On December 6, Congresswoman told the press her father had not signed a will before he died on March 10, 1994:

“My dad had done estate planning, he had had a will completed, but he hadn’t gotten it signed before he was killed,” Noem told HuffPost on Wednesday [Arthur Delaney, “Kristi Noem Says Her Story Shows How the Estate Tax Hurts Families. Not Quite,” Huffington Post, 2017.12.07].

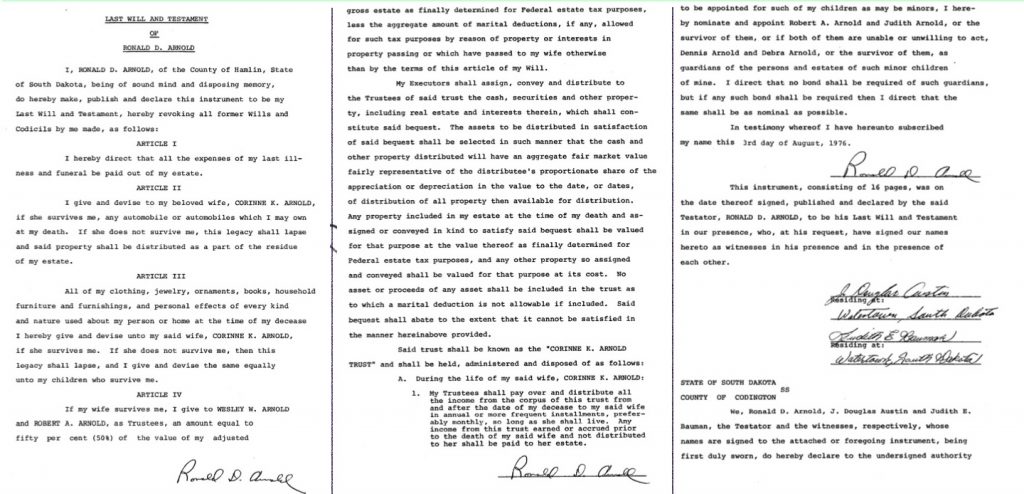

On December 13, I posted court documents establishing that Noem’s father, Ronald D. Arnold, had indeed signed a will.

On December 16, Congresswoman Kristi Noem changed her story:

As many parents do, my dad signed a will about a year after my youngest brother was born. That was 1976. Life went on. By the early 1990s, he began the process of updating his will. That new document, however, was never signed [Rep. Kristi Noem, op-ed, that Sioux Falls paper, 2017.12.16].

Hmm… how many more parts of her estate tax story will Congresswoman Noem have to change?

What does a Trumpian do when busted in a lie?

They double down and lie again hoping you’ll believe the first lie.

From the Argus Leader op-ed there is this from Noem, “For a decade after a tragic accident took my dad’s life, the Death Tax impacted nearly every decision our family made. To allege anything else is Fake News.

And if you don’t believe her a second or third time, it is fake news.

Dang, you’d think a congresswoman would know the difference a death tax and a estate tax.

What is the difference between the 2 wills and why did she have to pay some inheritance tax, when her should not have had to.

Now with the rest of it, I don’t have a problem with an inheritance tax. If my dad dies and I get $1 million in assets, well maybe I should pay a little bit in taxes, because yes the family has already paid taxes on it, but I haven’t.

Now I understand its a little different if you are 18-22 like she was when this happened. But damn if you are 40 and your dad dies and you get a million its like really? Also was the tax on the farm or on the life insurance? Normally you don’t pay taxes on a life-insurance, but if your estate is setup in a certain way you can have to.

I’ve been busy and have only caught bits and pieces of this story, so if you could tie it all up I think it’d make it easier to follow

Mr. Voigt, to summarize for you:

some people think taxes are bad, they are bad.

other people think taxes are necessary.

the fight is about who pays taxes and who doesn’t, as the trough fillers and the trough slurpers tend to disagree.

Amazing she thanks input.Would it had been great if these three cowards would have had town hall meetings to get input from constituents. The Supertindent from a school put both Photo op Thune in his place and the subsidy queen as to where future funding would come from to fund these schools.

grudz – presumably you drive or once drove our roads, receive goods and services delivered via those roads – and yikes – airports, drink our water, breath our air, receive the protection of our police and fire departments, perhaps even use the extravagance of our libraries – so are you a trough filler or trough slurper?

Before answering that – also reflect on your social security check and medicare coverage and that for your folks – without which you likely would have paid more to care for them. Reflect. And reflect that its likely that NOem’s (Arnold’s) collected tens, if not hundreds of thousands in direct and indirect ag subsidies and benefits – NOem’s tax complaint is unseemly for one having her mouth full of benefits. And put up some real numbers as we saw in the Hamlin County court documents.

“Taxes are what we pay for civilized society.” – Justice Oliver Wendell Holmes

John, I was going to advise Grud that, like the majority of people, he was both a trough filler and trough slurper, but you’ve already done an excellent job of that. Most people are both, they either refuse to recognize it or think that the services THEY get are the most important and they are more deserving than anyone. Or, worst of all and, unfortunately, quite common, they want the services but somehow think such services magically appear on their own and they shouldn’t and don’t have to pay anything for them.

Just like the red states suck up more federal money than they send in, but don’t suffer for such deficits because they’re subsidized by those awful blue states. South Dakota is really good at that attitude, especially in West River. The Black Hills would not be the tourist draw that it is were it not for the government and the CCC camps that helped build the majority of the roads and other services to make the Hills accessible. Private industry wasn’t interested until after most of the work was done and they could see how much money could be made.

Peter Norbeck, who did more than almost anyone else in the early part of the 20th century to start to build up the Hills, including the creation of Custer State Park, was a progressive Teddy Roosevelt-style Republican and Tom Berry, Democratic governor during the 30’s who worked closely with FDR, were both quite instrumental in using the government for good in that respect. Were it not for that evil government and trough slurpers, Mt. Rushmore would not have been built and would not continue to be in operation today, because where would the state get the fifteen grand per day it takes to run it?

NOem screams and rants against taxes, but has, along with her family, sucked up millions in farm subsidies over the years and her husband makes a good portion of his insurance company living selling federally-subsidized crop insurance. She gets Cadillac health care plan that she pays almost nothing for, courtesy of the very taxpayers she and her party are so gleefully screwing out of any of their own insurance. She’s a liar and a hypocrite and a disgraceful embarrassment to this state.

Joe, we have no idea what the second, unsigned will looked like. Given Kristi’s truth-stretching, we don’t even know if such a will actually existed. Any such alleged document is irrelevant to the debate at hand.

Joe, you undo the “double-tax” lie well. Estate tax is income tax on income received. Under Kristi’s bad logic, every tax would be a double tax. If I pay you for working for me, you are receiving money on which I’ve paid tax, but by gum, you still have to pay income tax on it, too.

The estate tax was on the net value of the estate not left to his wife—i.e., on the gross value of the estate minus all the debts Arnold had minus the estate tax-exempt portion left to his wife. Arnold’s assets were worth over $4 million, but the estate tax was assessed only on the $1 million or so after debt that was left to the trust managed by his brothers.

The life insurance payouts were worth over $1.2 million. $125K of the life insurance was taxable; $1.12M came to Arnold’s wife tax-exempt.

David Lias as a strong editorial on Noem’s holey story in the Vermillion Plain Talk, in which he reminds us that he tried to sound the alarm about her tale’s fishiness in 2010. Why weren’t we listening?

Cory, if you pay someone to work for you, the money you payed is a deductible

expense. If you’re paying taxes on money you payed for labor you need

a better tax adviser.

Edwin, say I make a million dollars. I pay income tax on it. Then I retire and pay you to mow my lawn. You pay tax on what I pay you. Double taxation, right? By Kristi’s logic, yes, right?

Most South Dakotans pay sales tax and property tax with money that Uncle Sam is charging income tax on. Oh, but the SALT deduction prevents that—oh, but wait, Kristi voted to reduce our access to that deduction and thus increase double taxation. Principles? What principles?

Cory, I’m not defending Kristi, just saying that in most cases, hired labor is a deductible

expense. If your tax adviser is bit creative, you might be able to deduct what you

pay to mow your lawn.

Grudz, your kids should be grateful for receiving anything you leave for them because it’s something they got for free without having to earn for themselves. If the country they live in takes a portion of their unearned income, just as it takes a portion of their earned income, they might view it as part of their price of filling the trough that we all slurp from. Or they might view it as a double tax on you instead of a single tax on on their genetic lottery winnings. It may depend on whether they view the trough they are slurping from as half full or half empty.

Don’t worry photo op Thune and slick Mike will come to her aid.

Some slurp more than others and some slop more than most. Jeder nach seinen Fähigkeiten, jedem nach seinen Bedürfnissen.

South Dakota won’t toss out a shovel full of asphalt on our roads without federal matching funds. I’m sure we are one of the biggest tax slurper’s in the nation. Republican logic! Right now we are building unnecessary road turn outs not because they are needed but because there is federal money available for “safety” improvements but not for anything else. I’m sure some favorite contractors are getting the job!

Kurt.

grudznick: how does inheriting parents’ wealth make one a “trough filler?” You perpetuate the mythology of success – that so many of the 1% (including President Trump) are born on third base and claim they hit a triple.

grudz, in this holiday season: Jehova wird zu euch hinzufügen, zu euch und zu euren Kindern. Psalm 115:14

Why tell the truth when lies adequately serve the purpose? Besides, there may be enough wiggle room to allow her to say she misspoke, instead of flat out making stuff up.

Back during the Cold War, SALT had actual and very important meaning – Strategic Arms Limitation Talks as opposed to Same Auld Lies Today.

Edwin, I get the deduction of labor costs. I’m trying to forge the kind of multi-year analogy that helps put the lie to Noem’s double-taxation claim. Better examples, anyone?

Keep her feet to the fire, Cory!

Kristi noem says that her dad had a new will prepared but didn’t sign it like that should mean something. That is just as bad as having a multi-million dollar business and not paying your insurance premiums – the resulting problems are your problems and not the government’s fault. If all her problems in life come from the estate tax on her father’s estate, she should be blaming her folks for not putting a decent plan in place instead of complaining about a tax that was widely known and easily avoidable. It would have taken what, two hours of his time to sign a new will?

Joseph Voigt – people say “life insurance is tax free” because the recipient doesn’t pay INCOME tax on it. However, if an insurance policy is owned by the person who dies, it is included in their taxable estate for ESTATE tax purposes. In this case, some of the life insurance was included in Arnold’s estate, and thus subject to estate tax, because he probably owned those policies. The life insurance that was not included in his estate, and thus not taxed, must have been owned by somebody else (likely his wife).

Social Security benefits for some people are taxed as income.

It’s true that some kids never earn what they inherit. Other kids, working in a family business–farm, restaurant, hardware store, etc.– work very hard for their inheritance. Other kids work very hard for a promised inheritance that never materializes. There are any number of possible scenarios.

Say a farmer buys a quarter of land. That is payed for with after tax dollars. One could reasonably argue that that portion of the estate is being double taxed. However, that portion of the estate that is appreciation could be looked at differently.

Many farmers have the hope that their land will be farmed by their children, their children’s children, etc. That’s where the estate tax might hurt. Again, different possible scenarios.

It’s true that very few farmers in South Dakota are affected by the estate tax under present law and present land values.

My opinion is that there might have been better things to fight for than the abolition of the estate tax, although I have not followed the discussion closely enough to make a suggestion.

Edwin Arndt,

Let’s look at some real world examples from my part of the world in Minnehaha County. Land that sold for $700 an acre in the late 80’s and $2,000 per acre in the 90’s now sells for $8,000-$10,000 per acre. A farmer who bought land in the 80’s or 90’s in these examples has $7,300 to $9,300 in untaxed gain at the time of death if it were to occur now. Only $700 or $2,000 per acre would be the portion that could be argued were subject to double tax. But what has also not been considered is that the heirs get a stepped up basis on this land to fair market value at the time of the decedent’s death. Thus, the heirs now will pay no capital gains tax if they sell the land. Thus, a small portion of these estate examples could be subject to double taxation, but a very large part of these example estates could be subject to ZERO taxation at the decedent’s death and ZERO tax when the heirs sell the highly appreciated property.

The other thing to consider is that debt offsets assets for the estate tax. So, if you buy land at $8,000 an acre and take out a loan for $6,000 an acre, you only have an estate asset worth $2,000 an acre that counts towards the estate tax.

I see the estate tax as somewhat of an issue in the 90’s that was addressed by Congress in the late 90’s and 2000’s with increasingly higher estate tax exemptions. Now we are to the point that $11 million dollars can be exempt in a husband-wife estate. That is also to say nothing of the gifts that parents can give to their children without tax consequences during their life. If anybody has heard their cries for tax relief be heard by Congress, it is the wealthy in this country. Kristi Noem is still fighting for tax relief that was already granted. She is the poster child for the wealthy getting tax relief, not the poster child for needing tax relief.

Well said, Darin. Exactly right. The stepped-up basis issue is huge and is conveniently ignored by most people who complain about the estate tax. The stepped-up tax basis that assets receive when the owner passes away is a much bigger benefit to the wealthy in this country than “burden” created by the estate tax. Billions of dollars of otherwise taxable gain is often wiped out over night for these super-wealthy families, while the average person doesn’t benefit much or at all from the stepped-up basis because most people die without deferred income taxes (except on their IRAs, but the IRS doesn’t let that deferred tax disappear, the beneficiaries pay that tax, you better believe it).

Darin, as far as I know, you’re right.

It is about time people call her on her fabricated story. Her being a straight shooter has been questioned by many of us for some time, and that belief is being brought to light by her changing her story many times. Her pattern of being less than truthful really makes me question, why does she thinks that she is qualified to be Governor of S.D.

So my husband keeps himself on NOem’s email list just so he can have the pleasure of responding negatively with actual facts whenever she spouts off her usual BS, which is, frankly, every single email. So what should appear in his email today? Why, a teary little email from Congresswoman Liar-Whiner herself, claiming that the “media is intentionally and maliciously smearing her father” and his legacy, blahblahblah. And, of course, she needs all of her loyal minions to send some dough her way to help her slam back at that evil, awful media that dares to tell the real truth with actual facts.

It’s bad enough that she uses her father’s tragic, accidental death to promote lies about the estate tax, especially after she and her family have slurped up millions in federal farm subsidies. It’s even worse that she twists and distorts the truth even more in order to bash the media that finally dares to begin telling the TRUTH about her lies and how she’s used her father’s death for her own political purposes all these years. I can’t wait to read the email hubby will blast her with in response!!!

Really good point about untaxed gain, Darin!

Yes, Laurisa, Noem is now resorting to the same delegitimization of the press that Trump uses. She can’t defend her fibbing, so she has to discredit the journalists that have finally reported her fibbing.

This is not “an intentionally malicious and false attack.” The press is printing facts and pointing out that they don’t square with the story Noem has used to win elections and push legislation.