Minnesota bankers’ banker Ben Eskierka (anagram: Banker is Eek!) is a funny guy. In his presentation to the South Dakota Banking Commission last week warning them that the Federal Reserve is driving us into a recession, Eskierka gets all Game of Thrones-y with Chairman Powell:

The Fed has no choice but to inflict this pain, says Eskierka:

Fighting inflation is the only thing on the Fed’s agenda right now, according to Eskierka. “They have no choice,” he said. His perspective: A recession will result that forces people out of work. “They’re intent on making everyone feel poor, so we stop spending money” [Bob Mercer, “Recession Ahead, Eskierka Tells South Dakota Bank Regulators,” KELO-TV, 2022.12.15].

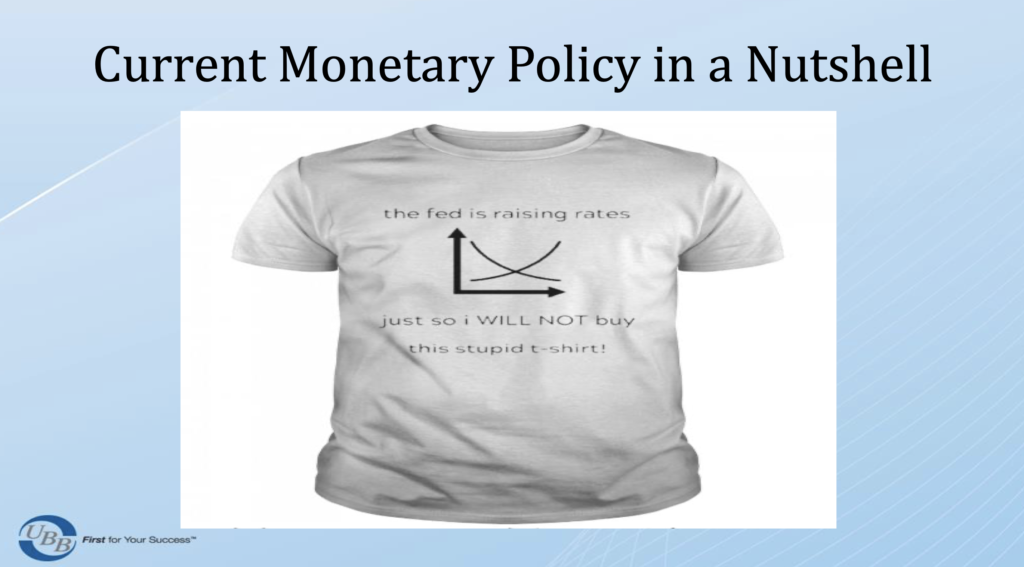

Eskierka pithily summarizes monetary policy with this t-shirt:

We need more funny t-shirts and memes at South Dakota board and commission meetings. Let’s have Eskierka back this winter for Legislative committee hearings!

Raise taxes on Ben and his ilk until they ARE poor. That’s the best inflation fighter. Why just keep letting the wealthy piss on everyone and talk about raising boats?

We seem to have a recession every ten years or so. It’s an “adjustment” in millions of people’s expectations of the future. This is supposedly “good for us”. One common thing that happens during a recession is that various and sundry con men who have stolen money from millions of us with various deceits, are apprehended and a few brought to court. This creates the facade that the “system” has somehow been cleansed. Then we go back to to various schemes to kite the market.

Inflation is a function of money supply control. As long as the wealthy control how the money supply is controlled, then squeezing the lower/middle class to ensure a healthy upper class and stock market will be the priority. Money could be taken out of circulation just as effectively with targeted taxation of the wealthy, but that is not being discussed. Inflation has become weaponized in the wealthy’s fight against the middle and lower class having a share of the pie in the US economy.

By the way, there was a HUGE spike in trading just before the announcement of the Fed’s action on rate changes. Somebody with the inside scoop jumped the gun and made some big moves profiting in trading. So far, the White House has not acted to investigate on who did this. More corporate Democrats at work perpetuating a broken money system. As Michael Moore said, two parties for them, none for us.

Correction: it was before the CPI announcement, not the rate determination: https://www.youtube.com/watch?v=rFTMG0I7Dg8

It’s fascinating that Canada has never had a “banking crisis”. Canadian banks don’t play games like the US federal reserve does. On the modern era, North Dakota also hasn’t had a banking crisis. Perhaps the “free market” isn’t the better means to operate banking.

Dr. Know It All (engineering prof, early Tesla adopter and constructive critic) shares a concern from 2 carnival barkers. The concern is ground in fact. Reflect that Norway was a first mover in EV sales. What occurred simultaneously was that the market for new and used internal combustion engine vehicles fell through the floor – and kept falling, thousands, ten thousand below “book” value. Now that EV sales are slowly beginning to reach exponential growth in the US, it’s likely the US will have a vehicle loan foreclosure crisis. in 2023. Folks with loans on ICE vehicles will realize the loan is worth more than what they are able to get re-selling their vehicle — so they’ll default on it, Meantime vehicle companies and banks will extend loans on new EVs to the same people. Every family has a vehicle or several, whereas far fewer families “owned” a house with a teaser mortgage. Thus the numbers may result in the vehicle foreclosures being as large as, or larger than the mortgage crisis. Repair what you own. Defer new vehicle purchases. Let the market settle out. Grab your popcorn. It would have been helpful had banker, Ben Eskierka, discussed. https://www.youtube.com/watch?v=GfAoUk_k7W8

My comment above reflected a bit on short-term issues. This comment takes a longer view.

If you haven’t yet read, “The End of the World is Just the Beginning” – what are you waiting for? It’s on the Financial Times top 10 list of best reads for 2022. It’s in its 16th printing, only published in Jan/Feb 2022. Point being, the US and North America continue being in the world’s sweet spot. Several regions will also be or remain in the sweet spot. Other nations will have tremendous turmoil. Reindustrializing the US will result in some of the greatest growth the US experienced. It will also lead to higher inflation – get used to it. Growth in China, Russia, Germany will subside. (Politicians and bankers “worried” about China have no idea what they are talking about . . . its fear-mongering, picking on a loser to amplify the appearance of the inevitable coming out on top.)

Zeihan updates his book via 3 recent interviews (~1h) this month:

Perhaps the best holistic update interview of his book: https://www.youtube.com/watch?v=Ai6OOQrt7_o

Zeihan’s brilliance shines through this unconventional interviewer. If you like humor in your economic analysis don’t miss Zeihan’s quip that the parents often move in with the children . . . https://www.youtube.com/watch?v=aHUoMmKDLUI

Zeihan shines in rapid Q&A formats, even when proctored with a skilled interviewer: https://www.youtube.com/watch?v=BSpT0yEtFBY

I feel better about my grandkids remaining in the US, or at least in North America.

Happy Holidays. Now get busy.

T shirts are way faster than waiting for the Democrats to win.

Here’s a t shirt to wear, “South Dakota has 820 000 Governors and one Noem.”

Thanks for the links, John. Zeihan is a compelling speaker with a self confidence that’s intriguing. It’s easy to be a soothsayer in our unsettling world. Accurate prediction is hard, however. Especially when it involves the future. #grins