Saturday I reported that Lisa Furlong of North Sioux City has created a ballot question committee, South Dakotans for Fair Lending, whose stated mission sounds like the decoy initiative tactic used by the payday lending lobby in Missouri in 2012. Now I can share the text of Furlong’s proposed constitutional amendment, which would not only confuse petition signers and voters but would, if passed, override the interest-rate cap initiative being circulated by Steve Hildebrand and Steve Hickey.

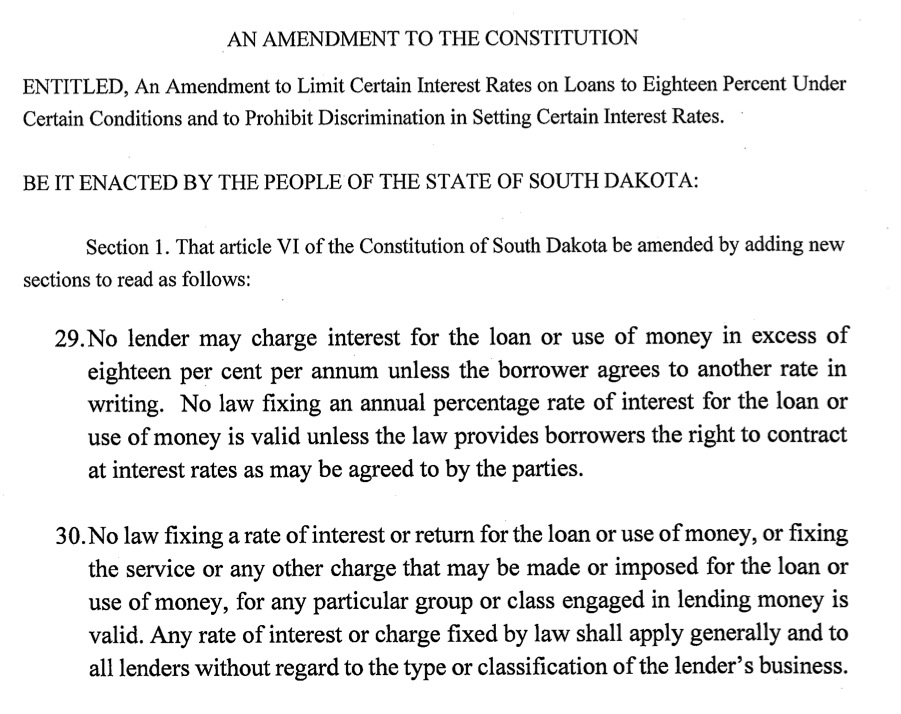

Here is the proposed amendment, as submitted to Attorney General Marty Jackley’s office for review:

The amendment pretends to cap interest rates at 18%, but that cap is made meaningless by “allowing” borrowers to agree to another rate in writing. This amendment would have zero practical effect on payday lending in South Dakota: every payday loan at every triple-digit interest rate would be just as legal post-amendment as it is now. Nothing would change for borrowers and the predatory lenders who trap them in an abusive cycle of debt.

The primary purpose of this proposal appears to be what it was in Missouri in 2012: to allow the payday lending lobby to hire circulators to walk around with petitions, ask people, “Would you like to sign a petition to cap interest rates?” and thus confuse voters who think they are signing the real interest-rate-cap petition.

But read the title and the second section of the Furlong proposal, and you can recognize two other purposes the amendment could serve. Suppose Hildebrand and Hickey overcome the payday lenders sneaky tactics and get enough signatures to put their slam-dunk measure on the 2016 ballot. If the payday lenders can collect enough signatures to place their measure on the ballot, they can sow more voter confusion right through Election Day. The payday lenders can create a smokescreen by pointing to the title and the second section and saying, “See? We want to stop discrimination!”

The second section says no law can set different interests rates or other charges for different classes of lenders. The Hildebrand-Hickey initiative caps interest rates for payday, title, and short-term lenders, not for state and national banks, trust companies, and other federally insured financial institutions. If both the real interest-rate cap and this decoy constitutional amendment pass, the constitutional amendment would take priority and annul the voters’ likely desire to set real caps on payday lenders before it ever takes effect.

The Attorney General’s office has not issued its explanation of Furlong’s amendment, and the Secretary of State has not yet approved that petition for circulation. So right now, the only petition relating to interest rates on the street should be the real Hildebrand-Hickey 36% interest-rate cap. But pay close attention, citizens! If a circulator approaches you with a petition dealing with interest rates, ask the circulator these questions:

- For whom are you circulating? [Correct answer: South Dakotans for Responsible Lending. Incorrect answer: South Dakotans for Fair Lending.]

- What’s your rate cap? [Correct answer: 36%. Incorrect answer: 18%]

If you get the right answers to those two questions, please do sign. If you get the incorrect answers, take a picture of the petition and the petitioner, and tell them to take their dirty tricks elsewhere.

So an industry that has been built upon the premise that people are financially ignorant hopes to succeed by the premise that to average voter is civically ignorant?

The scariest thing is they just might be right.

I wonder if they all have showers in their offices – because if I did this type of thing for my paycheck I’m pretty sure I would need to take a shower at least half a dozen times a day.

Wisconsin wienie wagger Walker pocket vetoed payday loan expansion. I didn’t think he had the nerve,but with nearly 60% job disapproval rate,maybe the pressure is getting to him.

Really? They want the State of South Dakota to change its constitution to benefit payday/title loan/short term lenders? Really?

You almost have to admire the ingenuity of those pay day fellows. But if we can crush them out of business then the people who are not smart enough to keep themselves from doing it will have to do it on the internet or drive over to Wyoming or some other state.

The payday industry is extremely sleazy, but let’s just say in Wisconsin they went for the big enchilada (what they really want) and it scared the bejesus out of the insurance and financial planning industry here. The established insurance industry is powerful here, as is the big industry lobbyists, and they put an incredible amount of last minute pressure on Walker to veto the portions of the budget bill that were slipped in at the last minute by the payday lobbyist working with Republican legislative leadership.

It was really breathtaking what the payday industry tried in Wisconsin, and almost pulled off. It ought to serve as a warning to insurance and other financial businesses in other states who think this industry is going to be content with just payday loans. This is an industry that wants to peddle everything they can to unsophisticated people who are in a bit of a financial crunch, and when they get them into financial panic, peddle shit insurance, etc., to them. It’s a sick, sick industry that ought to be permanently put out of business.

Yes, Walker vetoed out the payday industry expansion. My guess is the Republicans did not realize how much heat they were going to get from the established insurance and financial industry, as well as the largest business lobbies.

Here’s an idea for the two Steves: once the business community understands that the payday loan industry really wants to expand into many other areas, they are going to be more open to talking about supporting your efforts.

nouveau riche expose’ eh? furlong, thuringer, ageton, bollen connections? BPI, Regents, NSU National Center for Financial Infrastructure Security, GOED? see EB5fraud.com

now if i could just get my fork right!

R, you think payday lenders feel any moral compunction about using any tools available to protect and promote their interests? Really? :-)

Craig, I share your alarm at an industry that bans on ignorance in so many forms. We must fight them by dispelling ignorance. Hence, the blog post.

Don, Walker did veto that gift to payday lenders! Hooray! But he also cut a million dollars in conservation grants—booo!

Update: The AG’s office received the hard-copy text of the Furlong amendment yesterday. That means the AG’s deadline for issuing an explanation will be sixty days from July 13, or by my count, September 11. It will be interesting to see if AG Jackley takes the full 60 days to issue this explanation.

And when he issues that explanation of the decoy initiative, we should look for an opportunity to sue him the way payday lender Erin Ageton sued him for the ballot explanation of the real rate-cap initiative. The explanation should state clearly that this amendment has no net effect on current lending operations and prevents the voters or the Legislature from passing any laws to check abusive interest rates. If Jackley doesn’t say that, let’s go to court!

Two days later, Brady Mallory catches up with me and covers the payday lenders’ decoy petition. The payday lenders he calls refuse to comment:

http://www.keloland.com/newsdetail.cfm/payday-loan-opponents-warn-voters-about-decoy/?id=182490