The right-wing mugwumps trying to put the brakes on economic development/corporate welfare in South Dakota threw another minor fit yesterday, trying unsuccessfully via the Legislative Rules Review Committee to block new rules that will make it easier for the state to hand out bigger Revolving Economic Development and Initiative Fund loans:

Currently, the board needs to take a special vote when it wants to loan more than $1 million. The rule change raises the threshold to $3 million.

…The panel’s longest-serving members, Republican Sen. Taffy Howard and House Speaker Jon Hansen, both voted against the package.

…Howard also asked about raising the threshold to $3 million.

Valentine said the higher threshold aligns with increasing project costs and increasing loan requests.

“That million-dollar maximum has been on the books a number of years,” Valentine said.

A check of state rules shows that the $1 million had been in effect since at least 2007 and possibly since the program’s start in 1987.

Valentine said the loans in recent years averaged $2.5 million to $2.7 million.

Hansen didn’t speak during the discussion. Asked afterward why he voted no, Hansen said he disagreed with raising the threshold to $3 million [Bob Mercer, “Opponents Try to Halt Rule Changes for REDI Loans,” KELO-TV, 2025.10.07].

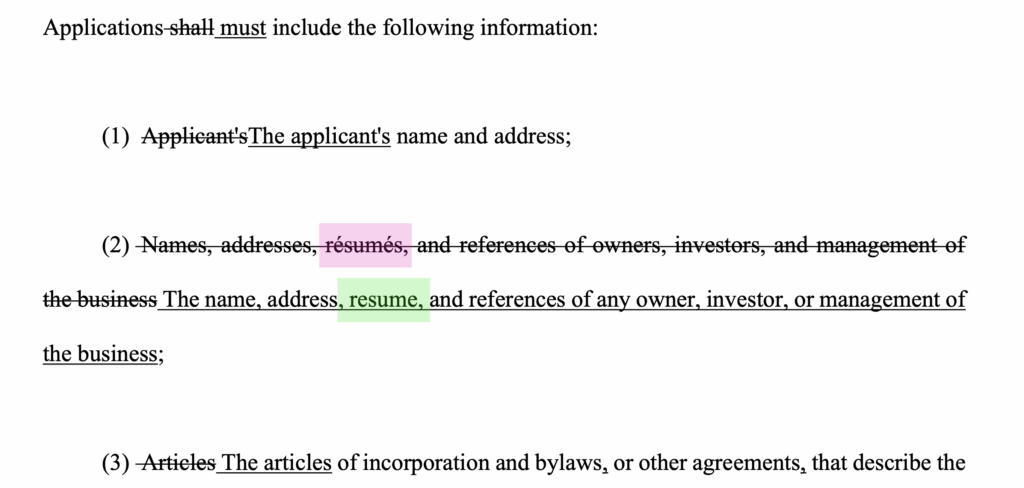

I’d have voted against the rule changes just because they remove the accents aigus from the word résumé, a clear MAGA attack on the diversity of the English language and on our French allies:

But I feel uneasy when I catch myself leaning toward the position of mugwumps like Hansen and Howard. If South Dakota is handing out corporate welfare, the REDI Fund loans are a relatively benign form of corporate welfare. They are loans, not grants, so the state gets its money back, with interest. The new $3M threshold for a two-thirds vote doesn’t seem to open the welfare spigot much wider. The current average loan size has been triggering the two-thirds vote requirement regularly, and the Board of Economic Development evidently hasn’t had much trouble mustering nine votes instead of seven for those average loans. Moving a long-unchanged and thus inflation-eroded $1M threshold won’t foster that much more dependence on government assistance among our capital class.

The approved rule changes include a small increase in accountability. The board has added a requirement that borrowers notify the state of any “change in ownership of ten percent or more of the business’s stock, membership interests, or ownership interests”. So while this revision package loosens the vote requirement for many loans, it also allows us to keep better track of who’s calling the shots with our loaned money.

I still can’t find any Tru Shrimp in grocery stores.

Your comment about French is spot on. Bad Bunny really got to maga boys and girls with his Spanish on SNL. Four months to learn Spanish. We have set up laws about that sayeth Marjorie Taylor Greene. What’s funnier is they really didn’t know who he is. Johnson wants Lee Greewood because he has a broader audience! In the seat of their pants broader. Numero uno in the entire world isn’t appealing for them. The NFL does know better.

People simplify. That’s the key to the decision to decrease the board’s workload by increasing the amount of the loan for which a vote of the board is required. That’s also the key to why “resume” is reconfigured from the French to the American. I don’t know how much effort board members need to put into going over each loan package, but I expect the larger ones deserve more scrutiny because there is more at risk. As far as “resume” is concerned, Juliet might say, “A rose by any other name, does not need a French accent.”

Speaking of the fringe white wing Sibby got quoted recently.