and future wingnut appointee likely to swamp the court, the Scotus might well be the arbiter of rolling back health regulations of tobacco and tobacco products.

Do smokers get the benefit of sincerely held beliefs they can blow smoke in everyone’s faces again?

I’m back in Winner visiting family for the Labor Day weekend, and the Lil’ Feller, Casey’s, and Country Pride gas stations all have these “NO on IM 25” displays at their cash registers. Lil’ Feller even has window stickers on the glass doors as you go in.

Only standalone—are any booths offering lit on multiple ballot measures? Is Mickelson back to defend the items he was there petitioning last year?

Wade, I saw the sticker on the door here in Aberdeen, too. Great placement, great regular exposure to voters. It’s nice to see businesses not afraid to participate in politics… isn’t it?

Tobacco wholesalers have the most clout of any vendor in small stores. They can choose where there products go, what price they’re sold at and apparently where their political notices are posted. Tobacco vendors use the “special cigarette carton deals” they offer the retailers like a hammer.

(I used there – they’re and their in a sentence. Two correct out of three isn’t worthy.) :(

Not bad Porter, but 66% could be a failing grade. D- at best.

I know, Deb. My spell checking is weak. (I am listening to Vermillion playing Kansas State football (on the radio) for extra credit.) I hope my Creative Writing Professor is impressed … if she’s still alive. ha ha What? No sheep intestines? I know. I’m a chef and we eat anything but I can see that it would be a challenge. If you eat mutton you’re in a very small percentage of eaters, already.

#VNOE

Especially the Wicked Willfully Worst “W”. The “W” one is the Worst.

Speechifying at Talley’s to commence shorty on this topic.

If vo-tech instructor pay is 28th in the nation while both K-12 teacher pay & SD professor pay are ranked 48th, then why do the vo-tech schools need more funding?

What is the graduation rate of S.D. vo-tech schools?

Who’s that good-looking guy on the poster strategically placed above the ugly poop brown IM 25 sign?

Maybe it’s time to stop adding new taxes every other week and start taxing corporations an income tax like other states that rely on sales tax in lieu of a personal income tax, stop giving away incremental funding away as if it didn’t cost us, stop abating property taxes on big businesses. Seriously !

That, Sharon, is a really good question to ask of G. Mark Mickelson if he appears at any public forums to defend his tax increase. I would suggest a reasonable response could rest on the stats showing that South Dakota students pay higher vo-tech tuition than anyone else in the region and thus bear an unreasonably high percentage of the cost of their education… but our university students could make a similar claim about unfair burden and lax state support.

Curtis, how dare you accuse me of strategy: ;-)

On graduation rates: this compilation of USDOE data shows the following:

Augustana University: 71%

Black Hills State University:39%

Dakota State University: 39%

Dakota Wesleyan University: 48%

Lake Area Technical Institute: 71%

Mitchell Technical Institute: 69%

Mount Marty College: 48%

Northern State University: 46%

Oglala Lakota College: 12%

Presentation College: 40%

Sinte Gleska University: 12%

Sisseton Wahpeton College: 4%

South Dakota School of Mines and Technology: 48%

South Dakota State University: 53%

Southeast Technical Institute: 45%

University of Sioux Falls: 53%

University of South Dakota: 55%

Western Dakota Technical Institute: 38%

Average: 46.75%

Robin wins the “common sense approach to life” award!

Always adding more taxing to just tobacco and not other things is wrong. But lets skip over that for a min. This bill says the funding will go to help tech schools, but in the fine print if some of you people would actually read it it mentions that the money raised off these taxes are going into general funds and anything over X amount of money (if any) would be used for the tech schools. I would not have a problem supporting this bill if all money raised was used for tech schools but it will not. They will be lucky if they even see 1% of the funds collected. Same goes for video lottery money and the last tax increase that was voted through few years back on tobacco.