In another draft issue memorandum presented to the Executive Board yesterday, the Legislative Research Council presents hard data on how much sales tax we’ve been collecting from out-of-state online vendors over the last four years:

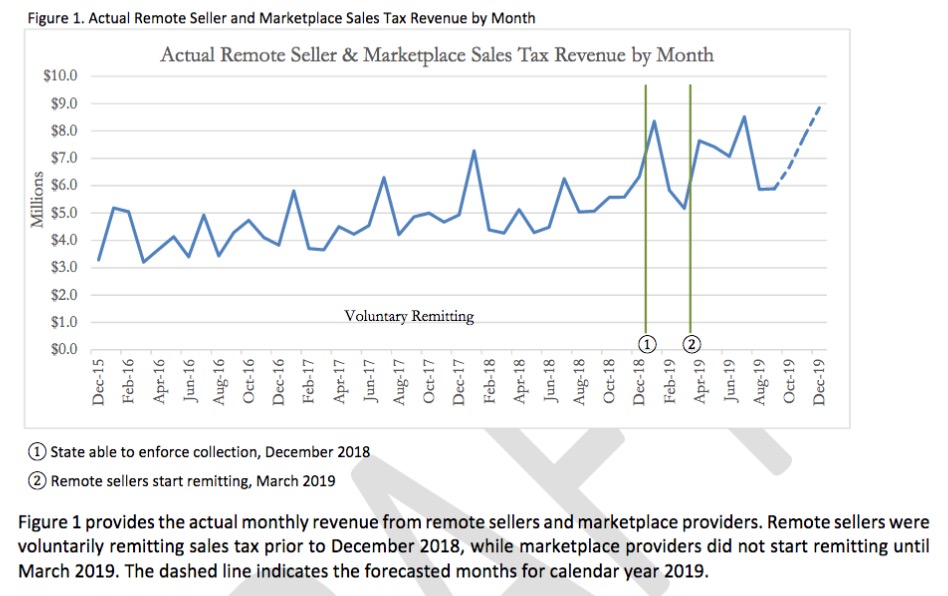

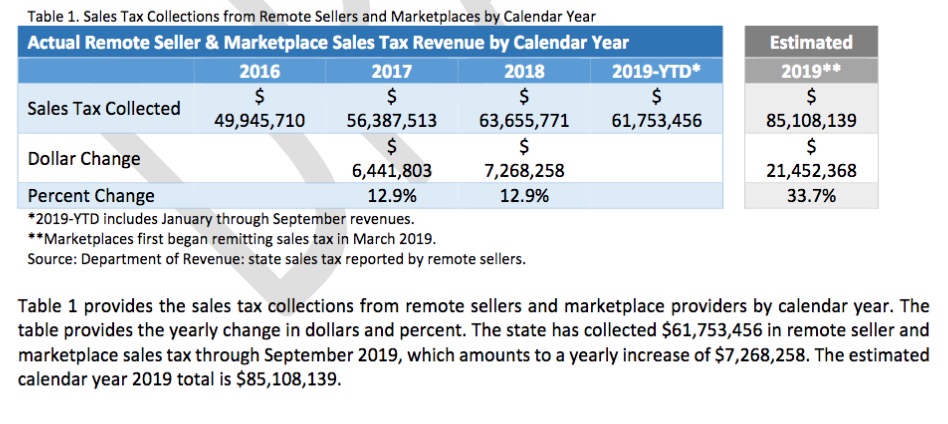

Sales tax collected from remote sales rose from $49.9 million in 2016, when we passed the law applying our sales tax to out-of-state vendors, to $63.7 million in 2018, when the Supreme Court approved our effort to subject people who’ve never set foot in South Dakota to South Dakota laws. And almost all of that money came in before we actually had the laws in place to enforce our Wayfair tax. LRC projects we’re on pace to take in $85.1 million this year, a 33.7% increase over 2018.

Now if you’re thinking Partridge Amendment, you’re looking at that $85 million in sales tax revenue and thinking, “Holy cow! That’s four 20-million-dollar increments! We’re getting four tenths of a percentage point knocked off our sales tax! Whoopee!” That’s the deal we made in 2016 when we raised the sales tax by 0.5 percentage points to raise teacher pay.

But hold your horses. The whole point of the LRC’s issue memo here is to tell the Legislature that we have no way to properly calculate how much additional revenue we’re making from our online out-of-state sales tax. LRC says we can’t even determine, under the law as written, who’s supposed to do that calculation.

We should also consider whether the increasing sales tax revenue from online sales is offset by a commensurate decrease in in-state sales.

While we have some really useful figures, we don’t have the numbers or the statutory language necessary to fulfill the intent of the 2016 Partridge Amendment. Legislators, how about putting aside your lazy culture-war bushwah and putting on your thinking caps to figure out this really relevant public policy problem?

GOAC? Or SD’s version of the OMB?

Pay the teachers, then lower the sales tax. Best idea. Apply all the lowering to food.

I was told the Council of Legislatures Research was chastised by young Mr. Greenfield, who is one of the most figuratively powerful fellows in the legislatures, and now that Mr. Nelson is quitting probably one of the strongest fellows too, and told to go back to the chalk board and do a better report. They have not written up the minutes yet, but perhaps we’ll see what they reflect. The tape recordings are very long so grudznick hasn’t listed to them all the way through to find where Mr. Greenfield pounded the table.