Could the Daugaard Administration be seeing the light on a progressive tax system? Bob Mercer reports that Pat Costello, chief of the Governor’s Office of Economic Development, told the Legislative Planning Committee yesterday that our lack of a state income tax is actually getting in the way of recruiting businesses and workers:

The lack of a state income tax causes people from income-tax states to question why South Dakota doesn’t have one and what they would have to give up if they move to South Dakota, he said [Bob Mercer, “No State Income Tax = No Trust?” Pure Pierre Politics, 2016.05.17].

Wow—ending the Governor’s schmoozy GOED golf tournament, admitting that taxes don’t motivate young people to move… who keeps sneaking good sense into Pierre?

I wouldn’t advocate a state income tax just to counter a perception. I would advocate a state income tax to replace some of our sales and property tax and make our state tax system more balanced and progressive.

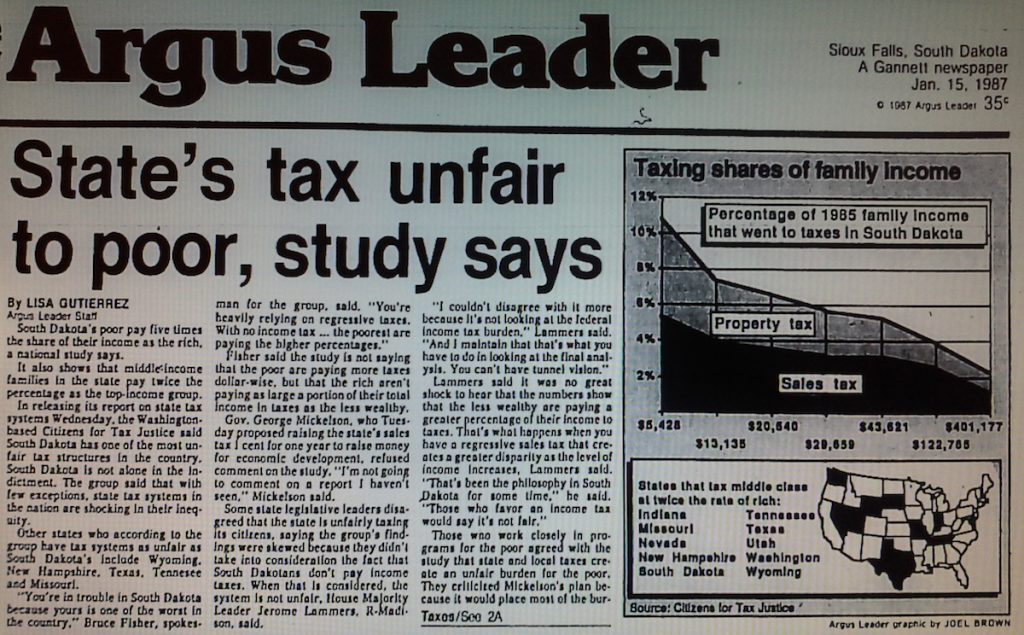

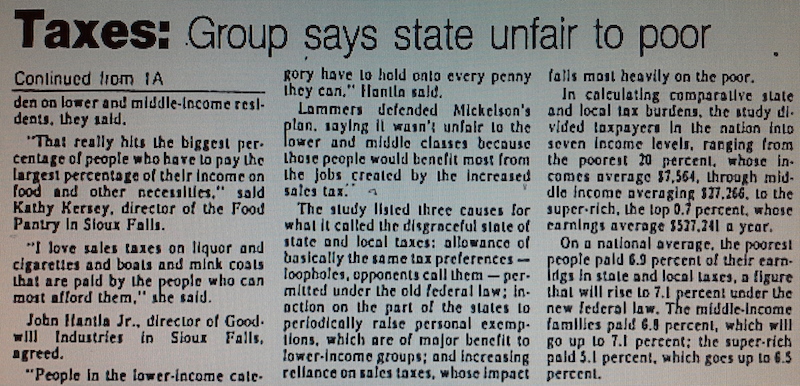

Bonus Reading: South Dakota’s resistance to taxing income has unfairly burdened the poor since at least 1987:

Treating the poor and middle class unfairly can’t be good for our reputation, either. We still have a regressive tax system, and raising teacher pay with more sales tax (starting in two weeks!) will only make it worse. Could Costello’s statement to the Legislative Planning Committee yesterday signal that the Governor is ready to work with next year’s new progressive Legislature to work on serious tax reform?

Here we go again, calling coveting “progressive”. Cory, if you really studied the true agenda of the Progressive movement at the turn of the 20th Century, you would run the other way. The movement was a propaganda program to get Americans to buy off on a new political/economic structure that allowed the economic elite to control the economy and society.

Not surprised that tax and spend Daugaard would cap off the last days of his term with a propaganda program to implement an income tax. The crony capitalists would secretly support it knowing that they will be getting loopholes. The real impact of income taxes is to reduce the middle class. And so-called progressives like Hillary claim they represent the middle class? Lies.

Until one moves out of state, you realize how screwed South Dakotans are with their food tax. It’s a double whammy when you’re a low wage state to begin with. How’s that cost of living going for ya SD?

A no state income tax sounds all nice until you find out that SD has one of the highest food tax rates and is only one of a handful of states that even tax food.

Steve, do you ever get beyond labels in your analysis/criticism? Do you ever look at what is being said/hoped for/desired, or does none of that matter when involving fortune cookie/bumper sticker politics? When does the totality of your world view simply devolve into no-tax anarchy?

I believe in Jefferson’s “We the people . . .” inclusive view of government. I believe in an inclusive society that supports itself and does not see those who need that support as the “others” . . . or as you would call me, a tax-and-spend-liberal-progressive.

“do you ever get beyond labels”

My comment was directed at the label “progressive” used by Cory and many of the comments on this blog. What is really being promoted is coveting by using the poor as political pawns. The liberal corporate capitalist benefit from the consumption that is funded by taxation, while they create loopholes to get around the taxes. I am just trying to provide an analysis that goes beyond the labels used by the propagandists. Obviously your questions shows you have eyes, but yet cannot see. That makes me sad.

Doggone it, Cory, do you suppose Costello and that Sioux Falls paper have been reading my comments on your blog?

Sorry Steve, your arguments won’t fly. If you/we are going to have the services that we expect, police and fire protection, roads, road repair, snow removal, education, healthcare, (ever since the capitalists made it a for profit industry), a clean and healthy environment, those things have to be paid for. And it would be much easier to do so, if it weren’t for the fact that we have some folks at the federal level who are constantly stirring up a hornets’ nest worldwide and causing us to have to spend over half of the federal taxes on defense.

The only problem I have with taxes is when those with the most want to shift the taxation burden to those with the least and do so by cutting or freezing property taxes and then increasing sales tax, or as has been done at the federal level, by cutting taxes at the same time fighting multiple wars and putting the payment burden on future taxpayers.

Let me use “progressive” in this context: I support a progressive income tax. I want a tax system that ratchets up the rate one pays as one’s income increases. I want those who “have” to pay at a higher rate (not just more gross amount) than those who have not.

A progressive tax system looks at what is left the tax payer – even at a higher rate, the wealthy still have plenty.

Let me beat Steve to the history lesson: in the US, growth was strongest when taxes were most progressive, and has slowed as they have been made less progressive (never mind that which those taxes fund).

Sibby,when you absolutely have to argue over every molecule of space, doesn’t that make you covetous of attention or something?

A progressive income tax makes so much more sense than a sales tax. With the latter, your taxes don’t go down when you have a bad year, while with a progressive income tax you pay less in taxes during hard years. That seem a logical choice for a state full of farmers and ranchers who can experience very bad years from time to time, but still incur the expenses of running a farm and paying sales tax on necessary supplies.

“I want a tax system that ratchets up the rate one pays as one’s income increases.”

And then redistribute to those who don’t pay the tax…that is coveting.

And bear, you pay income tax before you get the money. A sales tax isn’t paid until you “choose” to spend it. Everyone paying the same rate is only fair.

Lanny, I am not against paying taxes, I am against making other pay the tax so I don’t have to. Such is the case with the so-called “progressive” tax.

Steve can I ask what your ideal form of taxation might be? You mentioned a sales tax, so do you suggest the most equitable form of taxation is an equal sales tax on everything we purchase? Is there any consideration for a retiree who lives on Social Security and only makes $18,000 a year vs. a CEO who makes $800,000 a year… or doesn’t personal income have any bearing?

The only concern I have is that such a sales tax platform is regressive. As a percentage of income, those at the bottom of the ladder would pay much more than those at the top. Those who have excess funds who can invest and save pay nothing on that money until it is spent, and much of that spending is voluntary vs. the person living week to week who is only paying for essentials like food, shelter, clothing, and healthcare.

I doubt there is a perfect solution, but is a true sales tax really “fair”? Seems like the poor get the short end of the stick on that one.

“And then redistribute to those who don’t pay the tax…that is coveting.”

No, that is “we the people.” That is a view of society that goes beyond our own selfish interests. Coveting is saying, “no” to benefiting the fellow man so that you can improve your own, and only your own, selfish lot.

The only time you should check your neighbor’s cup is to be sure that he or she has enough.

Steve, “I am not against paying taxes, I am against making other pay the tax so I don’t have to. ”

I am throwing the flag on this one. ALL you do on any discussion of taxes is advocate to NOT pay them. You find it an atrocity that you (and others) who have no children in public school have to pay taxes for schools. You covet your funds at the expense of the demonstrated social good. Your world view is defined by a selfish, myopic perspective.

https://www.youtube.com/watch?v=QPKKQnijnsM

Sibby, you need to look at this video and understand the reality of the actual distribution of wealth in America. One percent of America has 40% of the nation’s wealth. But get this, the bottom 80% only has 7% of the nation’s wealth.

All conservatives need to watch this video and try telling me that asking for a living wage is greedy. That asking the one percent to paying a little more in taxes would be ‘socialism’. No wonder half of Americans don’t pay any income tax! They don’t have any money!

“The only time you should check your neighbor’s cup is to be sure that he or she has enough.”

wow, O, I wish i’d heard that beautiful sentiment before. :) thank you

“The only concern I have is that such a sales tax platform is regressive”

So we have fairness being labeled “regressive, and coveting labeled as “progressive”.

“That is a view of society that goes beyond our own selfish interests.”

Coveting is an act of selfishness. That is why it is found in the Ten Commandments.

Jenny, I agree that the accumulation of wealth among the few is wrong, but the economic elites need big government to pull that off.

You believe a system which requires the poorest amongst us to pay a larger share of their income as taxes than the upper or middle classes is fair?

Doesn’t that lead to a similar system than we have now where the poor are artificially subsidized with tax cuts and social programs just so they can survive? You have said before you aren’t a proponent of a living wage or even minimum wages so if a person works 40 hours a week for minimum wage and doesn’t have enough in the paycheck to cover a medical expense or perhaps not even enough to pay for rent in their city we are right back where we started. Is that really fair?

Coveting is the Walton family’s desire to pass all their wealth onto succeeding generations in perpetuity by using trusts to shield the money from taxes.

I’d like to see the poor get away with that.

Stoopid mike from iowa, the poor can’t pass money on because they have none. They prolly didn’t inherit millions like the hard working wealthy billionaires, so only the wealthy get to covet. Common sense-mfi.

Steve, you wrote, “Jenny, I agree that the accumulation of wealth among the few is wrong, but the economic elites need big government to pull that off.”

Problem is you will find that in any system of government whether capitalistic or socialistic or communistic. The only think is that our system with democracy was supposed to end feudalism and until the last 40 years had made pretty good inroads into that. It is when the tax cutters took over, you know the Ronald Reagans and the George H W Bushs and then finally the George W Bushs that we ended up with the model that we have today.

So we have fairness being labeled “regressive, and coveting labeled as “progressive”.

Treating everyone the same (with no regard for circumstance) is not “fair.” Taxing at an equal rate – forcing some into incomes below sustenance while barely inconveniencing others with the same rate of taxation is not “fair.”

I agree that our government helped create the corrupt tax system that extends tax cuts for the wealthy and taxes wages at a higher rate than income investment (and allows for income investment to be used for salaries for the wealthy). However, ONLY government can reverse those wrongs. Certainly income inequality has existed without (and because of) lack of government interference; government does not create the greed of the wealthy; government has been optioned as a co-consiritor, but is not the root cause of that concentrated greed. Although government helped create the problem, I do not rule it out as the ONLY way to reverse it as well.

Lanny, they may be! You may be getting through to the other party! Maybe our disagreement will do some good after all! :-)

“Problem is you will find that in any system of government whether capitalistic or socialistic or communistic.”

I agree with that statement.

“It is when the tax cutters took over, you know the Ronald Reagans and the George H W Bushs and then finally the George W Bushs”

I disagree, as you said before, the problem has existed under “any government”. You can’t then go and say that the Reagans and the Bushs created the problem.

Most don’t understand that today’s capitalism is not Laissez-faire. It was the so-called progressives at the turn of the 20th century who decided to dump that and establish what we have today…liberal corporate capitalism, which is a lot like communism, and a lot like socialism (specifically Fabian Socialism). All are slight variation of an “administered market”. Wilson’s so-called “progressive” income tax helped with that transition. So what you guys consider the solution, is in fact, what helped create the problem.

Hitler Weasel Bush saw Raygunomics as the voodoo economics they turned out to be. Then he sold out to be veep under Raygun.

Seriously, Steve you cannot rely on “GOP History for Dummies” to site historic fact.

Wilson’s progressive tax rates helped keep income inequality in check in the US while funding necessary social services at an appropriate rate. Slap whatever label you want on it, it does not change the fact that progressive taxation was effective and socially responsible. Saying it “helped create the problem” is a fallacy of ad hoc ergo propter hoc; why not say Washington fighting for American independence “caused” the mess we are in now. No, there are clearly bad actors to blew for this mess. It was the Regan/Bush tax cutters that backtracked the very progressive nature of the tax code to have the rich pay lower tax rates that put the whole system out of whack. Yes, it was still a “capitalist” system, but it was a retreat from the progressive nature of the income tax that has resulted in the collapse of the social system. Your Grover Norquist “starve the beast” philosophy enacted under Reagan made as its goal the destruction of the social welfare system (and the glorification of coveting of wealth by the rich). And as a result, the nation has suffered, both at the national and state levels (see Kansas for how cutting taxes for the wealthy destroys a state).

Of course capitalism is not and CANNOT be Laissez-faire because that allows the powerful/rich to prey on the weak/poor. Still, that is not at all like communism in that even under the highest progressive tax rates, we had plenty of rich folks in the US; rich folks that went right on doing the things that made them rich, investing in the country AND paying taxes.

“you cannot rely on “GOP History for Dummies” to site historic fact”

Historically, the Carter years were a disaster. Not all his fault, but the tax cuts you point at happened after the system was milked dry. And if your premise is correct, then why didn’t Clinton and Obama fix it? The answer is that both parties are controlled by the same economic elite. Our conservative vs liberal arguments and fighting are just distracting us from what is really going on.

Today Trump is talking with Kissinger and they want him to put Gingrich in the VP spot. That is what the globalists want. And Hillary would not have made Secretary of State if she was not also part of the global economic elites. So either way, they win in November.

I know you people want what is right and fair. I am just saying that both political parties are wrong. But then, who is going to stop them? I learned a lot about what I just said in 2008 when the NEA gave a million dollars to the SD Chamber in order to protect the system of crony capitalism in Pierre.

That mess Raygun inherited frpm Carter included an America was still the largest creditor nation in the world. Good ol’ Ronnie took care of that in a hurry.

Clinton and Dems passed the largest tax increase in history w/o a single wingnut vote.

“But then, who is going to stop them? I learned a lot about what I just said in 2008 when the NEA gave a million dollars to the SD Chamber in order to protect the system of crony capitalism in Pierre.”

What is your source for this Steve?

owen,

Sibson has been telling that tired old Chamber of Commerce story for years, if he can even find a source it would surprise me.

Anyway, it is hardly relevant today.

Sibson maintains a consistent pattern in his arguments, he loves to blame Democrats for large government and taxation, yet, when you corner him on an issue his response is, “oh well, both sides do it’.

Mr. C, I believe Sibby doesn’t consider himself part of either “side” but feels that his fringe element 1%ers are the only ones in the “right” and everybody else is in the “left”. He dislikes Conservatives with Common Sense even more than he dislikes libbies because he hates that the Republican Party has not been able to be completely turned insaner than most. Which is kind of odd to think about because if they were then they wouldn’t be insaner than most at all but instead would be the most themselves.

Sibby also has a hatred for teachers. blames NEA for about everything.

He has learned a new word though-coveting.

Steve, If you could just forget the ideological nonsense, your good ideas would have more weight. You poison the air with irrelevant nonsense that has little to do with real world reality.

no, “coveting” had some to do w/ his last banishment. oh, such peaceful many months:)

oh, I kno sibby, sad that I have whatever but cannot whatever….

sibby- if you are right about: “Today Trump is talking with Kissinger and they want him to put Gingrich in the VP spot. That is what the globalists want. And Hillary would not have made Secretary of State if she was not also part of the global economic elites”, is there any way to prove that conspiracy theory.

trump is a pure goofball and knows he is in the deep end. Obama didn’t need Hillary, but respected what she has done, like starting the medical care war. Obama finished it at great, great cost to democrats but in the long run it will be the greatest governance on behalf of the people that could ever occur.

look at republicans boasting they will kill social security. its like, once you own yours, everybody else can get screwed. dems have heart, repubs don’t. its that simple.

i’ll cite mine if you cite yours. “alien-nation” however is not an acceptable cite:)

“What is your source for this Steve?”

http://rapidcityjournal.com/news/local/top-stories/more-back-im-but-opponents-have-more-money/article_d3998c43-6937-5e8b-91c3-c046cdb82fee.html

Now are you people going to stop doubting me and understand that folks in both political parties are being lied to by their respective party leaders?

And teachers need to understand that the NEA does not care about them. The NEA only uses them to gain political power.

And here is my reaction to the NEA giving $1.1 million to the South Dakota Chamber:

http://sibbyonline.blogs.com/sibbyonline/2008/10/the-nea-and-the-chamber-of-commerce.html

Here is anther source from South DaCola:

http://www.southdacola.com/blog/2008/10/im-10-may-be-closer-then-we-think/

“NEA gave a million dollars to the SD Chamber in order to protect the system of crony capitalism in Pierre.”

Giving a citation that money was given to stop a gag law does not prove your claim of the “protection of crony capitalism.” It proves the OPPOSITE. NEA was in that fight to preserve the voices that could speak with authority and power – voices that were unified/organized.

Now I see it, Steve, you stand against government, unions, any group that has the ability to speak against the voices of the oligarchy. For all your railing against the crony capitalists, I question are you against them or just angry you have not been invited to the trough?

“any group that has the ability to speak against the voices of the oligarchy”

The oligarchy is represented by the Chamber of Commerce. Sad you bought their “gag law” lie.

Once again Sibson has hijacked a Dakota Free Press thread and made it about one of his hobbyhorses.

His own pathetic blog is no longer on life support, it is dead and he feels the need to antagonize the readers of Dakota Free Press with his mindlessness.

Roger, you are just made because your false accusation against me was proven false. Instead of admitting that you were wrong, you made another false accusation that I hijacked this thread. This thread is about the SDGOP economic development folks pushing tax increases. I am only providing support as to how that point is true.

I put one too many “e” on “mad”. The “e” belongs on Madville.

So pontificating (and side discussion) aside, it seems that a progressive income tax that replaced the current sales and property tax system (assuming a penny-for-penny replacement; no-more no-less total funding) would be of benefit to the state of SD and her citizens?

Wouldn’t this also provide an opportunity to write a tax code that does not carve out exceptions currently given to some sales tax payments?

What is the tipping point where SD has to say that the tax system is not only broken, but un-amendable; it needs wholesale replacement? I have long thought that one reason that some legislators cling to “no new taxes” mantras is that at “low” tax rates it is easier to perpetuate unfair taxes. At higher rates, they become untenable.

Not only that, O, but when one looks at the amount of money (billions) that has come into the state, (in fact created a whole new industry) since the repeal of estate taxes, if our current tax system is so beneficial, we should have seen at least a partial increase in population because of that beneficial tax system. But as we know it is just the opposite. When you look at all the rest that South Dakota has to offer, it has to be the low wages and tax system that is holding our population back.

Lanny, so lower taxes cause lower population. Like to see the sources on that. And good luck getting the cronies to give up on their loopholes. For example, will the Educrats allow their proceeds to be taxed as income?

Lanny, did we get a few more “RV residents” with the estate repeal?

Steve, WHAT? What are my proceeds as a teacher taxed as now (by the Feds) if not income?

Sibson,

your rcj 2008 cite says:

“the criticism of the NEA is just another tactic by the Yes on 10 group.”

“So far, they’ve attacked every proponent, every member; it’s one more baseless allegation,…”

“It’s easy to be critical of the NEA, Willard said, which came forward with support after the initiative campaign had started because members had seen similar initiatives in other states. The union wants to protect South Dakota teachers, he added.”

“When we go ahead and provide disclosure, they attack the source of the funds,” he said.

Espenscheid said she is grateful the Yes on 10 campaign is state-based. She said the group started working last November to collect signatures, which gave them an opportunity to meet people face-to-face.

‘We are grateful to everyone who gave to our campaign,’she added.”

please explain this “gag law lie” from 2008.

Leslie, the proposal would not have gaged teachers. If they want to testify they could. What the proposal eliminated was the taxpayers paying dues to the Teachers Union so that the Union can increase taxes on the taxpayers. That gag ads were about stirring up emotions.

And that is what happened last session. The taxpayer funded unions and School Board and Administration Associations stirred up emotions in order to falsely justify increased sales taxes. It is unfair for taxpayers to pay unions and associations to make up lies in order to pass on even more taxes.

Sad that the teachers were used as political pawns so they can covet from their neighbors.

And speaking of income taxes, how much of the teacher pay increase (that will be funded by local sales taxes) will end up in DC in the form of federal income taxes? Most likely 28%, because a 50 thousand a year salary puts most in the 28% progressive bracket. Now maybe some of you will understand that your so-called “progressive” tax takes from the middle class, while the economic elites get their tax loopholes.

Steve, I don’t know you from Adam, but if you are a property owner, then you have less to complain about, because the freeze on property taxes is what caused the sales tax increase in order to pay the teachers. The sad part is though, the governor took 40% of the sales tax to bribe property owners to be for the sales tax increase.

On the other issue that you raises, try to keep up. The people don’t actually move here because the tax system is rigged in favor of the haves not equal for those who are starting out or who are poor or who have retired.

O asked about the RVers. It is my guess that they don’t live here, they just use us as an address so they don’t have to pay income tax and for cheaper licensing etc. If they lived here they would be stuck with the higher sales taxes.

Interesting thought there, O, that we could reach a tipping point where higher unfair taxes would finally provoke tax reform toward a more progressive tax structure. I’d be surprised if this year’s extra half-cent got us to that tipping point, but it did provoke lots of arch-conservatives to use the word “regressive” in this year’s HB 1182 debate. Maybe we can capitalize on that to undermine the arguments against income tax.

Tax reform would definitely by an opportunity to write a better tax code with fewer exceptions carved out for special interests. But the opposite could happen, as it happened with little old non-reform HB 1182 this year: the special interests (in this case, the retailers and Chamber) could argue for their own new exceptions and favors (in this case, use of 34% of the new sales tax to reduce property taxes, with the largest chunk of that relief going to commercial property owners). If voters send a bunch of reform-minded legislators (myself included) to Pierre, we’ll have to work very hard to avoid creating a progressive tax code loaded down with favors that send the benefits right back to the folks atop the pyramid… but we’ll also have to listen to Lee Schoenbeckian pragmatism, demanding that a certain amount of horse-trading happen to produce a passable bill.

Steve, your constant talk off coveting wears my butt out.

Let’s get clear: if I were truly covetous, I’d have opposed HB 1182 and SB 131. I’d oppose competitive wages for teachers. All these higher wages do is encourage more teachers to apply for teaching positions in South Dakota. That’s more people I have to compete with when I want a full-time teaching position. That’s more talent that could get the job over me. I’m not leaving South Dakota, and I can live with a lower teacher salary, since I have other sources of income. It is in my personal best interest to keep South Dakota teacher salaries uncompetitively low.

South Dakota needs to covet the best teachers. South Dakota can only get the best teachers by paying the best wages. You go play your abstractions, Sibby. The rest of us will focus on practical policy.

I agree Cory that the 1/2 penny sales tax had probably nothing to do with instigating a conversation about an income tax, but the plethora of sales tax bills probably did. Anyone who has been paying attention knows that the counties are in worse shape than the school system and yet the legislature has done nothing to ease their problems. I see it here in Minnehaha where there is plenty of base property tax to take care of problems, but the county still runs short because of the freeze on property tax, in spite of the fact that they opted out last year.

But what about the Todds and Shannons or whichever one of them is now Lakota and some of the other mostly rural counties with a lot of federal or Indian land?

Roger appears to be right. Sibby has just used up a day and a half and 50 posts on coveting. has he accomplished anything of value?

OK, I’ll bite, “. . . to make up lies in order to pass on even more taxes.”? What lies were those exactly Steve? That SD has a teacher shortage (that we have fewer and fewer applicants and that schools have class rooms are not staffed are illusions?), or that SD pays $8,000 below regional averages, or is it the big lie – that education is valuable?

BTW, a progressive tax system that graduates rates only applies the graduated rates to what is earned above the rate cutlines: high income’s could be in several rates – the highest rate does not apply to the whole income. Being knocked into a higher bracket does not apply that rate to the whole income, only the amount above that which his taxed at the lower rate/s.

Ms. leslie, he has entertained probably dozens of people who read this blog to read Sibby.

Awe come on grudz, you are really referring to yourself. I am apparently the only person who comes to this blog, out of whom you irritate the heck.

There is a teacher shortage in South Dakota and you can deny it all you want but that’s the fact. The sales tax increase is regressive-but something had to be done and it was.

A personal or corporate income would be fair. But, as expected Steve, you shot that down.

My question for you Steve is this. How do you want to pay for qualified teachers, roads, police or firefighters? Are we supposed to pray for it and it’ll happen? Doubt it.

And in 2008 I was glad that NEA gave that money. It was an attempt to “gag” teachers, police,firefighters and so on. The only one that seems to want to suppress free speech is you Steve.

I do enjoy Mr. Sibby immensely, Mr. Stricherz. He is an interesting fellow.

“What lies were those exactly Steve? ”

That was not enough money in the existing budget to pay teachers more. The budget was $128 million more than what was spent in the previous year, before adding the extra sales taxes. So what was more important than increasing teacher pay? That question was never answered. Instead the Associated School Boards, the Associated Administrators, and the teachers union all lathered up the teachers in a covetous movement based on the lie that the only way they can get more money is to tax their neighbors, many who make far less than $50K a year working 12 months instead of 9. That is coveting Cory.

Then the Chamber of Commerce oligarchy was bought off with the property tax decrease. The culture of corruption in Pierre in action again. And no one wants to talk about the NEA giving the SD Chamber $1.1 million in 2008 to protect that system? And if the oligarchy is now willing to implement an income tax, it won’t be for sake of helping out the poor. Instead it will be a plan to line their pockets with money from the middle class, including teachers who make $50K plus to work 9 months.

“What lies were those exactly Steve? ”

Owen Reitzel just laid out a pile of lies in order to justify his covetous agenda in his last comment. And this is a guy who challenged me to provide sources. So Owen, you don’t want liars gaged huh? And free speech, I didn’t see you complaining when I was banned and gaged from commenting on this blog.

just a necessary correction. “gagged”

not trying to be mean or anything. but we have been gaging this issue with sibby’s “micrometer” for several days now. sorry to interrupt. prolly a good thing I gotta fly in a few minutes.

steve, btw, didja notice atlantic magazine is using your word “coveting” in it’s ivanka article today? who are you voting for, the lib?

“who are you voting for, the lib?”

leslie, thanks for the correction.

They are both libs, so I am still looking for someone to vote for. The global oligarchy usually has both sides covered. That is why Trump meeting with Kissinger means we could be getting feed pro-America propaganda from that campaign. Trump is the puppet, the real agenda is being implemented by others.

Steve, I would agree with you that they are two sides of the same coin, but there is no way that I would call either of them liberal. They are both tax cutters, (a conservative trick and pony show alah Grover Norquist). They are both war mongers. They both won’t hesitate to kill or denigrate other human beings to (they think) protect America. They both have no hesitancy about funding the military industrial complex. They both have no hesitancy about bailing out the banks and the auto companies. Hillary already did and Trump by his many bankruptcies would have no hesitancy to do so.

I should have said cutting taxes with no commensurate cut in spending other than on social programs.

Lanny, I agree with your analysis. Technically, the modern term that is appropriate would be “neo-con”. I read somewhere neo-cons are liberals chased out of the Democratic party by McGovern. If we want to be historically correct, liberals in the classical sense would be the libertarians who want a limited government. Then we have to say that both political parties are promoting some form of big government political/economic agenda, which is neither conservative nor classically liberal. We would have to call it socialist, communist, or fascist. Those would be the last labels the leadership of either political party would want us to use, perhaps with the exception of Bernie Sanders. He is certainly the most authentic candidate. Unfortunately his proposed solution to solving poverty is what has caused poverty. His visit to Pine Ridge should have opened his eyes to that. And having the poor covet from the rich will never be allowed by the economic elite control. The income tax idea for South Dakota will do nothing more than take from the middle class and increase the centralization of wealth in the same matter that the federal income has been doing since 1913.

And “cutting taxes with no commensurate cut in spending” is the other side of the Keynesian coin that includes government spending as GDP. If we increased taxes for every penny we increased federal spending, the net impact of the economy would be zero at best.

nearly 10,000 teachers with increased pay is “nothing more than [a] take from the middle class”? your entire hypothesis is flawed.

http://doe.sd.gov/ofm/documents/1415-Prof.pdf

once you settle on nomenclature develop credibility.

Hillary is no puppet. she has been fighting for the soul of good since she graduated. if trump is elected, one side of your hypothesis may be proven, arguably. or people vote republican out of ignorance.

Hillary would not have been allowed to be Secretary of State unless she was a puppet.

And the teachers are not taking from the middle class, as you all understand, they are taking largely from the poor via sales tax. It will be the implementation of a state income tax that the middle class, including the teachers, will be handing money over to the economic elite. The teachers will be doing exactly that with the extra $6,000 they will be getting by taxing the poor and then handing 28% ($1,680) of that $6,000 over to the feds via income taxes, so that the economic elite can get their hands on it. And let us not forget that a large portion of the sales tax increase that the poor will be paying will be property tax cuts for business owners. In the name of teacher pay, the economic elite are taking from the poor and lining their pockets. That is what happens when people are fueled by greed and sin (coveting).

Guys, don’t bother with Sibby, he’s off his meds and missed some therapy sessions.

And I thought you had gotten more tolerable lately, Sibs. Are you hanging around with Kurtz again?

Speaking of income taxes. In MN, the middle class are not ‘handing money over to the economic elite’. The wealthiest 20% are paying MORE than the middle and poorest classes. And guess what, it is working in MN. We have one of the healthiest economies in the nation. So don’t try telling me that if the wealthy pay more in taxes they won’t be able to create jobs and that the economy will collapse.

Really, when there are tax breaks for the rich, they just pocket that money into their trust funds and off shore accounts. It doesn’t necessarily always create jobs. The 2008 economy collapse proved that.

Jenny, Do you mean that if I went on meds, I would be able to accept the oligarchial way that our country is going. And would meds help those living in Minnesota to be more accepting of the $19 charge to tour the new football stadium that the taxpayers built for the billionaires for a place for the millionaires to play ball?

kurtz is reality, like a cockle burr. sibby, notsomuch reality.

e.g. “allowed to be Secretary of State unless she was a puppet.”

her experience as SOS is going to keep us out of trouble the next 8 years and continue obama’s legacy of restoring our credibility in the world. I don’t think the woman who wrote “it takes a village” is much of a hawk. she’s very tough, though, when necessary. and smart. trump is neither. https://www.youtube.com/watch?v=diMp241gAcw

Leslie, Kurtz was a nasty bully and Cory made the right move to ban him.

Lanny, I apologize for anyone on meds for mental illness.

MNs billion dollar surplus is proof that a state income tax where the rich pay more doesn’t destroy a state’s economy. (regardin the stadium charge, I can see my boys for free at the Mankato training camp in July and August every year :))

What planet are you living on leslie, and as I asked before, did you miss your plane?

“her experience as SOS is going to keep us out of trouble the next 8 years and continue obama’s legacy of restoring our credibility in the world.” She is the one who got NATO to bomb Libya and support the folks who are now ISIS. She also backed Obama on his ill advised assertion that “Assad must go”. We have less credibility each year that the oligarchs are in power.

If she had been SOS the second 4 years instead of resigning to prepare for her run for the Presidency, we would be cleaning up our first spill from the Keystone XL by now. She was the one who was in favor of it until the past year and it only needed State Department approval to proceed.

As far as “It takes a village”, that is an African proverb that she plagiarized.

As I said to Steve, they are both just two sides of the same coin and we are in more trouble after 1-20-2017, unless there is a third credible choice in November.

Well Jenny, with that billions dollar surplus, why didn’t the State of MN chip in to pay for the stadium instead of sticking the taxpayers of Hennepin County with another sales tax?

well, my planet is going to be leading the free world for the next 8 years unless trump dumps us all. we are really on the same team. kurtz, too. I like his acerbic standing up to power.

I agree with much u say, lanny and welcome your criticism but you may need to sharpen your blade concerning generalizations and talking points about lybia, isis, assad, nato and Hillary. I agree she left too early. prolly selfish. maybe self preservation. we all see what 7 years has done to an exceptional mind and body of our president. she is not pretty these days because she has walked the walk.

yes I did miss my 9 a.m., to the chagrin of my pocket book:)

Jenny, your opinion is interesting, but facts are what we should go by. If income taxes fixed the wealth inequality, then why did this happen:

http://www.pewresearch.org/fact-tank/2014/12/17/wealth-gap-upper-middle-income/

leslie, here is your puppet on a string:

Hillary is controlled by the parallel US government, the Council on Foreign Relations (CFR). In 2009, she revealed her relationship with the CFR when she addressed the council at their newly opened outpost in Washington D.C.:

“I have been often to the mother ship in New York City, but it’s good to have an outpost of the council right here down the street from the State Department. We get a lot of advice from the council, so this will mean I won’t have as far to go to be told what we should be doing and how we should think about the future.”

A look at the corporate membership of the council reveals the level of power vested in such a small amount of hands, with approximately 200 of the most influential corporate players belonging to the group, including: Exxon Mobil Corporation; Goldman Sachs Group; JPMorgan Chase; BP plc; Barclays; IBM; Google Inc; Facebook; Lockheed Martin; Raytheon; Pfizer; Merck & Co; Deutsche Bank AG; Shell Oil Company; and Soros Fund Management.

http://www.globalresearch.ca/puppet-on-a-string-hillary-as-president-would-be-catastrophic-for-the-us-and-the-world/5518357

leslie, as far as Libya. ISIS, Assad and our credibility, they are not talking points, they are facts. They are all centered around the CIA induced “Arab Spring”.

leslie, then there is Monsanto’s puppet:

http://naturalsociety.com/hillary-clinton-monsantos-next-poster-puppet/

Lanny, I usually agree with your comments, but your statements attacking Hillary are puzzling for several reasons.

First, there are consequences whether a leader makes a decision to act or not to act. It would seem we would want a leader who would do everything she could to evaluate such consequences before deciding whether to act or not. According to the NY Times analysis of the Libya intervention, that is exactly what Hillary did before making any recommendation to anyone.

Second, the motive for action or inaction seems a critical factor. Hillary’s goal in recommending action in Libya was reported to be purely humanitarian – to save innocent lives of civilians.

Third, we want a strong leader that can influence our allies to support what she believes to be the right course of action based on extensive study. If Hillary is capable of influencing members of the UN, she certainly fills that bill.

And we value loyalty. Hillary’s loyalty to the President who appointed her SoS seems a positive, not a negative. Anyway, the following article from the NY Times is extensive and supports each of the above points – you find it an informative read:

http://www.nytimes.com/2016/02/28/us/politics/hillary-clinton-libya.html

Sibby, my ‘opinions’ are facts. MN did get a one billion dollar surplus by taxing the wealthy (and cigarettes also). Oh, I definitely agree that taxing the rich higher in MN didn’t fix wealth inequality but it is definitely a fairer system, and there is less percentage of poor than in SD.

It is a lie that tax cuts to the rich create jobs, look at the last twenty years.

I certainly have big concerns about Monsanto’s monopolistic and gargantuan effect on the food we eat, and will determine whether your cited author knows what she is talking about in her “talking points”. don’t believe every conspiracy u read sib.

SD needs an honest decent governor like Mark Dayton to turn things around and stop the corruption. Gov Dayton, a member of the elite one percent, says all the time the rich should pay more and did just that with increasing the state income tax rates on the wealthy. He kept his word and helped the middle and lower income classes. I doubt you would ever see a governor do that in SD.

Jenny, your opinion is the opposite of facts:

Minnesota leads all 50 states in terms of per capita state and federal income tax revenue lost through the “tax haven” corporate-tax loophole, according to a Minnesota 2020 analysis of U.S. PIRG data from “The Hidden Cost of Offshore Tax Havens: State Budgets Under Pressure from Tax Loophole Abuse.”

https://www.minnpost.com/community-voices/2013/04/lawmakers-should-close-minnesotas-corporate-tax-haven-loophole

bcb, I certainly hope that article was not meant for me to change my opinion of how badly Ms Clinton bungled her job as SOS. I would suggest that it would be great reading for leslie, who thinks my assertions are somehow just talking points.

The article also brings up something that always made me question those on the right’s criticizing her. Instead of being against the entire fiasco, which according to the article, Joe Biden SOD Gates and military leaders were all against it and the President was skeptical. So it was at Ms Clinton’s urging that we got involved. But did the right criticize her for that? Oh no it was only that the Ambassador got murdered in Benghazi. So in other words, our one guy is way more important than the hundreds of thousands that have died since because of our failed Middle East policy.

The article said, “Mrs. Clinton was won over. Opposition leaders “said all the right things about supporting democracy and inclusivity and building Libyan institutions, providing some hope that we might be able to pull this off,” said Philip H. Gordon, one of her assistant secretaries. “They gave us what we wanted to hear. And you do want to believe.”

That sure as hell sounds like regime change and nation building to this poor dumb slob from South Dakota. At what point do we learn our lesson? We were all over George W Bush for the mess that he made in Iraq and we turn right around less than ten years later and do the same in the rest of the Middle East.

It all reminds me of the housing bailout in the 80s and 90s. It only took us 20 years to put our country and this time the world through the same crock of horse crap again.

As a famous song from the 60s asked “when will they ever learn? when will they ever learnnnn?

Jenny, your opinion does not match up with this:

A new study by WalletHub, a personal finance site that does a ton of these types of state-by-state analyses, found that in Minnesota the financial gap between whites and minorities is the biggest in the nation.

http://www.citypages.com/news/minnesota-has-the-worst-financial-racial-inequality-in-america-according-to-study-6565353

The facts are not kind to Jenny’s opinion:

The income gap between Minnesota’s high-income and low- and middle-income households has grown so wide that by the late 2000s, the richest 20 percent of Minnesota households have average incomes that are seven times larger than the poorest 20 percent and 2.5 times as large as the middle 20 percent.[1] Furthermore, the richest five percent of households have average incomes 11 times greater than the poorest 20 percent.

http://www.mnbudgetproject.org/research-analysis/economic-security/poverty-income/income-inequality-grows-in-minnesota

“Hillary’s goal in recommending action in Libya was reported to be purely humanitarian – to save innocent lives of civilians.”

bcb, not everyone shares you opinion:

Hillary is complicit in numerous crimes and atrocities perpetuated by the US when she was Secretary of State from January, 2009 to February, 2013. One of the most notable examples of this was the belligerent war in Libya in 2011. Clinton played a pivotal role in the NATO intervention which led to the toppling of the Libyan leader, Muammar al- Qaddafi, the destabilization of the country and the exacerbation of “humanitarian suffering.”

http://www.globalresearch.ca/puppet-on-a-string-hillary-as-president-would-be-catastrophic-for-the-us-and-the-world/5518357

Yes, I know that MN does have a racial income problem and the DFL and governor know that and is working on fixing it. They’re well aware.

What do the stats show for SD, Sib?

Sibby, those stats are also from 2011, find the latest ones since Dayton has become governor.

lanny, read this, then tell me if what you are arguing for against Hillary isn’t the same as Jeff

Goldberg argues in April, Atlantic.

https://oversight.house.gov/wp-content/uploads/2016/05/2016-05-17-Doran-Testimony-Hudson.pdf

If you read that link Sib, MNs gap is smaller than 34 other states! I would bet that SD is one of those states.

Sibby, I’ll give you that point – not everyone likes Hillary, yet the article you linked doesn’t contradict the evidence presented in the Times’ article concerning Hillary’s motives for her actions concerning Libya – her goal was to help stop the killing of innocent civilians.

Face it, growing income equality is a problem in the US and if there is anything I give Obama credit for is putting the living wage debate on the table. More people are becoming aware of how scewed the system is.

Again, the top one percent own 40% of the wealth in this country. 40%!! It’s probably more in 2016 since those stats are from 2009.

The bottom eighty percent own just 7% of the wealth.

Wake up, America, you deserve better.

Jenny, you need to provide proof that there is wider income inequality in non-income tax states. And second, all states fall under the federal income tax laws. Third, how is Minnesota doing on the corporate tax haven loophole issue? Do you think the SDGOP would provide the same corporate loopholes when they decide to add an income tax? Would the South Dakota Democrats agree to the loophole, because “at least that is better than no income tax”? You know, the same logic the Democrats used to vote for the SDGOP tax the poor and give tax breaks to the rich teacher pay bills.

then read this one: http://www.theatlantic.com/politics/archive/2016/05/ben-rhodes-and-the-retailing-of-the-iran-deal/481893/

then this http://www.nytimes.com/2016/05/08/magazine/the-aspiring-novelist-who-became-obamas-foreign-policy-guru.html?_r=0

and then this

http://www.nytimes.com/2016/05/12/magazine/through-the-looking-glass-with-ben-rhodes.html

I think I’ve cited these before here. when you finish we can discuss how your talking points regarding Hillary are not facts, like Jeff Goldberg wishes us to think of about Obama in this Iran/nuke deal. same storyline.

the heavy weights are Obama AND HILLARY, NO MATTER HOW MUCH THE RIGHT WISHES TO SPIN the facts. sorry for the caps. hate caps selector:)

I haven’t studied why there is such a high racial income gap in MN and I do indeed find it very perplexing that MN would have the highest in the nation. I know educators and local politicians here find it discouraging as well. MN definitely needs to do something about it. Gov Dayton and the DFL got all all day kindergarten passed a couple years ago so that is good and hopefully will help the achievement gap.

My opinion is fact Sibby that MNs jobless rate did NOT fall when MN taxed their rich. I take facts seriously, and I will also try to find stats on the income gap between non income tax and income tax rates between the states. Cory could probably help me with this also.

bcb, I cannot buy the “stop the killing of innocent civilians.” Just like I cannot buy leslie’s assertion via the Atlantic that all of this was done to take the pressure off the Obama administration for dealing with a nuclear Iran.

Either we elect a President to lead our country and the free world or we are electing a figure head to allow the puppeteers to use our foreign policy to do whatever they are trying to do to control the world and its finances and to form the ideology that they want for the planet.

At the time that George W Bush gave his famous Axis of Evil speech in the State of the Union in 2002, one of his zionist cohorts added three other countries to that axis. Former ambassador to the UN, John Bolton said that Libya, Syria and Cuba were also in that group. Guess what, Libya and Syria have both been destroyed. It was not for humanitarian reasons either, it was for regime change and control of those countries, as possible allies of Iran.

I meant MNs jobless rate did not rise when MN increased taxes on the wealthy.

leslie, I am going to have to drop out of this discussion. I won’t have time to do all the homework that you assigned.

lanny-did u get anywhere on this recent RCJ article:

Wealthy South Dakotans can certainly benefit from the state’s relaxed trust laws. According to Buks, baby boomers are the ones really generating the increase in trust assets.

“Over the next 10 to 20 years,” he said, “we are going to experience the largest wealth transfer in human history.”

and the following comment:

“Arlo Blundt Apr 14, 2016-our taxes go in part to the very wealthy who are helping us out by investing in tax free government instruments…we all are paying the wealthy for being wealthy…and getting new government buildings, schools, prisons, sewer systems and what not in return….

if the wealthy had to pay taxes in South Dakota they would immediately remove their Trust Funds from this State and transfer those funds to a non tax state, such as Delaware…the extremely wealthy are only loyal to their wealth…they are patriotic to neither state or country (see the Panama situation)…you can’t beat them at their own game….that’s why they are wealthy”

no problem. i’ll prolly pursue it.

to equate John Bolton w/ANY democrat is a huge mistake.

“we are electing a figure head to allow the puppeteers to use our foreign policy to do whatever they are trying to do to control the world and its finances and to form the ideology that they want for the planet”

Lanny, that is what is going on. And doesn’t matter which party supplies the puppet. When the American people become upset at a president and vote in the other party, the global economic elite remain in control.

leslie, can up provide a link to the RCJ piece. Your excerpts from it are right on.

Lanny, I agree that intervention in a foreign countries’ political structures with the goal of regime change has consequences and in the mid-east they have been unfortunate for the most part.

Non-intervention also has consequences. The refusal to intervene in Rwanda resulted in that government committing genocide by slaughtering a million innocent Tutsi people. Our refusal to intervene in the Syria conflict has also led to a modern day disaster.

Had Hillary just willy-nilly argued for regime change in Libya, I would share your concern. But she didn’t. She surrounded herself with the most experienced people and directly inquired about the danger of another Iraq post intervention debacle. She met with Libyan leaders for their knowledge and advice. That is the style of a policy-wonk – make every effort to understand how to get it right.

As you know, none of us can guarantee the outcome we seek, but that does not mean we shouldn’t try to make the best decision we can with all available facts. And I best I can tell that is Hillary’s modus operandi.

As far as NATO intervention hurting the Libyan people, consider the future of the Libyan people if we had not supported intervention. As a Libyan officer explained, under 42 years of Qaddafi’s rule, the Libyan people had “no infrastructure, a terrible education system, thousands of political prisoners, divisions among tribes, destruction of the army.” Meanwhile rebellion was growing and Libya looked like it would turn into the next Syria, absent intervention.

I tend to agree with you Lanny, that for the most part the US should not seek regime change nor interfere with the internal control of other countries. I can understand, however, why others might disagree when they learn about corrupt government officials slaughtering innocents and committing atrocities.

If you knew that ten people before you were shot and killed when they tried to intervene and stop an attack on a woman on the street, would that mean you should turn your head the other way and just “Walk On By” the next time see a woman under attack on the street?

https://www.youtube.com/watch?v=ijhL9Y7skQs

I meant growing income inequality is a problem (not growing income equality) which I typed in above.