On June 30, the White House said its Big Ugly Bill would cut the national debt:

Let’s be clear: A vote against the One Big Beautiful Bill is a vote for the largest tax INCREASE — $4 trillion — our nation has ever faced, which would make our national debt explode to 117% of GDP by 2034 [White House propaganda, 2025.06.30].

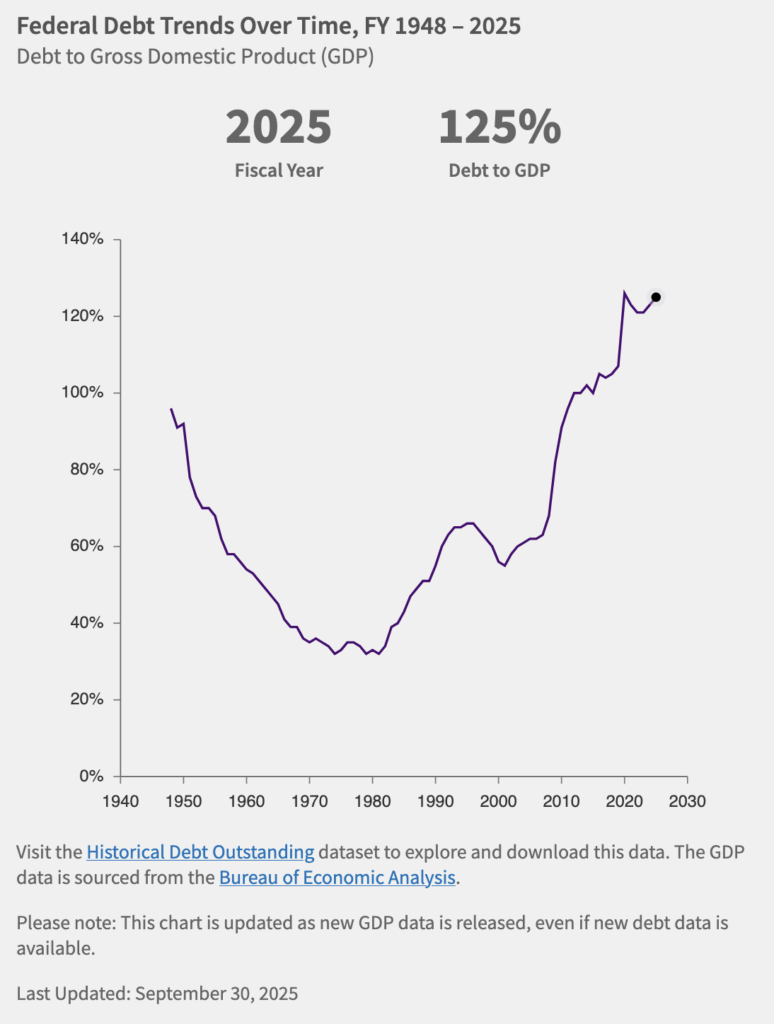

But the explosion is already here—just three months after Congress passed the budget reconciliation bill, the national debt is already 125% of GDP:

And we’re piling on debt faster than we did the last time this moronic grifter ran the show, when coronavirus gave us a pretty good excuse for deficit-spending:

In the midst of a federal government shutdown, the U.S. government’s gross national debt surpassed $38 trillion Wednesday, a record number that highlights the accelerating accumulation of debt on America’s balance sheet.

It’s also the fastest accumulation of a trillion dollars in debt outside of the COVID-19 pandemic — the U.S. hit $37 trillion in gross national debt in August this year [Fatima Hussein, “U.S. Hits $38 Trillion in Debt, After the Fastest Accumulation of $1 Trillion Outside of the Pandemic,” AP via PBS, 2025.10.23].

Nine years ago we were promised elimination of the national debt in eight years, but like elimination of Russia’s war on Ukraine in 24 hours, har–de–har–har.

But we shouldn’t laugh. The government’s hoovering-up of capital to paper over unkept promises is making capital for our practical dreams—houses, cars, entrepreneurial adventures—more expensive:

“A large national debt is damaging to the country in so many ways,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget. “The problem is, most of its invisible. You don’t really realize it.”

Take for example, interest rates and mortgages.

“If, in fact, we didn’t have this debt outlook, interest rates almost certainly would be at their pre-COVID level,” said Kent Smetters, director of the Penn Wharton Budget Model. “So, you remember the good old 3-3.5% mortgage rates, that would actually still happen today.”

As the government borrows more and more, it makes it more expensive for everyone else to borrow. Because everyone’s fighting for a loan, whether it’s you for a car loan or the government for a bond. And as the government fights harder, interest rates rise. Mortgages are just the start.

“If you’re choking off some of the money that might go to investments for small businesses or new private sector investments, and you’re using that for consumption in the federal government, it means that we are growing our economy more slowly than we otherwise would,” said MacGuineas [Sabri Ben-Achour, “Why You Should Care About the National Debt Hitting $38 Trillion,” Marketplace, 2025.10.23].

Gee, MAGAts, how’s a golden ballroom and owning the libs going to pay your mortgage?

Thanks to the Trump Organization the United States is in debt to the tune of $38 TRILLION so the US encourages mining companies from outside the country to drill more holes in the Earth looking for gold and silver. Repeal or even reform of the 1872 statute has been thwarted repeatedly and the US Forest Service is often powerless to stop the extractive industry from permanently altering sensitive watersheds because of the 1872 law. Today, visitors and skiers at Terry Peak in the occupied Black Hills are increasingly concerned by the encroachment of a massive tailings pile and ever-widening mining scars from decades of scorched earth.

They could just rename Terry’s Peak. I wonder what name they could pick.

Hold on, are we just now seeing for the first time that cutting taxes DOESN”T increase the amount of taxes we bring in?!!

Ahem! If King Donald declares USA has zero debt who has the military to argue?

Anyone studying the recent (early 1980’s on) history of Republicans pushing through major tax cuts, sees that the one overwhelming and glaring conclusion is that tax cuts explode the country’s debt and deficit. If any of our elected representatives had an open town hall, I would ask them to explain.

The destroyer-in-chief really is putting together a perfect economic storm: increasing national debt, offending trade partners, weakening the dollar, demanding lower interest rates . . . Soon the US and the dollar will become non-essential to international trade and that debt no longer gets serviced by foreign investors. I’m not sure I’d gamble with a $38T bond market by kicking every element that supports that market.