I noticed something funny about the three-tiered tax levy the Legislature included in Senate Bill 1, the hard-fought road bill sent to the Governor on Friday. SB 1 may be giving counties more freedom to raise money for road projects, but several counties may end up with less money to spend.

Section 20 of Senate Bill 1 does not create a new property tax levy. It modified an existing tax levy authorized in SDCL 10-12-13:

The board of county commissioners may levy an annual tax not to exceed one dollar and twenty cents per thousand dollars of taxable valuation as a reserve fund to be accumulated and used for the purpose of matching federal aid grants which have or may hereafter become available. Moneys in the fund may be expended in cooperation with the federal government in the laying out, marking, constructing and reconstructing roads and constructing and reconstructing bridges, under the jurisdiction of the board of county commissioners. The tax levy shall be in addition to all other levies authorized to be made by the board of county commissioners for road and bridge purposes provided for in § 10-12-21. The proceeds of such levy shall be placed in a special fund to be known as the “county highway and bridge reserve fund” [SDCL 10-12-13, as in effect 2015.03.15, last amended 1989].

Section 20 of SB 1 amends this statute by removing the requirement that the road levy be used to match federal money. Counties don’t have to wait for Uncle Sam to shake loose some dollars (which apparently our Republican delegation is too busy writing letters to Iran to do); they can spend the levy on projects funded entirely by the county. Section 20 of SB 1 also adds “maintaining” to the purposes for which counties can use this money.

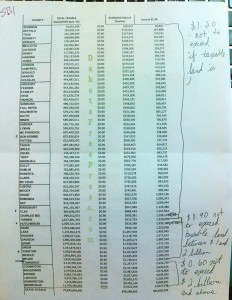

But Section 20 also changes the levy schedule. Currently, SDCL 10-12-13 sets the maximum levy for this county highway and bridge reserve fund at $1.20 per thousand dollars of taxable value. (If you own a $100,000 house, the county can ask you to kick in $120 for this fund.) Section 20 leaves that maximum amount in place for counties that have less than one billion dollars in taxable valuation. That’s 48 counties, according to the handout I picked up at the Capitol on Friday (click image at right—it’s a big one!).

Section 20 adds two new tiers that take money away from richer counties. The eleven counties that have taxable valuation between $1 billion and $2 billion see their maximum road reserve levy cut 25%, to $0.90 per mill. The seven counties with over $2 billion in taxable property see their maximum road levy cut in half, to $0.60 per mill.

So really, Section 20 of Senate Bill 1 does not appear to be giving counties the chance to raise any new money for roads and bridges. SB 1 simply removes one condition—federal matching funds—on the use of that money. Even with that condition lifted, eighteen counties will be able to access less money to spend on their road projects. Here are the reductions, calculated from the handout:

| County | Reduction |

| Minnehaha | $7,023,769 |

| Pennington | $4,450,140 |

| Lincoln | $2,602,672 |

| Brown | $2,017,642 |

| Brookings | $1,487,433 |

| Codington | $1,317,808 |

| Lawrence | $1,267,377 |

| Meade | $576,137 |

| Beadle | $545,068 |

| Yankton | $489,275 |

| Union | $484,342 |

| Spink | $442,779 |

| Davison | $421,891 |

| Hughes | $392,903 |

| Lake | $365,986 |

| Hand | $326,797 |

| Hutchinson | $308,797 |

| Turner | $305,245 |

| Total: | $24,826,061 |

Statewide, under SDCL 10-12-13, counties can currently levy up to $91 million in road reserve tax. In the above eighteen richest counties, Section 20 of Senate Bill 1 reduces the maximum road reserve levy by a total of nearly $25 million. Depending on your perspective, SB 1 cuts local taxes 27%… or leaves counties with 27% taxing power to fix their roads and bridges.

Counties do get a boost from the wheel tax. Section 25 raises the maximum wheel tax from $4 to $5 per wheel and raises the maximum wheel tax per vehicle from $16 to $60. That increase is a good step toward assessing vehicles more proportionally to the wear and tear they cause our pavement. It’s also a step up from the interim road committee’s original proposal, which left the wheel tax at $4 per wheel and set the vehicle max at $48, and from Governor Dennis Daugaard’s original proposal, which left the wheel tax alone at maxes of $4 per wheel and $16 per vehicle.

Hmmm… remind me how many wheels RVs have….

Of course the repubs push the tax increases on to the homes of the poorest persons. All too often those widows do not even have cars to wear out the roads. Now the repubs want to use this money for maintenance rather than to match federal dollars. Those rich sob’s keep their incomes free of any support but they all too often get their profits from the use of the highways. Why not tax every wheel on the car, truck or trailer even if there are 200 wheels as some of these special movers?

The only way tax burden will ever be equalized will be when SD starts taxing corporate and personal income on a graduated basis. The South Dakota democrats were the only ones who had the courage to run a government and pay its way. Ronald Reagan cut the taxes for the rich and used debt to buy every weapon the defense industry could produce. And you wonder why our national debt grows? Now they want war with Iran!