Rushmore PAC sure is proud of its partisan intervention in Watertown’s mayoral race. SDGOP chairman Dan Lederman’s personal political action committee posted this photo of the people it recruited to campaign around town for incumbent Mayor Steve Thorson Saturday:

Now I like kids getting involved in the political process—even though they can’t vote, they have to live with the decisions (and later clean up the messes) their elders make. But I see at least two people out front of the Cowboy Country Store—Dakota Dunes resident Dan Lederman in the middle of the back row, and next to him, Florence resident Fred Deutsch—who can’t vote because they don’t live in Watertown.

Of course, these two former Republican legislators (along with their fellow former GOP legislator from District 5 Ried Holien, next to Deutsch) are always proud, I guess, to come fight for a fellow Republican (the mayor’s race is supposed to be non-partisan, but Steve Thorson is a registered Republican, while his main opponent, Sarah Caron, is registered independent) who likes to keep taxes low. Unfortunately, Steve Thorson likes to keep his own taxes a little too low:

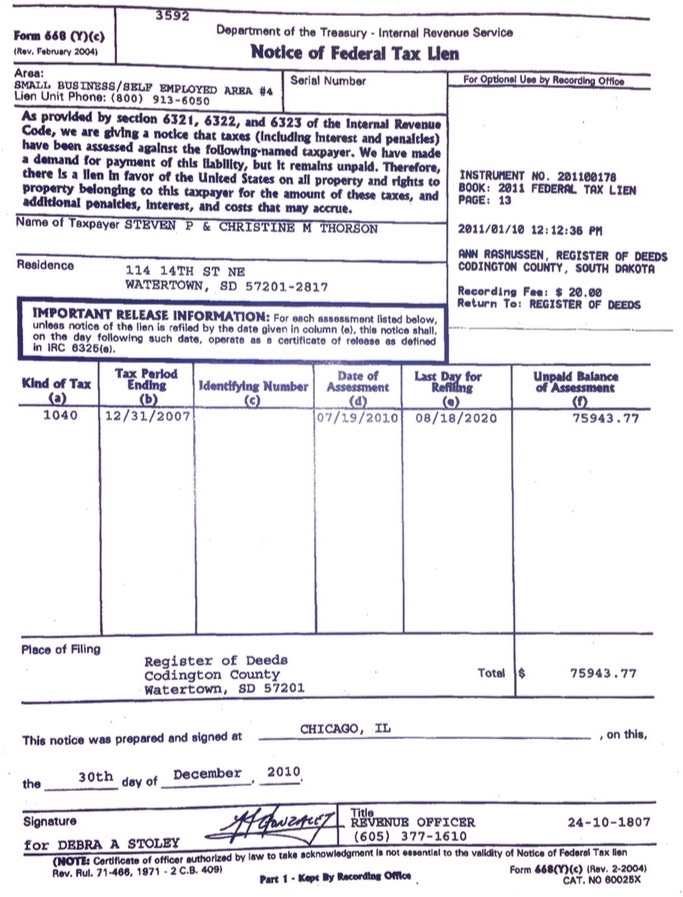

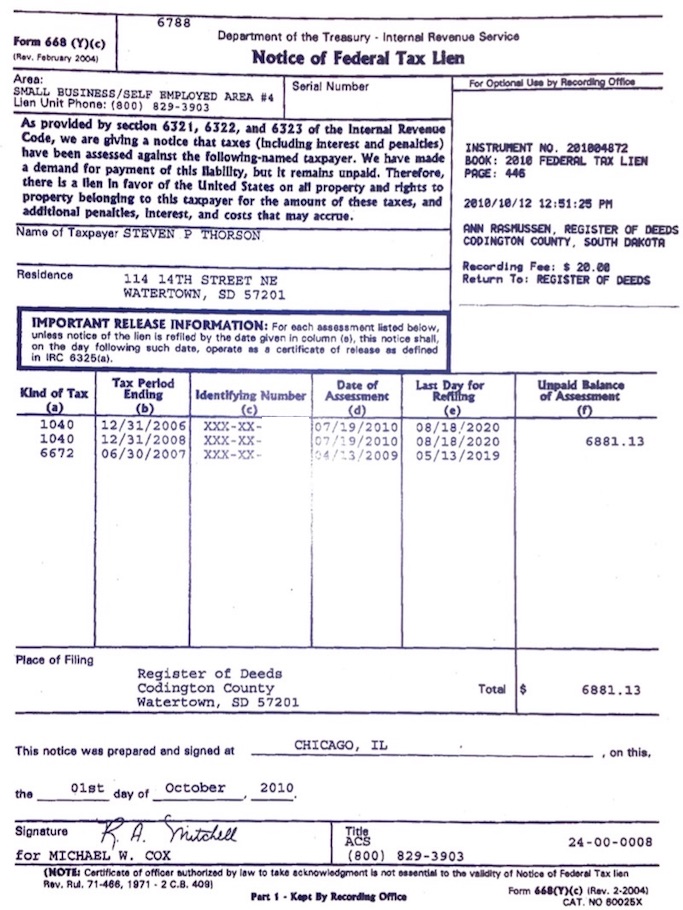

According to the Internal Revenue Service, from 2006 through 2008, before Steve Thorson moved from owning the Ace Hardware store and working as an investment executive for Feltl & Co. to serving on Watertown’s City Council, Thorson and his wife apparently took an $82,824.90 tax break that they shouldn’t have. In 2010 and 2011, the IRS said, “Pay us back.” These tax liens have not yet been released, according to the Codington County Register of Deeds… meaning that over a decade after first stiffing the IRS, Steve Thorson still owes the IRS—i.e., Uncle Sam—i.e., us, the taxpayers—over $2,000 more than one full year of his salary as mayor.

Just a little note to mayors: if you’re going to fight for federal tax dollars to fund your city’s amenities, like subsidized air service, you may want to protect your moral authority to make such a call by paying your federal taxes.

And a little note to the party of extreme vetting: if you’re going to make such a huge investment of partisan PAC resources in a simple nonpartisan mayor’s race, you may want to vet your chosen candidate.

Damn man, I thought, in that photo, ol’ Ed was a woman, even with the beard! Funny how these cult republicans are all about being outside the law. This Watertown dude stiffs the public by not paying his income tax, Ledermann gets one of his guys wacked in his office, Gordo runs for governor with a string of outstanding property tax debt. Cult republicans loves them so crooks though.

I can not figure out why the Republicans want to lower taxes when they seem to think it is on not to pay them.

The racial diversity really stands out. I see white and I see………more white.

Well, now, Mike, that’s just Watertown, 94.8% white by last Census count.

I do not have data on percentage of Watertown residents with federal tax liens; however, the percentage of current Watertown mayors with federal tax liens appears to be 100%.

I don’t think that a tax levy means you are guilty of anything. It also doesn’t mean the party even owes anything. Dealing with the IRS and their myriad of forms, penalties and even levies is “a process”. To imply him or his wife did anything wrong is irresponsible on your part. You are on awfully thin ice with this attack. . .

The ‘pubs really want their man to win. Must be grooming him something.

Now remember, If it was the dems doing this, boy oh boy would the ‘pubs be on full attack. It would be such a disgraceful thing to round up kids to work for their PAC.

So getting this tax levy is common then, OldSarg?

Interesting information, Cory. Did the Watertown voters know about his tax problems when he ran for Mayor? Where did you get this info?

Tax lien, OldSarg, not tax levy. Tax lien means you haven’t paid your taxes. It’s pretty simple.

The IRS says…

Given that a federal tax lien has a pretty serious impact on one’s credit score, an individual under such a lien has significant motivation to get it cleared up. In seven years, Thorson has apparently neither paid the tax claim nor effectively refuted the IRS’s claim.

So, OldSarg, what evidence can you provide to support your position, that the tax lien is meaningless and I’m on thin ice? I don’t hear any cracking under my well-documented feet….

@Old Sarg: You are right except that a levy is where the IRS is already in the property confiscation mode such as seizing bank balances, assets, garnishing wages, et al. Liens are just claims on current and future property and assets but nothing has been taken.

Thorson very well might be appealing the liens or in court disputing the liens. The US tax code isn’t exactly black and white when it comes to computing tax liabilities especially with regards to business’s deductions of capital expenses vs operating expenses, depreciation of property, so on and so forth. Tax avoidance is perfectly legal and is not tantamount to tax evasion. Pretty thin gruel you’re serving today Cory.

And this lien has been so soon as well. 10 years is like no time at all to be dealing with something like this? What would be a reasonable time to settle this kind of thingy fellers? You get the notice and then you just let it sit? As complicated as the tax law are, there are these fellers and ladies out there that make a living figuring tax codes and problems out. Now, it the books are really not being truthful, then these tax attorneys would probably not be able to do anything other than to tell you to pay the damn thing off including interest and penalties. In short, why do you condone that theft of monies that should be paid to the treasury? You cult republicans are all about food stamp fraud for a couple of bucks and yet you think that 83 grand is not a big deal. A fellow like myself might think that it is a racial thing more than anything else. I would say Cory’s post is pretty thick on the gruel as well as the irony. Wow, a twofer!

Don’t you wonder what accountant gave that advice?

Mr. Sam number 2, that is only some Republicans, like the heinous Mr. Howie and his Howites of Gordantic Proportions. You do not see me typing that all libbies are soft headed socialists, do you?

The government needs to come down on these tax cheats with both jackboots and a billy.

Mr. Lansing, the advice was signed off by the accounting firm of Wismer, Gant and Co.

I can’t find them in the phone book, Grudzie.

http://dakotawarcollege.com/wismer-announces-dem-legislative-primary-loser-angelia-schultz-switches-to-run-for-sos/

Got your goat, Mr. Lansing.

It was a joke Grudzie. We don’t use phone books, anymore. Two Goats to me 🐐🐐

There’s lots of good tax people in Watertown. Do you think he tried to do his own taxes? If he did it’s either a big boo boo or ……. something else.

Ha, a true Trumpster at heart. Live off the fruits of the labor of the rest of us. Acting like a real welfare queen.

Mr. Lansing, all your goats are belong to us.

The money that has been spent bashing Caron likely could have paid of the Mayor’s tax liens!!!

If Thorson drags this lien out long enough, wingnuts will have abolished the IRS and his troubles are over.

Funny how quick Coyote and OldSarg are to make excuses for not paying taxes. I’m still waiting for their evidence to counter my evidence. Wishes don’t cut the mustard or thin the gruel.

Ace Hardware also took Thorson to court and won a judgment of $300K in 2011. Something was going seriously wrong with Thorson’s finances during that period. The documents speak for themselves… and the excuses peddled by OldSarg and Coyote speak to their agenda, which appears to be more interested in making blog posts about me instead of about public officials stiffing the taxpayers.

Seems to me that a guy with these kinds of liabilities might be open to granting all kinds of favors for a few dollars under the table. Just the kind of Republican that is liked in South Dakota!

Clyde, that point applies from mayors on up to the President. A guy in significant legal and financial trouble opens up a weakness in the executive branch.

Cory, I’m not against paying taxes nor did I give you any excuses for not paying taxes. I nearly pointed out that when you implied this family “cheated” or in some way was wrong for not paying taxes in the amount the IRS demands you were wrong. The IRS is not infallible nor does the analyst who sent the notice know all of the conditions that may have created this situation. On that note, nor do you. I would think as a “liberal” you of all people would think a fellow citizen deserves the right to defend themselves against a tyrannical bureaucracy.

Cory, “Ace Hardware also took Thorson to court and won a judgment of $300K in 2011”. All of this fits into the corruption we have seen in our state that is perpetuated at local levels like Aberdeen, Platte etc. This guy is still in the arrears for 83 thousand after all these years while seeming to ignore it. In a real job market, having such a blemish on your background check could have the employer deem you unfit for the job. In South Dakota, this kind of poor business seems to be the prerequisite for cult republican positions. How much money does the city of Watertown have access to and why would Rushmore Pac, on the other end of the state, have an interest in the goings on in Watertown?

Where did I use the word “cheated”, Old Sarg?

I said what I said: Thorson owes the IRS nearly $83K. I’ve provided evidence to that effect. It is perfectly logical and more straightforward to look at federal tax liens that have not been released for six years and conclude that a taxpayer failed to pay the proper tax amounts than to make the excuses you’re trying to fabricate out of wishes for a blog fight. You’ve provided no evidence to the contrary. Feel free to correct the record with a substantive response.

And do you feel Ace Hardware and a U.S. federal court also reached the wrong conclusion about what Thorson owes?

There’s just too much corruption and greed in SD. And too much money in our politics on all levels in the US! For one job I had, I had to have an immaculate credit rating! If I’d had anything remotely close to these issues on my record, I probably wouldn’t have gotten most of the jobs I’ve had! But for Republicans, having something like this seems to be a prerequisite to get the funding needed to win even a local election! Perhaps it indicates a willingness to bend rules!