The Department of Labor and Regulation does us the favor of posting the official statement from the Division of Banking on its Cease and Desist and License Revocation Order issued yesterday against Dollar Loan Center.

In trying to get back into payday lending in South Dakota, Dollar Loan Center boss Chuck Brennan appears to have made two main errors. First, according to the Division of Banking Order, all of Dollar Loan Center’s applications for money lender licenses “indicated that it would not provide ‘short term consumer loans’ as defined in SDCL 54-4-36(16).” When Brennan launched his new loans in July, he called them “signature loans.” However, the Division of Banking found, “all of the new loans mature in 7 days and require full payment of principal and interest upon maturity.” State law says “short-term consumer loans” are any loans with a duration of six months or less. Dollar Loan Center was thus selling loans it has said on its applications that it would not sell.

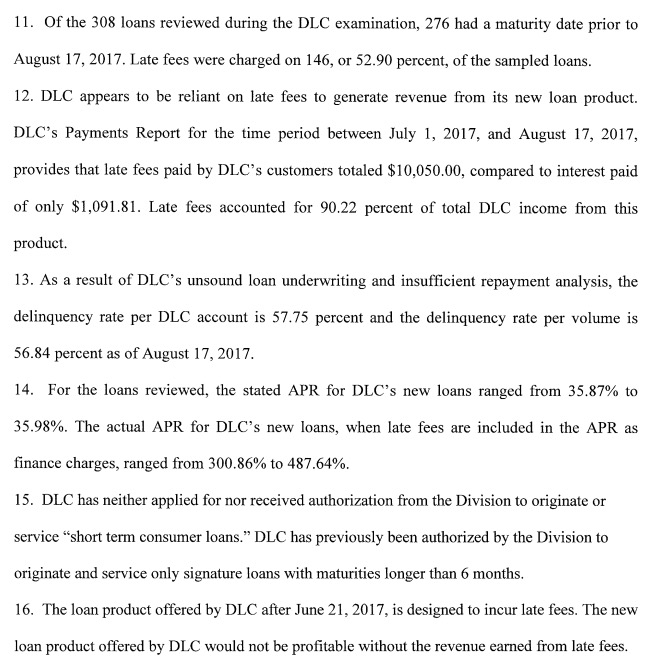

Brennan’s second error—or, more specifically, the way the Division of Banking analyzes and explains it—is violating the 36% rate cap by charging big late fees. The Division of Banking calculated that Dollar Loan Center’s late fees created an effective APR ranging from 300.86% to 487.64%. Brennan thought (and I did, too!) that the exemption of late fees from interest calculations snuck into SDCL 55-4-44.3 by this year’s Legislature meant he could charge all the late fees he wanted after one week. But the Division of Banking concludes that the “late fees” weren’t really late fees incurred upon consumer default but “anticipated” charges that Dollar Loan Center viewed as an essential part of its predatory financial product:

The Division of Banking thus includes those anticipated late fees in calculating the finance charges on the short-term loans that Dollar Loan Center said it wouldn’t be offering in the first place and concludes that Dollar Loan Center is violating SDCL 54-4-44.1 by offering a product that is really a “device, subterfuge, or pretense to evade” the 36% rate cap.

As a result of these violations, every loan Dollar Loan Center issued in South Dakota after June 21, 2017, is void and uncollectible. Dollar Loan Center loses its license and any any principal, fee, interest, or charge issued to any customer since June 21.

South Dakotans voted overwhelmingly last year to cap interest rates at 36%. Fortunately, the Division of Banking is enforcing the will of the people and telling Chuck Brennan that, yes, the people really meant 36%.

Related: The Division of Banking issued a new order today telling Cash N Go Pawn in Rapid City and Sioux Falls to shut down unlicensed lending activity.

As Humpty Dumpty said – ” Words mean exactly what I say they mean, nothing more, nothing less.” Lewis Carrol, “Through the Looking Glass”

Guess some folks won the lottery, eh?

I’m curious to see how the appeals process will turn out for this. The fraudulent claims about signature loans vs. short-term loans seems like DLC screwed up and should lose based on misrepresentation, but it seems like Brennan was following the letter of the law for keeping the “interest rate” under the threshold and he simply exploited a poorly drafted series of statutes that allowed him to charge late fees. Ask any business, they all anticipate certain fees or losses and build them into their pricing model. Suggesting that DLC should not consider a certain percentage of projected default in pricing their loans is stupid and no other businesses are treated like this for the same practice.

How does the state law read on loan origination fees?

DR, SDCL 54-3-1 defines interest to include origination fees.

Ryan, interestingly, SDCL 54-3-1 also includes “unanticipated late payments” in the definition of interest. So even if Brennan could show that the late payments are, contrary to DivBanking’s interpretation, unanticipated, they’d still count toward the 36% cap.

Either way, DivBanking makes a good separate point about DLC offering short-term loans that it said in its license application it would not offer. If Brennan appeals, he’ll have to win both arguments.

This decision was a breath of fresh air. I think we all remember when the DofB claimed that money transfers (or “loans”) involving EB-5 transactions were not loans and thus did not require a bank charter to execute them….This is a positive public policy decision or activism by the DofB, that is much welcomed.

Activism—interesting word, JKC! DivBanking could have gone for a strict interpretation of statute and words on paper and ruled that Brennan was doing nothing technically wrong. But in this case, DivBanking reviewed the actual loans offered, default rates, amounts paid, and DLC’s profits, and reached a broader, practical conclusion that Brennan was violating the law. Unlike Joop Bollen, Chuck Brennan must not have friends in Pierre.

With Marcy’s Law, our AG facilitated local law enforcement officials with AG opinions to make the ML requirements more attainable. Here, with DofB, activism was used to live up to the spirit of the 36% initiative. And I am sure, that getting 76% of the vote in the last election probably helped too, but where were the practical AG opinions and or the practical activism to make IM 22 workable for the critics as well? Often conservatives are the greatest critics of activism, or I guess in this case, it would be an example of the “administrative state,” but isn’t it ironic that such legal maneuvers have more than one parent and know no ideology, when some think its doable or to their political usefulness….

Interesting comparison, JKC. On the 36% rate cap and the crime victims bill of rights, state government has accepted the will of the voters and made it work. On IM22, AG Jackley offered the defense required by law in court but otherwise lifted no finger to keep the Legislature from overturning the voters’ will during Session.

Cory, exactly! The AG sat back and allowed the “House of Lords” Republican legislature to go to court and get an order that enjoined IM22 even though the AG technically did and was required to defend the initiative in court, Then this same order gave the “Lords” enough breathing room to continue to get their free donuts from the lobbyists, while they went to work to legislatively end IM22 with the court action then becoming moot. The “Lords” abused the separation of powers and checks and balances doctrines of the state constitution, while the AG sat silent with no intent to negate this abuse with practical opinions that could have prevented a constitutional abuse of our government by one branch of government unto an other….. We can always debate the legality of “activism” or public policy decisions in their own right, but when they are used in a cherry picking manner, that is when their true ethical and legal qualities can be placed into definite question….

All the more reason for Democrats to add Attorney General to the races they focus on this year… and hope the Republicans nominate their weakest candidate, Jason Ravnsborg.