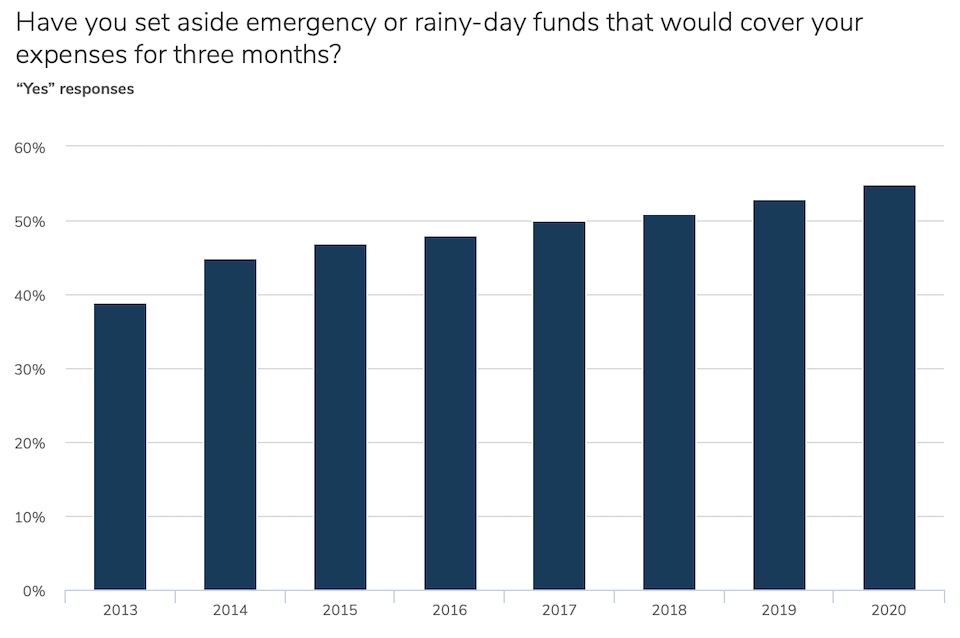

According to data on “financial fragility” from the Federal Reserve’s Survey of Household Economics and Decisionmaking, Americans have been getting a little better at keeping emergency funds in the bank. From 2013 to 2020, the percentage of American adults reporting that they have enough rainy-day funds to cover three-months of expenses has risen from 39% to 55%:

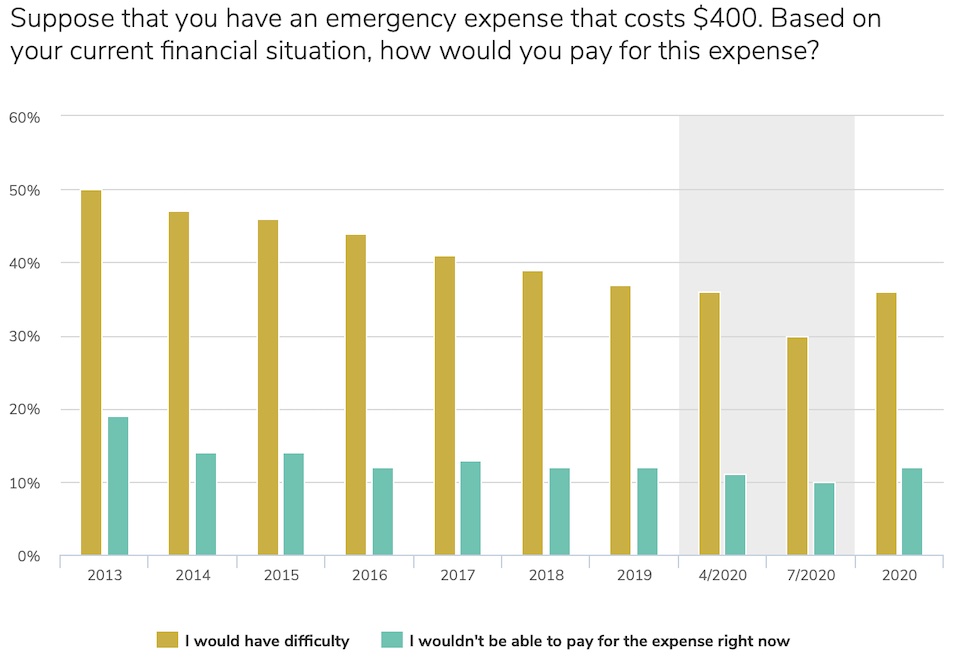

Last year’s round of direct coronavirus relief payments to individuals briefly boosted personal reserves. In July 2020, the percentage of Americans who said they’d have trouble covering a surprise $400 expense dropped to 30%, down from 36% in April. We ate up those temporary reserves and brought the percentage of financially fragile Americans back to 36% for the year, but that still beat the 50% we were at in 2013.

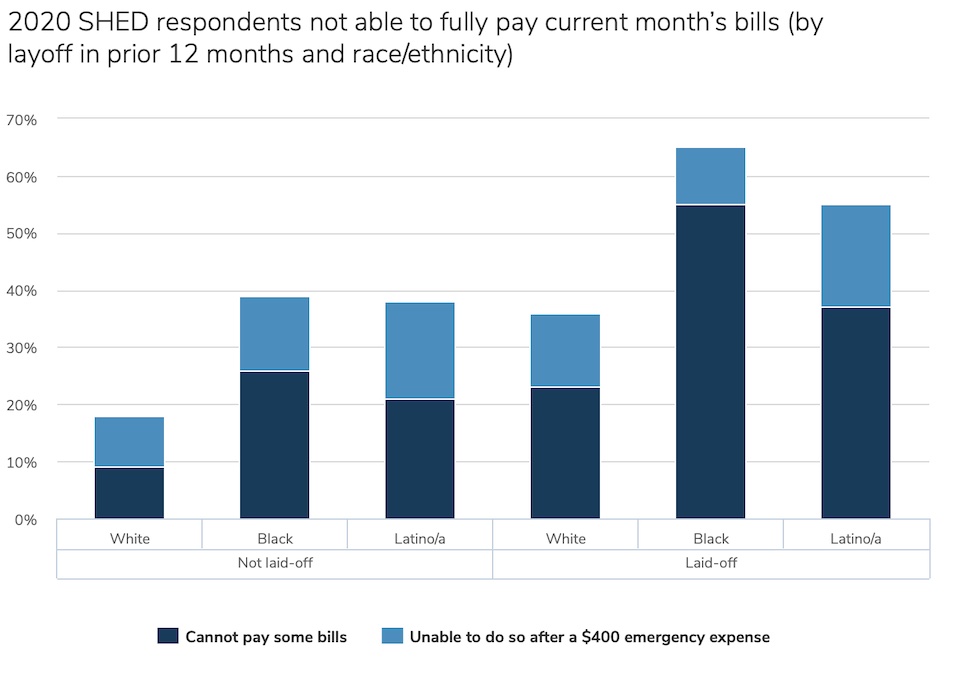

Trish Ladner and Kristi Noem probably want to ban us from talking about this next chart, but the Federal Reserve notes that last year’s coronavirus relief payments didn’t erase the drastic difference in financial fragility between comfy white folks and the Black and Latino neighbors whom we continue to box out of economic opportunities with systemic discrimination:

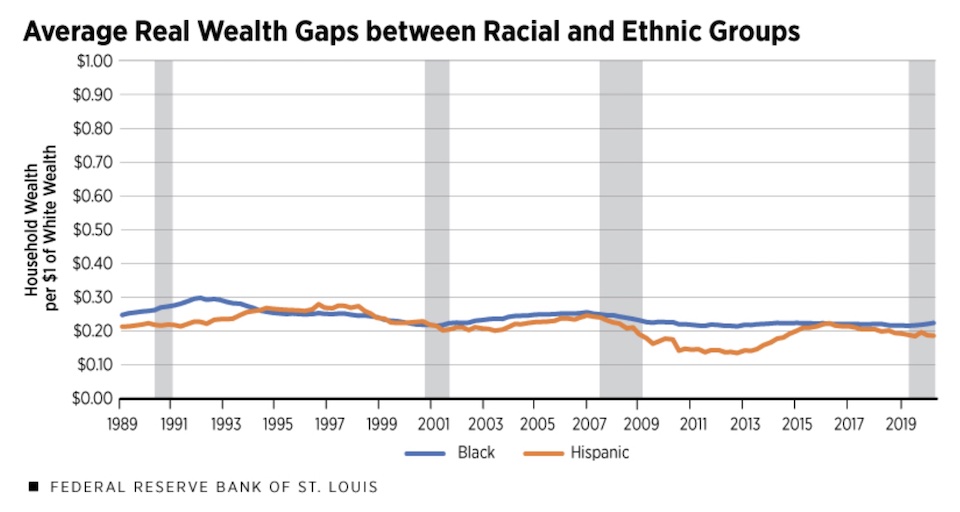

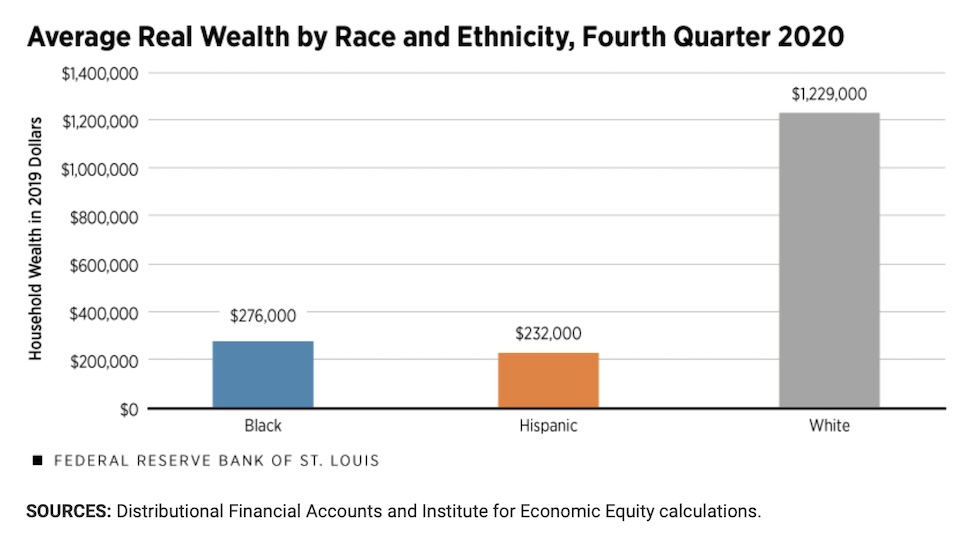

Overall household finances show a similar racial gap, with average real family wealth, the value of all household cash and the stuff we own, for Black and Latino families in America in 2020 Q4 at about 20% of the average real wealth for white families:

We’ve been getting better at keeping some emergency cash in the bank; now we’ve got to get better and opening jobs for minorities so they can enjoy similar household financial cushions.

White billionaires are driving up the average of white household wealth because $1.2M average household net worth is laughable to most white people. I work in a white collar industry and most of the people I know are highly educated and professional and do well for themselves – but ZERO of my close peers are millionaires, even with real estate equity included. Now, I respect the fact that even when the billionaires are removed, white households are likely to have higher net worth, but I think it’s fair to point out that being a millionaire is not a true reflection of average.

Second – this is somewhat snarky but also a valid question when it comes to “households” being used in graphs like this. I don’t know the percentages off hand, but black mothers are much more likely to be single moms than white mothers. So, does Mom and the Kids equal one household, and then Dad alone equals another household? Because that could be driving the averages down quite a bit – if the average family is 4.3 people and that is closer to One household in white families and is closer to Two households in black families, that skews the household wealth chart, obviously.

We should just have a billionaire cap. Once you get there, you can’t earn or aquire any new money. Any future gains must be given to the needy (to be defined differently each year, just for variety).

Well…Ryan’s point is well taken …for 30 years of my 45 years of working my net wealth was less than 100,000….and at no time has it exceeded 500,000….relative to my peers I’d say my career has been average…I didn’t work in a highly rewarded sector of the economy, put three kids through college, and my real estate investment was very modest. 1.2 million was always out of reach.

Well it is tough to get to that level, luck steps in, bad luck more. We were doing great, but my wife’s job at Planned Parenthood disappeared, she was director of education for 20 years and they shut that down around the country. Try getting rehired after that job. Now we’re both retired and had to use a good portion of our savings to pay off the house, etc. We are doing fine but all those European vacations are out for now. Have a week long trip to Brooklyn to see our kids in a couple of weeks so we can’t really complain, but careful planning only goes so far. Actually the pandemic put our savings up but not living and saving has it’s downside, doesn’t it?

I agree (as I suspect Bernie Sanders would) that there are plenty of white working-class families who are of the great wealth concentration among the elite and mostly white hoarder class, and I agree that plenty must be done to reform our economy and redistribute wealth more fairly to the workers who make that wealth possible. Closing the savings and assets gaps shown above by adding 40 Black and Hispanic households to the top 100 multi-billionaire elites would not constitute a true or complete defeat of racial economic injustice.

But apples to apples: Even among the wealthy households, white boys raised rich are more likely to stay rich; black boys raised drop into lower income classes more frequently as adults. And never mind households: the same NYT 2018 report shows that “Black men consistently earn less than white men, regardless of whether they’re raised rich or poor” and that “No such income gap exists between black and white women raised in similar households.” No amount of statistical hair-splitting can dismiss the fundamental fact that our economy is rigged in favor of white men. The system is racist from top to bottom.