Only a jerk as big as Donald Trump could make me say, “Thank goodness for our humanitarian Republican Congress!” But there they are, John Thune, Mike Rounds, Kristi Noem, and their Congressional colleagues somehow not enacting the cruel cuts Trump would wreak on less fortunate Americans:

The White House, for example, wants to terminate the Low Income Home Energy Assistance Program (which helps families pay monthly heat and air conditioning bills), but the House and Senate appropriations subcommittees have passed bills that leave its funding at the same level. The White House wants to cut $200 million from the Women, Infants and Children program (which aims to improve the nutrition of expecting and new mothers), but the Senate appropriations bill leaves its funding alone. The White House wants to cut about $310 million from its rental vouchers program, but the House and Senate appropriations bills call for the opposite — about $1 billion more in the Senate version and $355 million more in the House version [J.B. Wogan, “Welfare Programs Appear Safe from Trump’s Cuts, for Now,” Governing, 2017.11.28].

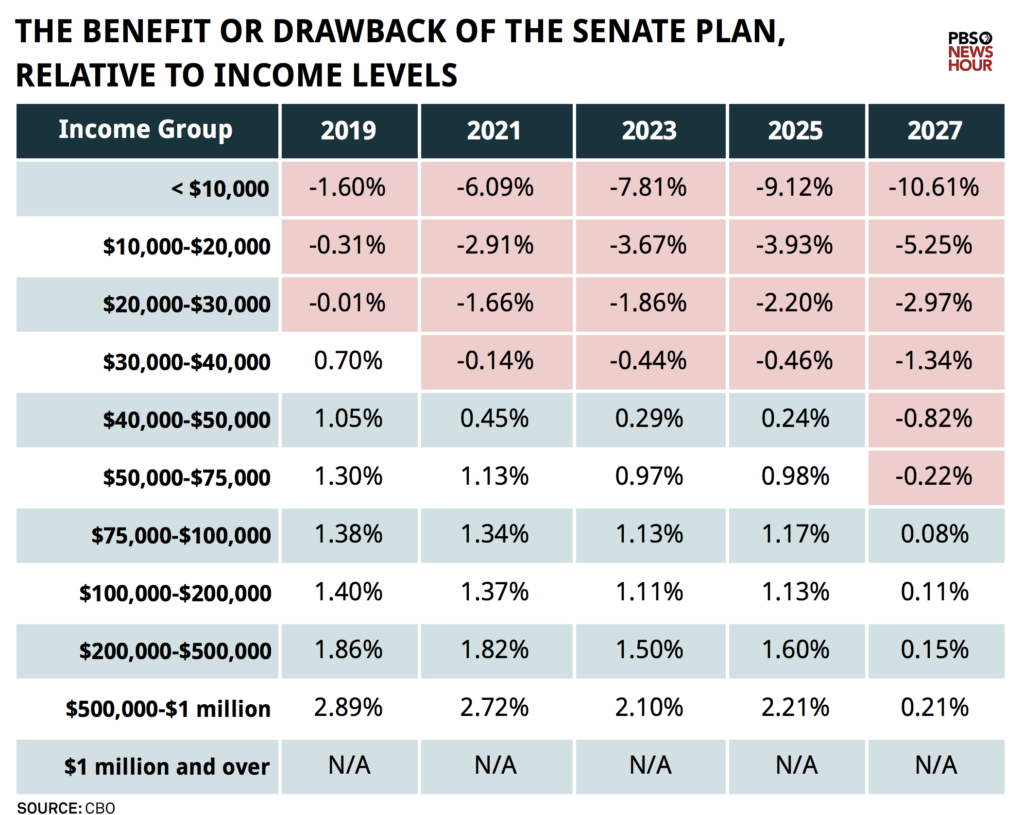

But don’t be fooled: this is the same Congress that is cruising to further bust the budget (the same budget South Dakota Republicans are preparing to demand be balanced by an Article Five Convention Constitutional amendment) by transferring $1.633 trillion mostly up the ladder to their already rich friends while taking cash away from folks making less than $30K.

Congress is plenty in line with Trump in ignoring his own phony populism and solidifying the Trump-class’s control of the state; our plutocratic Congresspeople can afford to ignore Trump’s Archie-Bunker outbursts over the pittances of social assistance.

What they are trying to sell is the con that this cut cut cut tax bill could have been worse had it not been for these brave republicans Thune/Rounds/NOem, who saved the day. Make no mistake, this bait and switch, is a bigger heist than what the banks got away with in 2008. This time, the consequences will be much greater and be felt to a much higher degree soon. The market may go through the roof, but the bottom is coming out of the house of cards they will have created.

Here is the goal of the Thune/Rounds/NOem cut cut cut tax plan.

“”[T]he stealth goal of GOP tax cuts is to start down the path toward gutting the New Deal and the Great Society—and if tax cuts pass, they might get away with it. […]

If anything, by enacting a stimulus now, in the form of a tax cut, when the economy is near full employment, the government risks raising inflation, which would mean the stimulus generates higher prices rather than reduced unemployment—when employers can’t find additional workers to meet increased demand, they have little choice but to bid up wages, which get incorporated into prices.

So, why do it? Because for decades, conservative intellectuals have pushed for big tax cuts; less to grow the economy and more because they want to “starve the beast.” They want to force a major overall spending cut that would be a political non-starter without first passing a tax cut that creates a deficit so large, something must be done about it. Spending cuts must be enacted, then, as they would be presented as the only way to pay for the already passed tax cut’s lost revenue.”” Washington Post

The brave republicans will keep the heat going (for now) while they take away any kind of money needed to pay for the rest of the needed heat to keep from freezing to death. Compassionate berstards, aren’t they?

It gets worse. They are also slashing education. They estimated the cuts to SD alone would lay off over 200 teachers. This means a massive shift to charter schools which would further hurt families if they lose benefits. The state wasn’t to move as many intellectually disabled into foster care of some sort which means large layoffs

Jerry, I can only partially agree with your analysis that the GOP is cutting taxes for a “starve the beast” forced reduction of the size of government. I really see it this time as a pure money grab. The donors want the ROI for all that campaign contributing.

The left has fallen!!!!

“Minnesota Public Radio (MPR) is terminating its contracts with Garrison Keillor and his private media companies after recently learning of allegations of his inappropriate behavior with an individual who worked with him.”

As always, it ceases to amaze me that so many Americans talk about welfare in relation to poor people.

When you find that poor white Trump supporters demand tax cuts for the 1% you know there is something seriously wrong with this country.

Welfare is an unchecked and unchallenged taxpayer dollars for foreign aid, corporate tax cuts, oil subsidies, agricultural subsidies, bank bailouts, and on and on.

During the 2016 campaign Trump said he would shutdown the government if he did not get his budget passed, that may just happen.

A serial sexual abuser and rapists remains in the White House.

Al Franken, John Conyers and other congressmen accused of sexual assault should resign when Trump does.

OldSarg is amazed that the left holds it’s own accountable. That is a foreign concept to him and his ilk. That is not something that is seen on the right very often. Heck, Republicans in Alabama are going to elect an accused pedophile. It’s better in their mind to let pedophiles go unmolested in their campaign for office then to let a lowly Democrat win an election. Alabama-where the politicians go unmolested and the children pay the price.

Back on topic: Cory, I like the chart from PBS a lot, but we need to see a separate chart with the dollar amounts instead of the percentages. The dollar amounts are what really tells the tale of this Republican con job. Remember when Don the Con said that he would pay higher taxes under the Republican plan?

Roger, I’m thinking there will be a whole lot more liberals being fired and resigning before you see the Trumpster going. . .

The day of the Beta males is over. Women are turning out in droves ratting out the guys who used the whole “I hate misogynists and support abortion” lines to get close to the girls. Good thing none of you guys have employees. . . jus sayin. . .

Darling: “Heck, Republicans in Alabama are going to elect an accused pedophile”.

Did you really type that? Did you honestly think no one would see the word “accused” and not understand that an accusation is simply “that”, just accused? no trial, day in court or confession? Oh, and I love how you “liberals” hold people accountable. . . Like for the young lady left to drown in her car. . . good job there Big Guy! Way to hold them accountable. . . Like your man Al would ever give up power for “just” sexually abusing a woman. . .

OldSludge, I know it amazes you when people like me tell the truth on purpose instead of constantly lying and distorting the truth. You live in a world of distortion and lies so profound that you can’t believe I would not just say someone is guilty out of hand. Moore is “accused.” I used the word purposefully. I know the truth shocks you.

Now, what you don’t talk about is that even many Republicans in Congress and leaders of your party have asked Moore to resign from the race. Your party leaders find the allegations by numerous girls that were underage and numerous witnesses to be credible. Notwithstanding the mountain of evidence and the credibility finding by your party leaders, your Republican brethren in Alabama will vote Moore into office and then he will be expelled from the Senate.

We do agree on one thing I think. Trump will resign from office when you pry his cold little hands from where he grabs women.

This thread is for the tax plan. Stay focused, talk policy.

o, what you might be missing is the Medicare and more importantly, Social Security grab, that is in the mix. This whole shebang has never been about tax cuts, it has always been about the grand theft of the holy grail of republican hate, Social Security.

The wealthy hate Social Security because it is a huge stockpile of money that they cannot get their greedy little mitts on. That was until now. Now it is in their reach and they even went to bed with the Russians to get a serial pedophile and woman abuser elevated to the highest office in the land. Think of how wonderful of a gift this is for them. Why take a little tax break of a few million each when they could grab at least a billion each for the hell of it. They want to get that before they have to split it with Putin.

o, Here are billions for the wealthy on the backs of our seniors “”The Senate tax bill is really a health care bill with major implications for more than 100 million Americans who rely on the federal government for their health insurance.

The bill reaches into every major American health care program: Medicaid, Medicare, and the Obamacare marketplaces.

These are expected outcomes based on two significant policy changes in the bill. First, the bill repeals the individual mandate, a key piece of Obamacare that requires most Americans get covered. Economists expect its elimination to reduce enrollment in both the Affordable Care Act’s private marketplaces and Medicaid by millions. The money saved will be pumped into tax cuts for the very wealthy.

The bill also includes tax cuts so large that they would trigger across-the-board spending cuts — including billions for Medicare. The last time Medicare was hit with cuts like this, patients lost access to critical services like chemotherapy treatment.

This tax bill deserves a broader name. Its policies will cause millions of vulnerable Americans to lose coverage, disrupt care for the elderly, and potentially change the health care system in other ways we can’t fully predict.”” https://www.vox.com/policy-and-politics/2017/11/29/16712430/senate-tax-bill-change-federal-health-care

This is the Medicare cuts for things like cancer treatments. Got cancer, too damn bad gramps, you were gonna die anyway, so here is the republican helper for ya, die quickly. We are even gonna keep Thune/Rounds in office for their theft. NOem can ignore the facts and try to ride her hobby horse into Pierre. Jackley is just as guilty and that bone head Krebs says that she is gonna be trump’s moll into even more thievery. This is how the republican method of operation is, are we gonna help them take away our future?

o, Little Marco Rubio speaketh the truth “”Tax reform is only one piece of the overall puzzle needed to revitalize the American economy, Sen. Marco Rubio (R-Fla.) told a group of Washington, D.C., lobbyists and policy analysts this morning at a Politico Playbook Interview sponsored by the Financial Services Institute. The other part? Reduce the deficit and offset the cost of the reform, which the Congressional Budget Office estimates at $1.3 trillion.

“I analyze this very differently than most,” Rubio told the crowd. “Many argue that you can’t cut taxes because it will drive up the deficit. But we have to do two things. We have to generate economic growth which generates revenue, while reducing spending. That will mean instituting structural changes to Social Security and Medicare for the future,” the senator said.

[…]

“Tax reform is the economic component of this equation,” said Rubio, who expressed doubts that there will be a government shutdown. “When more people are working, there are more taxpayers and more revenue, but that alone won’t be enough. You are still going to have a debt problem in the absence of spending cuts.””

There ya go, the slashing and ending of both Medicare and Social Security. What could possibly go wrong?

jerry, you mention the people who will lose medical insurance coverage under the Republican tax bill. To add insult to injury, the Republicans are taking away the medical expense deduction. So, if a person gets cancer and has to spend tens of thousands or hundreds of thousands of dollars on their medical care (if they can come up with the money out of pocket), it will no longer be tax deductible.

So let’s review the absurdity of Trump with regard to tax deductions: Trump wants to allow religious organizations to be directly involved in political campaigns by getting rid of the Johnson Amendment. Thus, political donations made to a religious organization for use in a political campaign will be tax deductible, but medical expenses for lifesaving care will not be tax deductible. But if you are part of the mega rich, you would much rather have political donations be tax deductible. The mega rich already have great health insurance or are self insured. They don’t care about the pocket change they might spend on out of pocket medical care. But if they can deduct their political contributions, that would amount to a huge windfall for the big money donors. Fill that swamp, Trump!

True that Mr. Larson. Keep also in mind that trump does not send me propaganda about what a great thing this tax cut is, NOem does though. Rounds writes about it in his weekly columns as does Thune. These three are proud of this and they should be as it has taken since the early 1930’s for republicans to finally kill all of the social networks our grand parents and parents have been blessed with for a dignity in their later years and end of time. The frauds in republican land rush to pass this and then when the bottom falls out, they will blame Democrats for not stopping their killing fields.

I remember as a kid listening to the collection plate’s coins being passed around. No one will have any money to feed the plate as it will have been spent on things to survive, that is the great irony of it all. The big money donors will not need to give any of their precious money to the likes of congregations as they have already fleeced them for whatever they have. Life is funny like that and in a strange way proves what a fraud they have been living.

What this country needs is a good old GENERAL STRIKE!

It’s time people to get out in the street and startbangin’ on pots and pans!

O is right this is nothing but a Coup D etat.

There is no conceivable benchmark—in our past, or in comparison to our international peers—by which one could sustain the argument that the rich are taxed too much, or “taxed enough already.”

1)Average household tax rates have fallen, for all income groups, since 1979.

On the whole, the federal taxes are progressive—high earners pay more, both in absolute dollars and as a share of their income. But no one is paying more in taxes now than they were thirty years ago, or twenty years ago, or ten years ago.

2) Tax rates have already fallen dramatically for the rich

One of the hallmarks of the postwar compact was a relatively robust redistribution of incomes (and funding of social programs) through the tax system. Since then we have seen a dramatic decline in the top marginal tax rate (see graph below), which climbed steeply in response to the demands of depression and war and was over 90 percent during most of the peak years of postwar growth (1945-1964). The top marginal rate dropped to 70 percent with the Kennedy-Johnson cuts of 1964, to 50 percent (1982) and then 30 percent (1988) under Reagan, climbed back to 40 percent under Clinton, and then was pushed back to 35 percent by the Bush tax cuts.

And, in exchange for diminished revenues and rising inequality, we see none of the benefits that are supposed to follow from unshackling investors and job creators. “Supply-side” cheerleaders have willfully and wildly overestimated the “elasticity” of taxable income( the likelihood that high earners will invest when taxes are low and sit on their hands when taxes are high).

3. Taxes have fallen even more dramatically for business.

Over the last generation, we have also seen a marked shift in the tax burden. Individual income taxes have accounted for between 40 and 50 percent of federal revenues since the end of the Second World War, but over the same span corporate income taxes and payroll taxes have traded places as the next largest contributor. In 1943, corporate income taxes account for 40 percent of federal revenues and payroll taxes about 13 percent. In 2010, corporate income taxes accounted for only 9 percent of federal revenues, while payroll taxes had grown to 40 percent.

4. We don’t collect enough money.

Beyond the distribution of the tax burden (who pays and who doesn’t), an even bigger challenge is its capacity. We simply don’t collect enough revenue to sustain a decent threshold of public goods and public services, or to make much of a dent in the maldistribution of income. Among its OECD( Organization for Economic Cooperation and Development ) peers , the United States has one of the lowest rates of taxation as a share of gross national product—and it has moved steadily down this list since the 1970s.

If you look beyond the tax system itself to the net impact of taxes and transfers, the United States is a stark outlier. Across the OECD, taxes and transfers have the net effect of reducing poverty by more than half—from about 25 percent to about 11 percent of households. In the United States, the poverty rate before taxes and transfers is close to the OECD average, but is dampened only slightly (to about 18 percent) by taxes and transfers. The net effect of tax and benefit policies in the United States is to reduce overall inequality by only about 20 percent, one of the lowest rates in the OECD.

Rich Taxed enough? Not by a long shot.

Robin, you have laid out a very compelling argument against the Republican fiction that the rich are overtaxed in this country. Thank you.

Darin ,

Not so much my brain- I have been picking brains. I wish I could get the charts posted because I got charts from the CBO showing all 4 points

You are welcome- I learned lots in the process as well.

President Trump said again how these tax cut bills will not help him or his rich friends. He says it will “cost him a fortune”.

Seriously folks. What is wrong with this guy? The House version of estate tax cuts will alone save his family well over one BILLION dollars. Billion! Yes. Thats Billion dollars!

Meanwhile, lower income earners receive cuts to healthcare and other programs. And those meager middle-class tax cuts expire in a few years. “The Republican Party is just for the rich”. That is what I would hear when I was growing up. I didn’t believe it then…. but I sure do now.

Eric, Donald, Ivanka, Baron and Tiffany will EACH benefit 200 million dollars (or more) by that tax bill. A lot more if Donald were actually worth what he claims.

What will you get?

None of your arguments matter. You, your neighbors, your elected officials all know the tax code is screwed up and instead of working together to get something to help you all decided it was more important to just attack one man, Trump. You have elected officials, that are actually working on the tax bill, you could call but instead you come on here like a bunch of hens clacking away about how much smarter you are than Trump while he gets this tax bill through congress and into law and it will be another “win” notch on his bedpost.

The argument of Tim Bjorkman matters. He’s not just attacking one man. He’s saying (as do most of the empirical economic data and objective analyses) that the tax package Congressional Republicans are brewing up will raise taxes for the folks on the low end, further concentrate wealth at the high end, raise the deficit, and have little positive economic effect. Bjorkman is also offering an alternative plan—focus tax cuts on the working class—that empirical data show is a better policy.

If you can step away from the politics of personality, OldSarg, feel free to address Bjorkman’s arguments and the economic facts behind it.

OldSarge, “another ‘win’ notch on his bedpost?” Was Melania out of town? Were the Russian hookers in town? What “wins” has Trump had? Obamacare Repeal and Replace, Build The Wall, Mexico is paying for it, Muslim bans, Taking on China, Renegotiating trade deals, Playing more golf than Obama. Tired of winning yet?

Instead of blaming some people on a blog for your party’s absolute obsession with policies that favor the wealthy, how about you explain why the Republican plan is so focused on helping the rich? Why does Trump keep lying about the plan being focused on the middle class when everyone can see it is not? It is more of the same trickle down economics that has failed to help the middle class time and again. Over the last thirty years, the vast majority of economic gains over inflation have gone to the rich. Why institute more policies that favor the rich over the middle class?

I also fear that this tax bill will (like the last presidential election) reveal some ugly truths about my own Democratic party. I made the argument that this is not a political ideology fight, but a pure cash grab (thanks, Jerry, for showing how the cash grab goes beyond tax policy). Even though the GOP is front and center pushing this skimming of national wealth, too many Democrats are also being called to make the ROI for campaign contributions from wealthy/corporate donors. There is plenty of sitting on hands now in DC.

We have to be cautious that we do not fall into the trap of allowing a “Democrat” label to be an automatic pass on issues.

OldSarge the cat has a surprise coming. His master Drumpf said so. He even placed the cat in a gunny sack full of rocks so the cat wouldn’t catch on to the surprise. In the middle of the lake, OldSarge finally realized, when the bag is sinking, that life preservers aren’t made of burlap. Too late, old one. Us Libs tried to warn you, but you refused to believe anything bad about your fearless fool in the WH. Bwahahahahahahahaha!

OldSarge (et al), how do you create the cognitive dissonance to take a stand that has been shown to be objectively false in the course of our nation’s financial history and IS proving to be objectively false in Kansas?

Many people believe that we have more government than we can afford. I am probably one of them.

Cutting aid programs to the disadvantaged would create hardships for those people. However, don’t we think that continuing to fund those programs would create hardships for the country in general, due to the growth in debt? Eventually, in theory, our national debt would get to a point where servicing it takes the entire GDP, and then what would we do?

Trump, and others, believe that cutting taxes could create some economic growth. I realize that this is speculative, but perhaps they are right. Anyway, that is their hope. It is a path forward that could be better than the path we currently walk.

What hope do people have who think we should maintain (or increase) the various social spending programs?

I have no desire to quarrel. I ask in all innocence.

Debt snowballed when wingnuts decided they could cut taxes twice and start two unfunded wars and add an unfunded entitlement prescription drug plan. Before dumbass dubya, congress always raised revenues to pay for the wars. Not know it all dubya.

Debt continued under Obama because wingnuts refused to raise revenues to pay our bills as the constitution demands. The majority of the 20 plus trillion debt is laid rightfully at wingnut’s feet.

There is much good to say about tax and spend Dems. Best of all, they don’t spend like drunken sailors without having an idea to pay for it all-without throwing the poor and elderly under the billionaire taxcuts bus.

That was a handy bit of historical blamestorming, and that helps me to understand how you view the past. But you forgot to address the part about a competing (liberal and Democratic) idea that could offer economic hope for our nation’s future.

What is so hard to figure out, historically speaking and with empirical evidence abundant that raising taxes makes the economy grow and pretty much always has.

Our largest growth and prosperity came when top rates neared 90%. Check out the economy under Clinton when he pushed one of the largest tax increases through congress w/o a single wingnut vote. How did Clinton’s economy do. He had the highest % growth in the stock market after that tax increase.

Plus raising taxes on the wealthy kept the income disparity relatively close and everyone was relatively satisfied. You get revolutions when the top get the largest share of the wealth.

Mike We have not made any attempt to fund any military action since Johnson because quite frankly everyone would get out in the street and demand it stop- we also have been in permanently fighting someone else’s battle since the Vietnam war.

Obama added 858 billion to the debt in two years with tax cuts .

Obama added 3.5 Trillion to the debt with Quantitative easing.

Don’t tell me that the Dems don’t throw the elderly under the bus- I work with elderly people and sure the Obama made a big deal about giving them a tiny SS increase but what no one was given the voice to say was he took away a lot more than he gave. He cut Medicare by 320 Billion in 2011, Not to mention he cut their meals on wheels program severely and raised their medicare D payments.

Yes Republicans suck but I see the Dems doing the same thing only quietly behind our backs- The Republicans just seem to be the neener neener in your face party about it.

Revolutions ??? Yeah not in this life time. If it were any other country this show would not have carried on this long. The U.S. we just argue whose fault it is so we don’t have to take responsibility for fixing it.

Tax hikes/cuts are causal not factual proof in regards to economy performance. Clinton imposed tax hikes on an economy that had been resuscitated and was breathing. This time is way different Friedman economics and Keynesian economics have both been applied and the best they can do is say it’s on life support for the 90% .

Yes Taxes on the rich are suppose to reduce the income disparity between the rich and the poor , but if we look at all the countries belonging to Organization for Economic Cooperation and Development the poverty rate before taxes and transfers is close to the OECD average, but every country but the U.S. has the net effect of reducing poverty by more than half—from about 25 percent to about 11 percent of households. In the U.S. its far less. This is before Trump does his damage-

Trump is the Republicans on Steriods, but make no mistake the Dems have been doing their fair share of damage as well- They all wear corporate sponsorship badges for a reason.

The Trump/GOP tax plan will add $1 TRILLION to the deficit.

This is another example of how Trump practices bad business.

Obama’s plan for deficit reduction cut Medicare/Medicaid by 320 billion OVER 10 years. Meals on Wheels program cuts were due to sequestration. Drumpf wants to end M on W.

You will never get me to fall for the Dems are just as bad as wingnuts. It isn’t and hasn’t been true. I have eyes. I can see what is going on. I don’t know what your problem is.

Robin, your argument that the Dems “do the same thing” is really off base. The Democrats have fought for social programs and gotten them instituted through blood, sweat and tears. The Republicans want to dismantle those programs. Democrats agreeing to cuts in order to pay for other social programs and healthcare is nothing like the Republicans attempting to abolish the programs altogether and take the savings to pay for tax cuts for the rich.

Statements from hardcore Republicans and Democrats are exactly why the the founding fathers warned against a party system.

Neither side is willing to be objective about their respective parties and divide into camps and close their eyes to the the changes going on.

Granted Republicans were spawned from Satan and are in need of some deep psychiatric help, But the Democrats are no longer the Democrats of Kennedy’s era since they transferred their affections to Wallstreet.

Democrats stopped confronting privilege and turned to flattering privilege.

Obama gave every opportunity to wallstreet instead of the people- 4 things he totally blew and almost saddled us with a 5th bad deal.

Remember it was a democrat that killed Glass-Stegall, and gave us Nafta .

I don’t even want to hear about Republicans because the office of President is so powerful that evn in Obama’s worst period, with Congress entirely in the hands of unyielding Republicans, it still would have been possible for the President to use the executive branch to big and consequential things about inequality. To name just one: He might have resumed Franklin Roosevelt’s legacy on antitrust enforcement. Just enforcing laws already on the books could have brought back taken us back to the Dems who were for the working class. Prosecutions of the financial industry fraudsters would have been healthy and were entirely within Obama’s power even after the Dems lost Congress. Using Education department funding to encourage Universities to reconsider their out of control tuition inflating would have been transformative !

The Federal Trade commision could have cracked down on pharma’s price gouging.

Obama had opportunity to do social economic justice with the crash but instead he kept the Bush team on to carry on as usual- No banks were put into receivership or cut down to size. No important bankers were terminated in the manner of the poor chairman of General Motors. No baniks were required to stop doing the risky things that got us here in the first place.

Obama back out of his proposal to allow judges modify homeowners debt when they filed for bankruptcy ( Cramdown) that would have been extremely helpful to millions of homeowners – When it came up for vote in a Democrat held Senate in 2009, Obama and his team would not lift a finger to help- The banks lobbied hard against it and won

Dodd Frank reform,- 22,000 pages of loopholes that allow banks to continue risky hedgefunding.

Healthcare- It was a fellow Democrat ( Baucus D Mt and bff to insurance lobbyists) that steered Obama away from single payer or public option . ACA made insurers a permanent feature of the landscape without dealing with the real problems and endowing us with a Cadillac tax.

He crawled in bed with the pharmaceuticals as well- If they would support his ACA he would bar any possibility of drug re importation from Canada ( a country with a sane health care system. All this and Obama described his opponents as the ones who wanted to preserve the system for Insurance and drug companies- Talk about populist drama BS

It has merits but it was a deal, a deliberate swap in which a chance for a truly democratic health care system was parlayed into the opposite .

Obama denounced NAFTA as a candidate ; as President he blew workers off. Labors highest priority was Employee Free Choice Act which would have made it easier for workers to bargain collectively with management , and might have even reversed the long slide in the unionized percentage of the workforce. Obama declared himself in support of the measure; he even voted for it as a senator. When Wal-Mart and the Chamber of Commerce mobilized their lobbyists against the measure . One important thing to note was the number of Democrats that these business hired to do the lobbying against the workers from John Kerry, Rahm Emanuel, to several Democratic senators, even the secretary of labor !

Thus did the Party of the People turn the Government over to Wall Street in the years after Wall Street did lasting damage to the ……………. wow, the People

Obama was completely free to act, especially before 2010, and even after Republicans took Congress. The times certainly called for it with Amazon, Google, and AB InBev romping the globe- He did nothing ! 4 anti-monopoly investigations in 2009 to nothing in 2014 ( the last Democratic admin did 65)

The Republicans are snooty enough to only love the top 1% but the Democratic love only goes to the top 10%

Anything you need citations on let me know an I am more than happy to keep you busy reading.